More Than 10 Million People 65 and Older Have a Mortgage — Here’s Where They Make up the Largest Share of Homeowners

Mortgages are the largest debt held by Americans, which is why it’s often recommended that homeowners pay off their balances before retiring. That way, homeowners would have more money and less debt in retirement.

But paying off a mortgage before retirement age isn’t feasible for everyone. In fact, more than 10 million homeowners paying off their mortgages across the U.S. are 65 and older.

To better understand where homeowners are likely to still be paying off their mortgage near or past their retirement age, LendingTree analyzed the latest U.S. Census Bureau data. We utilized this data to look at the share of homeowners who are 65 and older and still have a mortgage in each of the nation’s 50 largest metros.

Across those 50 metros, an average of about 19% of homeowners who are 65 and older still have a mortgage. We also found that homes owned by people in this age group tend to be less valuable than those owned by the general population — and that their monthly housing costs tend to be lower.

On this page

Key findings

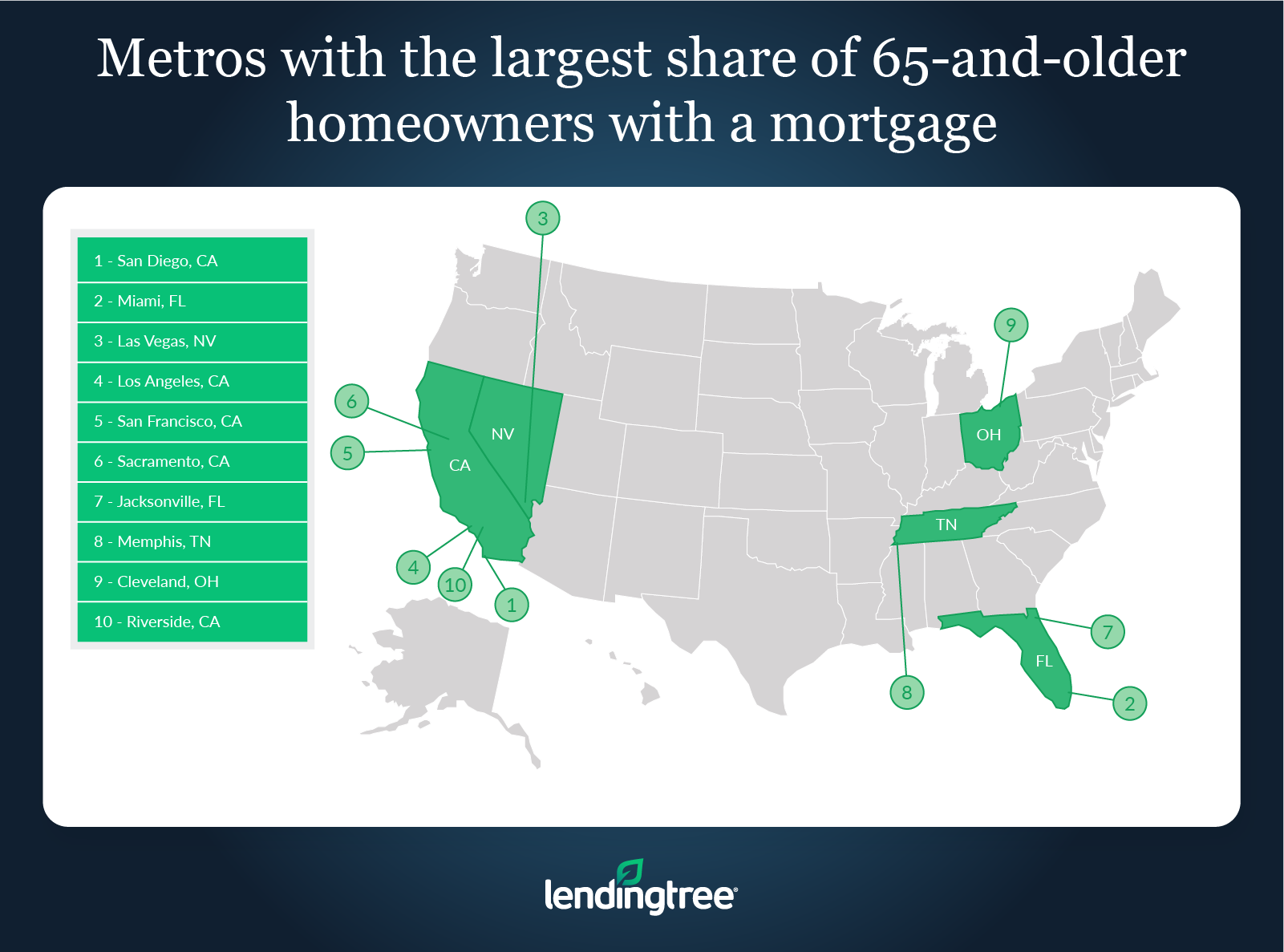

- San Diego, Miami and Las Vegas have the largest share of 65-and-older homeowners with a mortgage. Across these metros, an average of nearly a quarter — 23.74% — of homeowners 65 and older have a mortgage. That’s about 5 percentage points higher than the 50-metro average of 18.96%. In 2019 — before the pandemic — Miami had the largest share of retirement-age homeowners, while Las Vegas was fourth and San Diego was seventh.

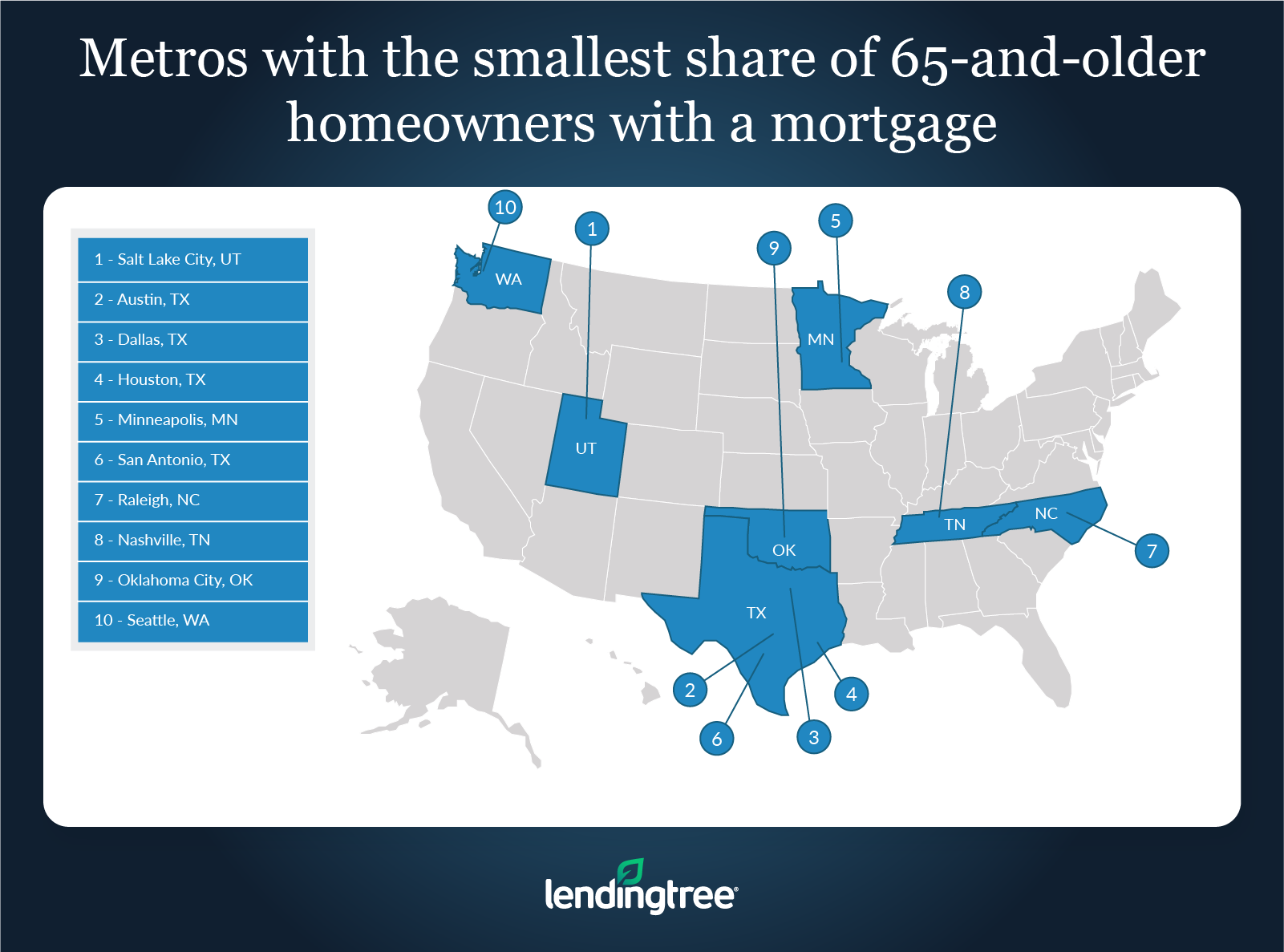

- Salt Lake City, Austin, Texas, and Dallas have the smallest share of 65-and-older homeowners with a mortgage. An average of only 13.91% of homeowners who are 65 and older have a mortgage in these metros.

- Metros in California tend to be home to larger shares of older homeowners with mortgages, while Texas metros tend to be home to smaller shares. Five of the 10 metros with the largest share of 65-and-older homeowners with a mortgage are in California, while four of the 10 metros with the smallest share of 65-and-older homeowners with a mortgage are in Texas.

- Typically, the homes owned by those 65 and older are worth less than those owned by the general population. Across the nation’s 50 largest metros, the median values of older homeowners’ homes are worth an average of $20,214 less than the median value of homes owned by the general population, up from $10,626 in 2019. Los Angeles is the only metro where the median value for homes owned by those 65 and older is higher than the median value of homes owned by the overall population.

- Even if they’re still paying off their mortgage, older homeowners usually have lower housing costs. Across the nation’s 50 largest metros, median monthly housing costs for 65-and-older homeowners with a mortgage are an average of $297 less than for the overall population of homeowners with a mortgage.

Metros with the largest share of 65-and-older homeowners with a mortgage

No. 1: San Diego

- Share of 65-and-older homeowners with a mortgage: 24.18%

- Median value of homes owned and occupied by those 65 and older: $698,000

- Median value of all owner-occupied housing units: $722,200

- Median monthly housing costs for homes with a mortgage owned and occupied by those 65 and older: $2,281

- Median monthly housing costs for all owner-occupied housing units with a mortgage: $2,735

No. 2: Miami

- Share of 65-and-older homeowners with a mortgage: 23.52%

- Median value of homes owned and occupied by those 65 and older: $334,300

- Median value of all owner-occupied housing units: $362,500

- Median monthly housing costs for homes with a mortgage owned and occupied by those 65 and older: $1,682

- Median monthly housing costs for all owner-occupied housing units with a mortgage: $2,005

No. 3: Las Vegas

- Share of 65-and-older homeowners with a mortgage: 23.51%

- Median value of homes owned and occupied by those 65 and older: $357,000

- Median value of all owner-occupied housing units: $365,800

- Median monthly housing costs for homes with a mortgage owned and occupied by those 65 and older: $1,386

- Median monthly housing costs for all owner-occupied housing units with a mortgage: $1,616

Metros with the smallest share of 65-and-older homeowners with a mortgage

No. 1: Salt Lake City

- Share of 65-and-older homeowners with a mortgage: 13.56%

- Median value of homes owned and occupied by those 65 and older: $426,900

- Median value of all owner-occupied housing units: $444,200

- Median monthly housing costs for homes with a mortgage owned and occupied by those 65 and older: $1,429

- Median monthly housing costs for all owner-occupied housing units with a mortgage: $1,755

No. 2: Austin, Texas

- Share of 65-and-older homeowners with a mortgage: 13.77%

- Median value of homes owned and occupied by those 65 and older: $382,900

- Median value of all owner-occupied housing units: $397,100

- Median monthly housing costs for homes with a mortgage owned and occupied by those 65 and older: $1,736

- Median monthly housing costs for all owner-occupied housing units with a mortgage: $2,087

No. 3: Dallas

- Share of 65-and-older homeowners with a mortgage: 14.41%

- Median value of homes owned and occupied by those 65 and older: $279,200

- Median value of all owner-occupied housing units: $294,900

- Median monthly housing costs for homes with a mortgage owned and occupied by those 65 and older: $1,657

- Median monthly housing costs for all owner-occupied housing units with a mortgage: $1,979

Getting a mortgage later in life isn’t necessarily a bad idea

As would-be homeowners age, there are various reasons why many might second-guess getting a mortgage, especially if they’re worried they’ll be paying off their loan into their late 60s or beyond.

Some older buyers might be concerned they won’t be able to keep up with their monthly mortgage payments once they retire, while others might worry that they’ll die before they finish paying off their loan and saddle their family with leftover debt.

In fact, those who get a mortgage later in life might be in a better position to handle their debt than someone younger. This is because older Americans generally have better credit scores and more financial assets than younger Americans.

Because people with stronger credit scores and more cash that can be used for a down payment tend to end up with better rates and smaller monthly payments than those with less cash or worse credit scores, older Americans who get a mortgage could find that paying off their loan isn’t as challenging as they feared.

Of course, income tends to drop when a person retires, but many thinking about getting a new mortgage in their 50s or 60 might find that they’re still more than capable of managing their debt even as they grow older.

Tips for getting and paying off a mortgage when you’re older

Older Americans considering a mortgage should keep the following tips in mind to help ensure they qualify for a loan and keep on top of their new debt.

- Consider a retirement mortgage. As the name implies, retirement mortgages can help older homebuyers no longer in the workforce purchase a home. Because these types of mortgages don’t have the same income standards as traditional loans, some older buyers might find qualifying for one easier than a traditional loan.

- Try to avoid taking out a massive loan. Though managing a mortgage after retiring is certainly possible, it’s especially important for older homeowners not to bite off more than they can chew. The smaller their loan, the less money they’ll need to allocate each month toward paying it off and the more money they’ll have for other expenses.

- Shop around before buying. Because different lenders can offer different rates, even to those with the same financial profiles, shopping around for a mortgage before buying a home is generally a good idea. Shopping around could increase an older homebuyer’s chances of finding a lender willing to work with them and help them secure a lower rate.

Methodology

Data in this study is derived at the metropolitan statistical area (MSA) level from the U.S. Census Bureau 2021 American Community Survey — the latest available.

Because of how the Census Bureau organizes its data, LendingTree focused on homeowners 65 and older, even though 65 is below the current minimum full retirement age in the U.S. of either 66 or 67, depending on the year the person was born.