Metros Where People Pay the Lowest, Highest Property Taxes

With the federal income tax filing deadline quickly approaching, taxes are on many people’s minds. LendingTree wanted to mark the occasion by looking at a tax all too familiar to homeowners: property taxes.

How much you pay in property taxes — also called real estate taxes — varies significantly and can be influenced based on the home’s worth and location, among other factors.

To illustrate the variances in people’s property taxes, LendingTree analyzed U.S. Census Bureau data on the median amount paid annually in each of the nation’s 50 largest metros.

We found that homeowners in some metros can expect to shell out thousands of dollars more a year in property taxes than homeowners in other parts of the country.

On this page

Key findings

- Property taxes can vary significantly across the nation’s 50 largest metros. For example, annual median property taxes in Birmingham, Ala. — where homeowners pay the least in real estate taxes — are $8,096 cheaper than in the New York metro, where they’re the highest.

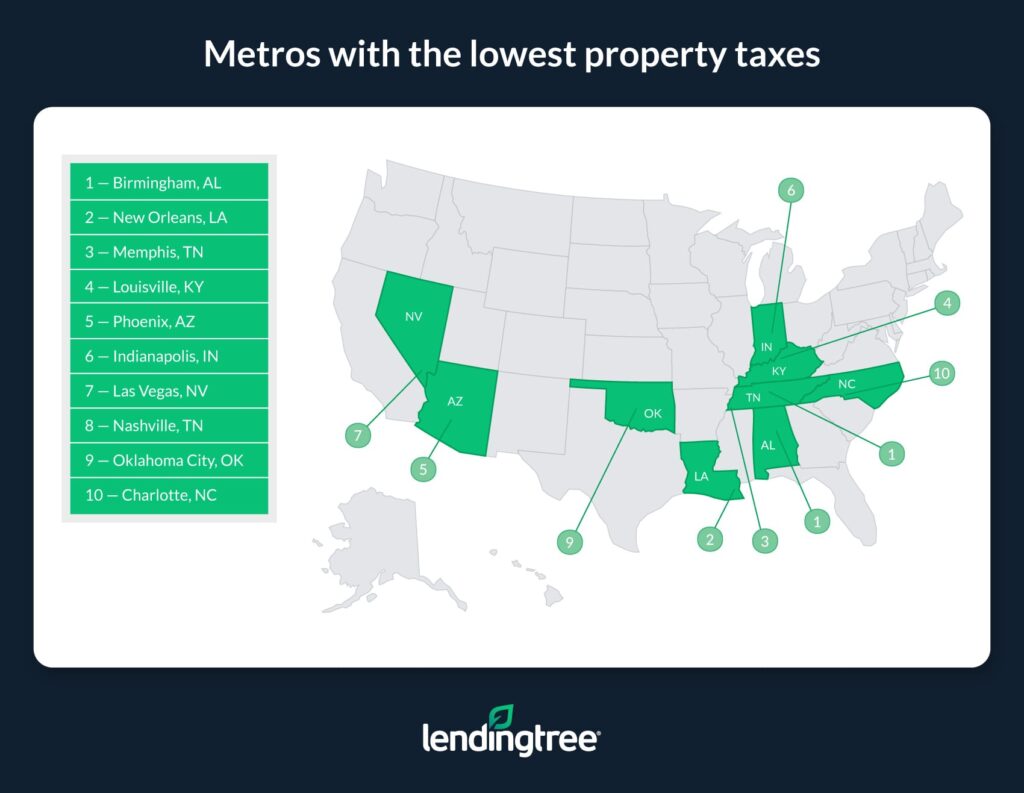

- Birmingham, Ala., is the only metro where median property taxes are less than $1,000 a year. The median amount of property taxes paid by homeowners in Birmingham is just shy of that total at $995. For comparison, residents in the next two metros with the lowest median real estate taxes — New Orleans and Memphis, Tenn. — owed $1,506 and $1,672 a year, respectively. Seven of the 10 metros with the lowest property taxes are in the South.

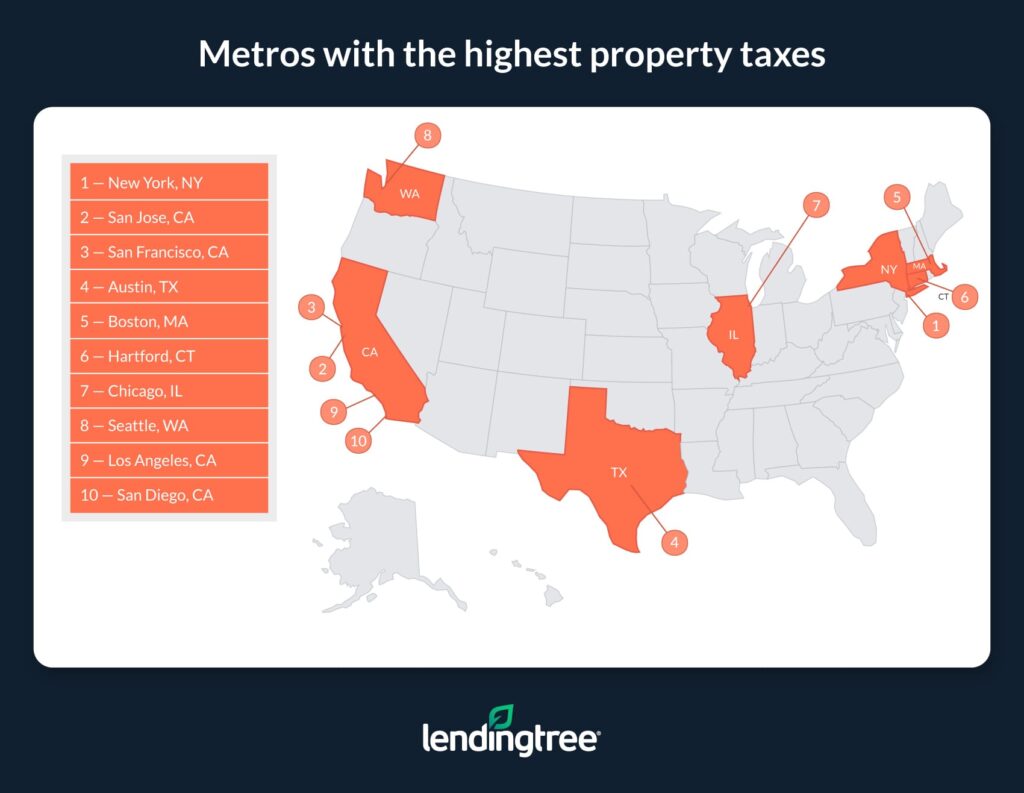

- New York, San Jose, Calif., and San Francisco are the metros where homeowners pay the most in property taxes. Unsurprisingly, residents in these metros known for their expensive real estate shell out a lot of money in property taxes each year. The median amount paid is $9,091 in New York, $8,858 in San Jose and $7,335 in San Francisco.

- Since 2019, median property taxes have increased in each of the nation’s 50 largest metros. Property taxes increased the most in Tampa, Fla., where the median amount paid increased by 18.0% from 2019 to 2021. In Hartford, Conn., the increase was the smallest at 1.1%. Remember that real estate taxes can vary significantly by person, meaning that some people’s property taxes may have increased by considerably more or less than their area’s overall rate.

- Median property taxes on homes without a mortgage are $692 less expensive, on average, than on homes with mortgages. There are various reasons, ranging from home values tending to be less expensive on homes without a mortgage to some states having tax exemptions or reductions for older homeowners who may be more likely to own their home outright. Salt Lake City, Seattle, Portland, Ore., Boston, Virginia Beach, Va., and Nashville, Tenn. — the six metros where median property taxes are slightly higher for homes without a mortgage — illustrate there are exceptions.

Metros with the lowest property taxes

No. 1: Birmingham, Ala.

- Median property taxes paid — all homes: $995

- Median property taxes paid — homes with a mortgage: $1,152

- Median property taxes paid — homes without a mortgage: $774

- Percentage increase in median property taxes paid on all homes from 2019 to 2021: 6.2%

No. 2: New Orleans

- Median property taxes paid — all homes: $1,506

- Median property taxes paid — homes with a mortgage: $1,733

- Median property taxes paid — homes without a mortgage: $1,174

- Percentage increase in median property taxes paid on all homes from 2019 to 2021: 12.1%

No. 3: Memphis, Tenn.

- Median property taxes paid — all homes: $1,672

- Median property taxes paid — homes with a mortgage: $1,810

- Median property taxes paid — homes without a mortgage: $1,372

- Percentage increase in median property taxes paid on all homes from 2019 to 2021: 3.5%

Metros with the highest property taxes

No. 1: New York

- Median property taxes paid — all homes: $9,091

- Median property taxes paid — homes with a mortgage: $9,342

- Median property taxes paid — homes without a mortgage: $8,669

- Percentage increase in median property taxes paid on all homes from 2019 to 2021: 4.6%

No. 2: San Jose, Calif.

- Median property taxes paid — all homes: $8,858

- Median property taxes paid — homes with a mortgage: $10,000

- Median property taxes paid — homes without a mortgage: $5,816

- Percentage increase in median property taxes paid on all homes from 2019 to 2021: 14.2%

No. 3: San Francisco

- Median property taxes paid — all homes: $7,335

- Median property taxes paid — homes with a mortgage: $8,422

- Median property taxes paid — homes without a mortgage: $5,278

- Percentage increase in median property taxes paid on all homes from 2019 to 2021: 8.2%

Property taxes can be a pain, but they’re often worth it

Though paying property taxes isn’t fun, one of the nice things about them is it can be easy to see their impact. Property taxes are often reinvested directly into the communities from which they came.

Real estate taxes are generally used to pay for things people and their families frequently use, like roads, schools and emergency response services — including fire departments.

While it can be easy to take these kinds of public services and infrastructures for granted, maintaining them isn’t cheap. Without the taxes to support them, many things in our communities would likely become unusable for the majority of people — or outright disappear. It’s for this reason that paying property taxes is important.

Tax tips for homeowners

Though you can potentially deduct various home-related costs on your federal tax return — such as property taxes and mortgage interest — you’ll need to itemize your return to do so. Consider the following tax tips to help you determine whether itemization is worth it for you.

- To make itemizing a tax return worth it, a person’s deductible expenses must be higher than their standard deduction. For the 2022 tax year (that is, taxes to be filed in 2023), the standard deduction amount is $12,950 for single taxpayers and married taxpayers filing separately, $19,400 for heads of households and $25,900 for married taxpayers filing jointly.

- There are limits to how much people can deduct for state and local property taxes. The total amount that can be deducted for all state and local taxes, including property taxes, is $10,000 — or $5,000 for married taxpayers filing separately.

- Your first mortgage may not be the only thing you can get a tax deduction on. If you used a home equity loan or home equity line of credit (HELOC) to buy or substantially modify a property on which the loan is secured, you could potentially deduct the interest paid on those loans from your taxes. Specifically, if you incurred your debt after Dec. 15, 2017, you can deduct interest on up to $750,000 worth of your total mortgage debt (from both first and second mortgages). If you incurred your debt before Dec. 16, 2017, you can deduct mortgage interest from up to $1 million worth of your total mortgage debt.

Methodology

LendingTree analyzed data from the U.S. Census Bureau 2021 American Community Survey with one-year estimates — the latest survey available at the time of writing — to determine median property tax amounts for homes in the nation’s 50 largest metropolitan statistical areas (“MSAs”).

The Census Bureau uses the term “real estate tax” to define a tax charged on an “entire property (land and buildings) payable to all taxing jurisdictions, including special assessments, school taxes, county taxes and so forth.”

Real estate taxes are often referred to as property taxes. The terms are used interchangeably in this study.