Survey: Many Americans Depressed About Finances — Especially Student Loan Borrowers

Financial troubles can have serious psychological consequences, especially if you’re struggling to keep up with bills or pay off debt.

To find out how Americans’ finances are impacting their mental health, LendingTree surveyed over 1,000 adults. According to our findings, almost half of respondents are struggling with feeling depressed about finances, and have anxiety due to their financial situations.

Key Findings

- 45% of respondents reported feeling depressed about their financial situation recently. (More here)

- 37% of respondents said their mental health was negatively impacted by their current financial situation. That number jumped to 49% when focusing on millennials, the highest of any other generation’s results. (More here)

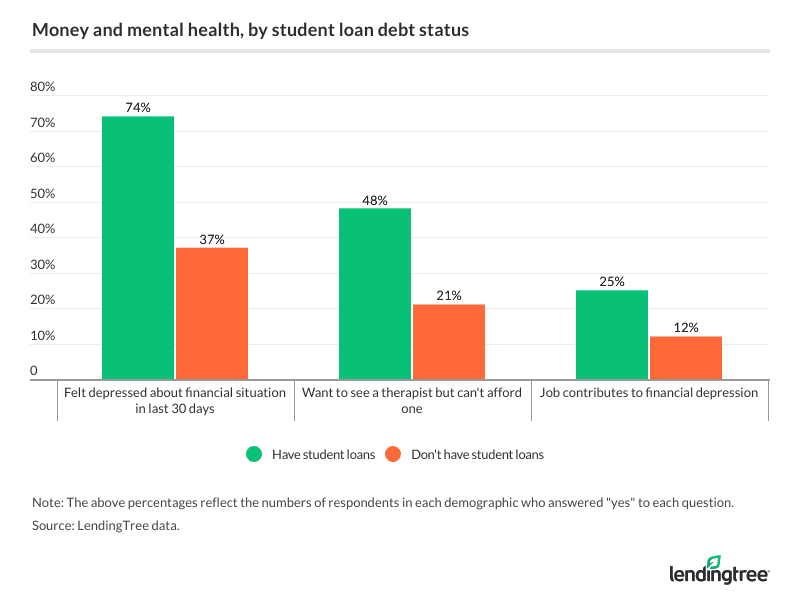

- Student loan borrowers were twice as likely to feel depressed about their financial situation as those without student loans. (More here)

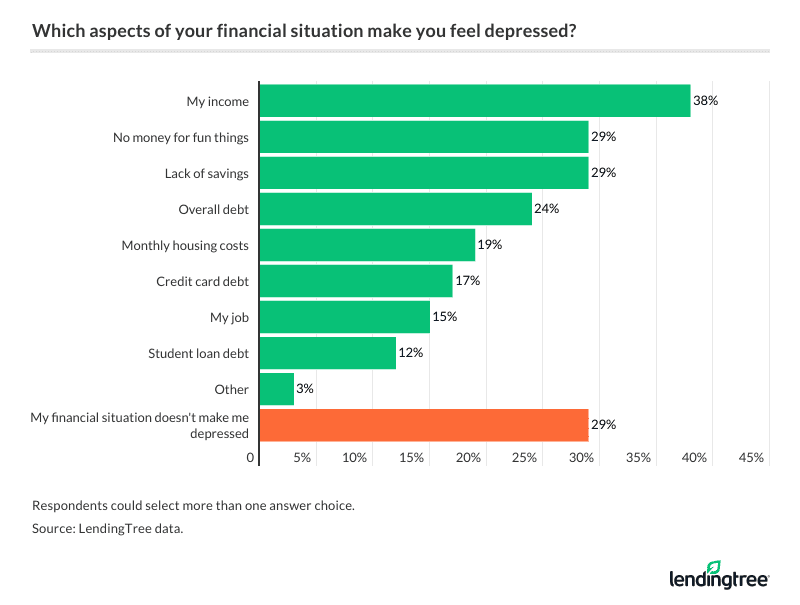

- Income (38%), no money for fun things (29%) and a lack of savings (29%) were the top three money-related issues making consumers depressed.

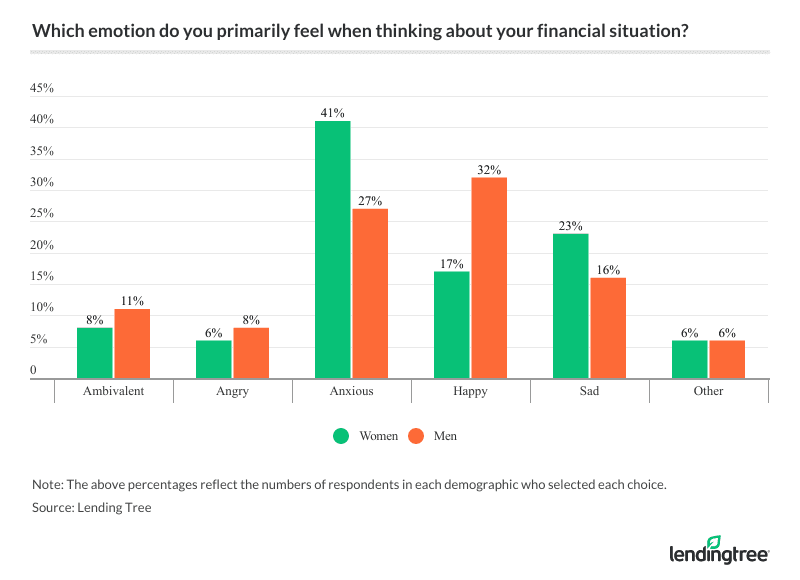

- There’s also a gender gap around money worries, with women more anxious over finances than men by a nearly 14-point margin. (More here)

Nearly half of Americans depressed about finances

Among respondents, 45% reported feeling depressed about their financial situation at some point over the previous month. Student loan borrowers felt the most defeated, with 74% reporting feelings of depression.

In other words, those with student debt were twice as likely to report feeling depressed about their finances, compared to those without student loans (37%).

That said, student debt wasn’t the top stressor for most respondents. According to our findings, income (38%), no money for fun things (29%) and a lack of savings (29%) were the top three money-related issues making consumers depressed.

Half of millennials say finances impact their mental health

When we compared responses by generation, we discovered that millennials seemed to be having the hardest time, with 49% saying their financial situation negatively impacts their financial health. This number dropped to 36% among Gen Xers and just 28% among baby boomers.

Unfortunately, consumers are struggling to get the mental health support they need. Among the respondents, 27% said they wanted to see a therapist but were unable to afford counseling — and that number rises to 40% among millennials and 48% among student loan borrowers.

1 in 4 student loan borrowers depressed about their job

Most of those surveyed said their job didn’t make them depressed. But when we compared consumers with student debt and those without, we saw a stark contrast: 25% of indebted borrowers reported feeling depressed about their job, more than double the 12% rate of those without student loan debt.

Part of the reason behind this discrepancy may be that having student loan payments to keep up can limit choices when it comes to building a career.

The overall number of respondents who said their job made them feel depressed was 15%.

Women report more financial anxiety than men

Our survey also found that women are struggling with financial anxiety more than men — 41% of women feeling worried when thinking about money, compared to 27% of male respondents.

What’s more, almost double the amount of men reported feeling happy about their finances as compared to women (32% vs. 17%).

Additionally, 42% of women reported that their mental health was negatively impacted by their current financial situation. Among men, that number eased to 32%.

You can turn your financial situation around

Financial troubles can potentially be a huge source of stress, depression and anxiety in people’s lives. If your finances are negatively impacting your mental health, consider reaching out to a therapist or counselor. If in-person counseling is out of reach, you might be able to find more affordable online options or free support groups in your area.

Learning about personal finance strategies, such as budgeting or debt payoff methods, might also help ease your stress. Turn to trusted resources (including LendingTree) to empower yourself with knowledge.

Student loan borrowers, for example, might consider one or more of the following options to get relief from their debt:

- Apply for income-driven repayment, which will limit your monthly payment based on your disposable income.

- Apply for deferment or forbearance, which will pause your payments temporarily.

- Explore student loan refinancing, which could save you money on interest.

- Learn strategies for getting out of default if you’ve fallen behind on student loan payments.

Managing money is a process, and it will take time to change your circumstances. Be patient with yourself as you take steps to improve your situation; do what you can to learn about your options so you have the tools you need to turn your finances around — and relieve your stress and anxiety as a result.

Methodology:

LendingTree commissioned Qualtrics to conduct an online survey of 1,024 Americans, with the sample base proportioned to represent the overall population. The survey was fielded Nov. 15-19, 2019.