Should the Government Grant Student Debt Relief? 95% of Federal Borrowers Would Approve

The world of federal student loans has become quite the roller coaster over the past few years. While 41% of Americans with federally held student loans have enjoyed a much-needed breather from their monthly bill by not making payments, others have debated whether to continue or wait for President Joe Biden’s highly contested mass forgiveness program to be approved.

LendingTree surveyed 2,000 consumers ages 18 to 77 to dig deeper into public opinion regarding student loans and debt forgiveness. Our findings show that 95% of those with federally held student loans believe borrowers deserve some form of student loan forgiveness.

On this page

Key findings

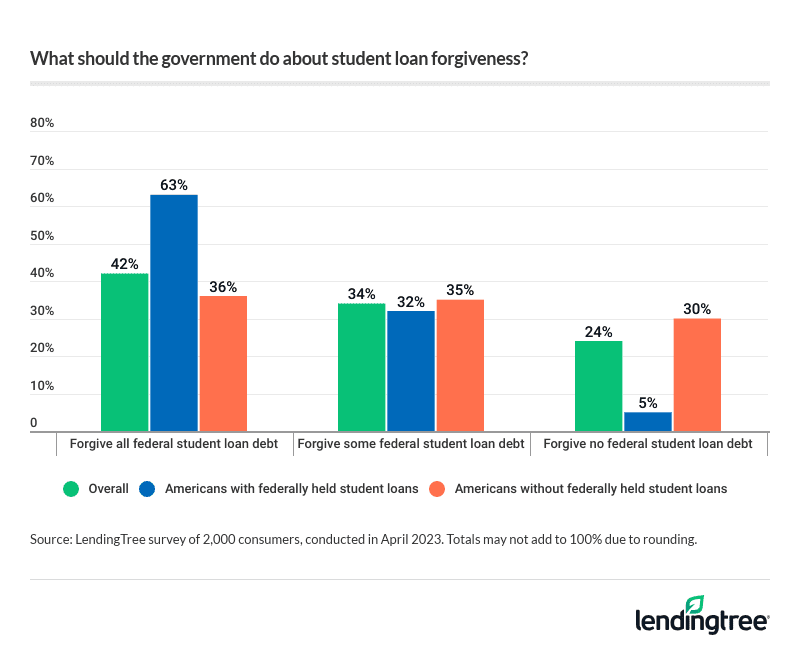

- 76% of Americans and 95% of those with federally held student loans believe the government should offer some form of debt forgiveness. If approved, Biden’s forgiveness plan would wipe out federal student loan debt for up to 20 million people. While 42% of Americans think all federal student debt should be forgiven, the rate jumps to 63% among those saddled with federally held student loans.

- Americans are split on who has the authority to decide the question of mass forgiveness. Among those who think some debt should be forgiven, 52% say they believe the decision is the responsibility of Congress, while 48% feel the power to grant forgiveness resides with the commander in chief.

- 69% of Americans think the Biden administration should extend the forbearance period for student loan repayment, interest and collections. That figure jumps among younger generations (78% for millennials and 77% for Gen Zers) and drops to 45% among baby boomers. Related, 38% of federally held student loan borrowers say they’re unprepared to start making regular payments if or when the forbearance period ends.

- Since the federal student loan payment pause took effect in March 2020, 41% of those with federally held loans haven’t made a single monthly payment, while 22% say they’ve made some. Almost one-third (32%) of this group has continued with their monthly payments every month.

- Almost two-thirds (65%) of Americans think the forbearance period has been helpful to borrowers’ financial situations, and many remain optimistic about the relief federal student loan forgiveness could bring. 41% believe loan forgiveness is possible within the next two years, while 34% say it’s not likely.

76% of Americans, 95% of those with federally held student loans believe in debt forgiveness

Many Americans are on board with mass student loan forgiveness, especially those with federally held student loans. While 76% of Americans believe the government should forgive some or all federal student loan debt, that rate skyrockets to 95% among those with federally held student loans.

Breaking that down, 63% of those with federally held loans believe the government should forgive all student loan debt, and another 32% say some form of forgiveness should be offered. Overall, 42% of Americans stand behind complete student loan forgiveness and 34% want partial forgiveness.

By generation, younger consumers favor full or partial forgiveness more than older consumers. Gen Zers ages 18 to 26 are the biggest fans of forgiveness at 88%, compared with:

- 84% of millennials ages 27 to 42

- 73% of Gen Xers ages 43 to 58

- 55% of baby boomers ages 59 to 77

Looking another way, 85% of Americans with children younger than 18 believe student loan debt should be fully or partially forgiven. That compares with 76% of Americans without children and 63% of Americans with adult children.

While one might expect annual household income to skew the results, there was only a 6 percentage point difference between the lowest and highest income brackets. In fact, 80% of those earning less than $35,000 annually support partial or complete forgiveness, with six-figure earners close behind at 74%.

Based on income, the majority say Congress should take charge. However, over half of six-figure earners (56%) and those earning between $50,000 and $74,999 (53%) put the responsibility in Biden’s hands.

69% of Americans think the Biden administration should extend the forbearance period

While 69% of Americans favor extending the current student loan payment freeze, the most significant support comes from those with federally held student loans. A whopping 93% of those with federally held loans say yes to extending the forbearance period, compared with 62% of those without federally held loans.

Generationally, more than half of baby boomers (55%) vote against continuing the forbearance period — highest among the demographics. Meanwhile, the other age groups favor the payment pause, with millennials the highest at 78%.

Balancing finances with children appears to be a key factor in student loan payments — 79% of Americans with children younger than 18 hope for a forbearance extension. Meanwhile, 67% of those without children and 56% of borrowers with adult children favor forbearance continuing.

While the government has yet to set a concrete date, LendingTree student loan expert Michael Kitchen predicts the current forbearance period will end in August 2023 (more on this later), just over three years beyond its beginning.

Meanwhile, borrowers are bracing themselves for when repayment resumes, especially those from low-income households. Nearly 4 in 10 Americans (39%) with federally held student loans aren’t ready for payments to begin. Women (51%) are far more unprepared than men (28%).

Returning to regular monthly payments could be a big adjustment for many borrowers, Kitchen says.

41% of those with federally held student loans haven’t made a single payment since March 2020

While 41% of Americans with federally held student loans took a complete break from payments when the pandemic pause began, 32% continued meeting their monthly payment and 22% made periodic payments.

According to Kitchen, the nationwide forbearance was designed to help avoid financial disaster.

Interestingly, those with underage children (63%) have continued student loan payments in some form during the forbearance period, compared with 48% of adults with no children.

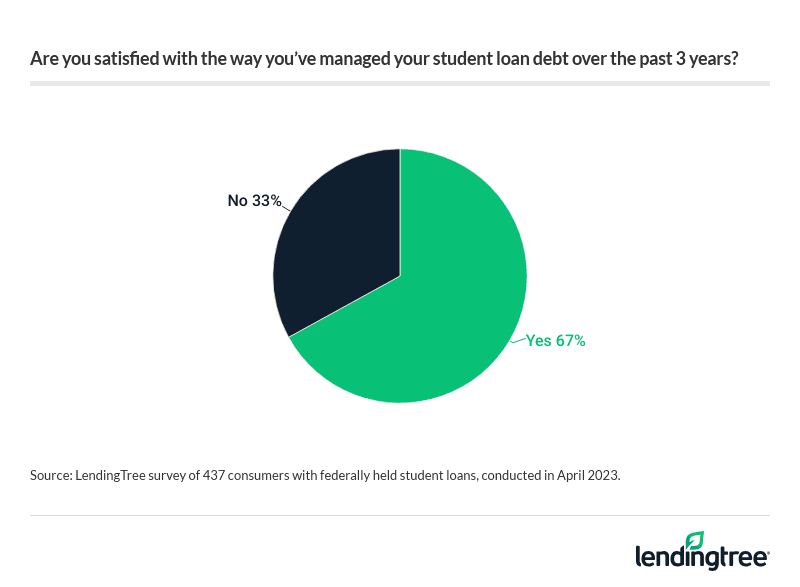

Overall, 67% of borrowers with federally held student loans are happy with how they’ve managed their federal student debt over the past three years. Men (73%) feel more positive about their approach than women (60%).

Yet many borrowers are left wondering: Was paying off student loans during the pandemic pause a good decision?

Of course, not everyone had the means to continue paying their student loans, especially those hit hard by the pandemic. The payment pause was there for a reason — to help those who needed it the most.

How has the attitude toward student loans changed since the pandemic? Well, 72% of men and 47% of women with federally held student loans say managing payments before the pandemic was fairly easy. Additionally, 61% of those with federally held loans say they were able to manage their pre-pandemic payments successfully.

“It’s difficult to say what proportion of borrowers are going to have a rough time when the repayment pause ends, but there’ll certainly be some,” Kitchen says.

65% of Americans think forbearance has been helpful to borrowers’ financial situations

There’s no denying that temporarily pausing student loan payments has had a widespread effect — 65% of Americans agree that the forbearance period provided a financial advantage for all borrowers. Further, those who want to get ahead can still make a significant dent in their loan balances while interest is paused.

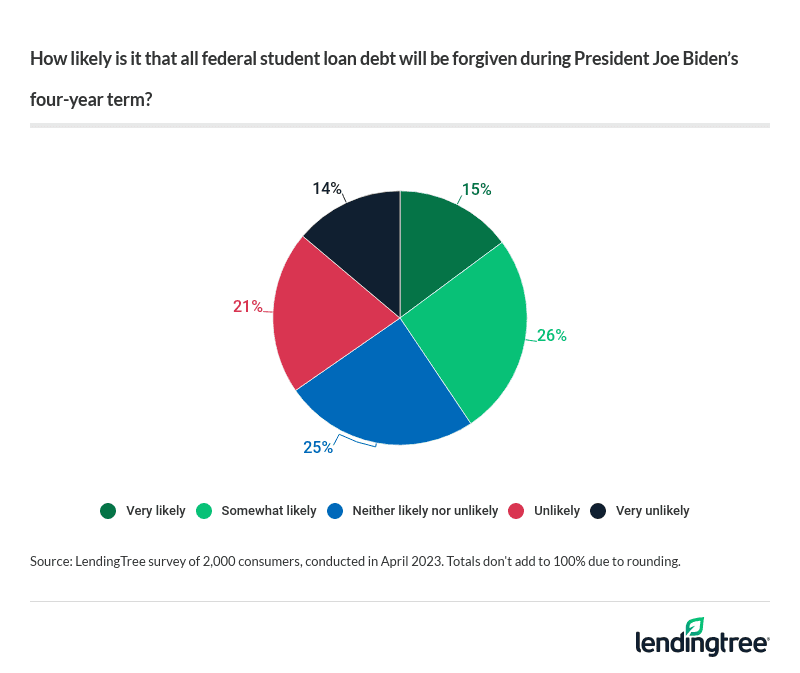

However, the debate continues on whether the mass federal student loan forgiveness will happen during Biden’s four-year term. Based on our findings, 41% believe it’s at least somewhat likely for the plan to gain approval.

Baby boomers seem to have the least confidence in the forgiveness plan’s future, with only 28% believing it has a chance of moving ahead. Meanwhile, millennials (46%), Gen Zers (44%) and Gen Xers (40%) are clinging to more hope for the plan’s success.

The Supreme Court will decide the outcome of the two current lawsuits against the Biden administration’s mass forgiveness plan, likely sometime in June.

More than 4 in 10 (43%) Americans feel the Biden administration has positively impacted the U.S. student loan debt crisis, while 22% view the administration’s work on the issues in a negative light. Meanwhile, 35% feel neutral about Biden’s overall impact on student debt.

Looking closely at income, only 36% of those earning between $35,000 and $49,999 believe in Biden’s positive influence on student debt. In contrast, 57% of six-figure earners think Biden can help make a difference with the student loan burden.

Should borrowers prioritize federal student loans when forbearance ends?

Deciding which bills to focus on can be tough, especially if you have a limited budget. However, 72% say individual borrowers should prioritize federal student loans once payments resume. Surprisingly, all income brackets agree that student loans should come first — from 66% of the lowest earners (under $35,000) to 81% of the highest earners ($100,000 or more).

Kitchen says there’s no perfect solution for everyone since people have different financial priorities.

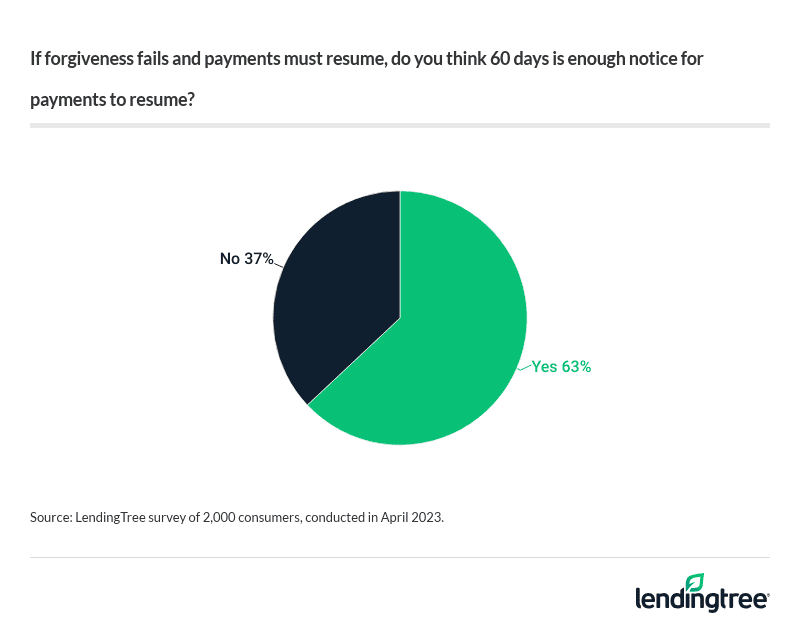

The White House has said it wouldn’t resume federal student loan payments until 60 days after the litigation over its forgiveness plan resolves (or 60 days after June 30 if the challenges are still pending). If forgiveness fails and payments restart, 63% of Americans feel 60 days is enough notice for payments to resume.

Kitchen notes that while private student loan borrowers have needed to make monthly payments during this time, most federal borrowers have gotten out of the habit of thinking about their student loan debt.

You can consider the following options to help manage your student loan debt:

- Apply for an income-driven payment plan

- Change your student loan repayment plan

- Apply for student loan deferment or forbearance

- Research other student loan forgiveness programs, like Public Service Loan Forgiveness (PSLF)

- Create a solid budget to live within your means

- Find an employer offering student loan repayment assistance

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 2,000 U.S. consumers ages 18 to 77 from April 3 to 5, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77