Most Popular Metros for Gen X Homebuyers

Born between 1965 and 1980, many members of Generation X are in their peak earning years. While the COVID-19 pandemic has doubtlessly stifled some of that earning potential, Gen Xers are still taking advantage of near-record-low mortgage rates to buy homes.

But where are Gen Xers looking to buy? To answer this, LendingTree analyzed mortgage purchase requests made in 2020 on the LendingTree platform in the nation’s 50 largest metros.

LendingTree researchers found that Gen Xers made up more than a quarter of potential homebuyers in almost all the country’s largest metros, and that they were the second-largest generational group of homebuyers after millennials.

Key findings

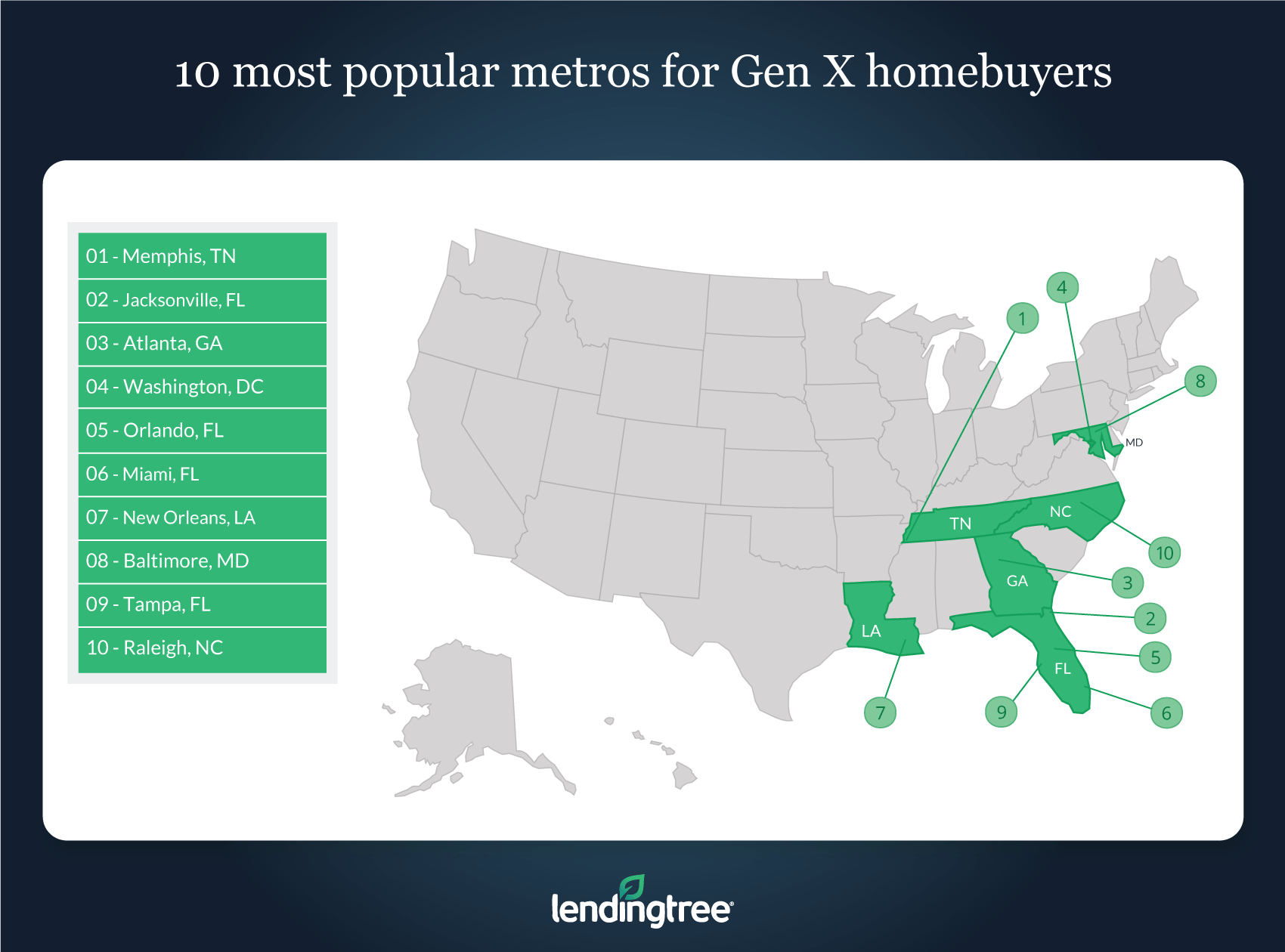

- Memphis, Tenn., Jacksonville, Fla., and Atlanta have the largest share of Gen Xers making purchase requests. In Memphis, 33.42% of purchase requests came from Gen Xers. In Jacksonville and Atlanta, it’s 32.02% and 31.91%, respectively.

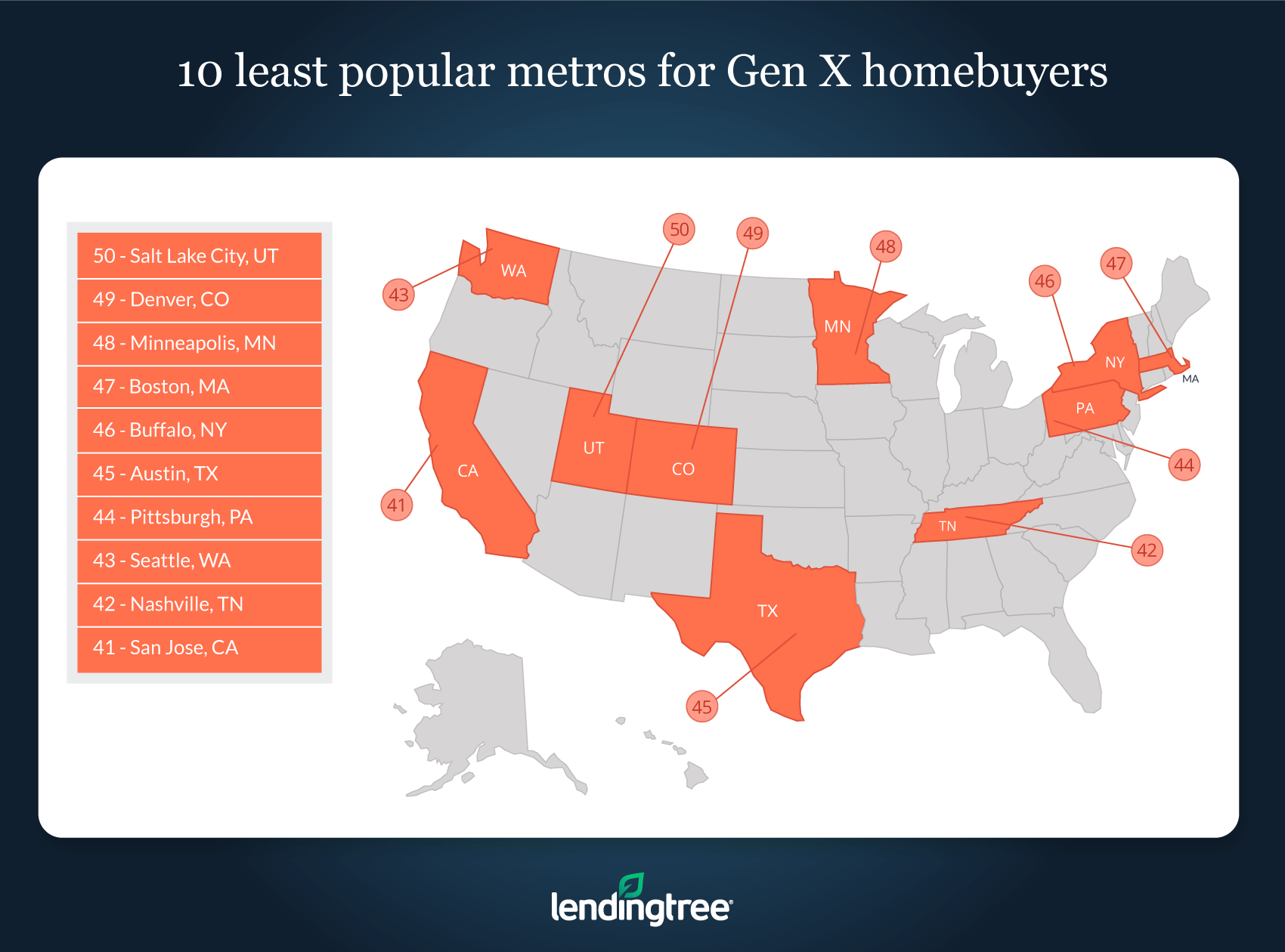

- Salt Lake City, Denver and Minneapolis have the lowest percentages of Gen Xers making purchase requests. Gen Xers made just 22.66% of the purchase requests in Salt Lake, 24.46% in Denver and 25.39% in Minneapolis.

- Gen X homebuyers in Tampa, Fla., Las Vegas and Phoenix are the oldest and those in San Jose, Calif., San Francisco and Austin, Texas, are the youngest. The average age in the three metros with the oldest Gen X homebuyers is 46.98, more than a year older than the average age in the three metros with the youngest Gen X homebuyers, 45.83.

- Potential Gen X homebuyers in San Francisco, San Jose and New York had the highest average credit scores. The average credit score for these three metros is 705, which makes sense given how expensive and competitive these metros are. By comparison, the average credit score for Gen X homebuyers across the 50 largest metros is 661.

Most popular metros for Gen X homebuyers

No. 1: Memphis, Tenn.

- Share of mortgage requests coming from Gen Xers: 33.42%

- Average Gen Xer age: 46.12

- Average credit score among Gen Xers: 634

- Average down payment amount among Gen Xers: $28,695

- Average requested loan amount among Gen Xers: $198,822

No. 2: Jacksonville, Fla.

- Share of mortgage requests coming from Gen Xers: 32.02%

- Average Gen Xer age: 46.52

- Average credit score among Gen Xers: 648

- Average down payment amount among Gen Xers: $35,519

- Average requested loan amount among Gen Xers: $234,899

No. 3: Atlanta

- Share of mortgage requests coming from Gen Xers: 31.91%

- Average Gen Xer age: 46.55

- Average credit score among Gen Xers: 647

- Average down payment amount among Gen Xers: $36,651

- Average requested loan amount among Gen Xers: $244,800

Least popular metros for Gen X homebuyers

No. 1: Salt Lake City

- Share of mortgage requests coming from Gen Xers: 22.66%

- Average Gen Xer age: 46.11

- Average credit score among Gen Xers: 678

- Average down payment amount among Gen Xers: $59,538

- Average requested loan amount among Gen Xers: $333,019

No. 2: Denver

- Share of mortgage requests coming from Gen Xers: 24.46%

- Average Gen Xer age: 46.27

- Average credit score among Gen Xers: 679

- Average down payment amount among Gen Xers: $70,628

- Average requested loan amount among Gen Xers: $380,498

No. 3: Minneapolis

- Share of mortgage requests coming from Gen Xers: 25.39%

- Average Gen Xer age: 45.97

- Average credit score among Gen Xers: 670

- Average down payment amount among Gen Xers: $47,462

- Average requested loan amount among Gen Xers: $268,237

Tips for Gen X homebuyers

Buying a house — especially amid a coronavirus crisis — can be a daunting task for anyone, regardless of age. But by keeping the following tips in mind, Gen Xers can potentially save money and increase their likelihood of being approved for a mortgage.

- Work on your credit score. While you don’t need to have perfect credit to be approved for a mortgage, making on-time payments and keeping your spending in check can help you boost your credit score and increase your odds of securing a home loan.

- Pay down your monthly debts. Lenders will look at your debt-to-income (DTI) ratio, or the percentage of your gross monthly income that goes toward recurring debts. Maximum DTI ratios vary by loan program, so it’s a good idea to keep your DTI ratio (which includes your monthly mortgage and all debt payments) at 36% or less.

- Save up for a down payment. There are many potential benefits to putting a larger down payment on a house, from lowering your monthly payments to allowing you to qualify for a more expensive home.

- Shop around before choosing a mortgage. Different lenders can offer different mortgage rates to borrowers with the same financial profiles. As a result, the first lender you go to might not be giving you your best loan terms. By shopping around for a mortgage, you could potentially lower your monthly payments and save thousands of dollars over the lifetime of your loan.

Methodology

LendingTree used generational definitions from the Pew Research Center to determine the following age ranges:

- Generation Xers are defined as being born between 1965 and 1980.

- Millennials are defined as being born between 1981 and 1996.

Metropolitan statistical area (MSA) rankings were generated by looking at the percentage of total purchase mortgage requests received by LendingTree from Generation X borrowers. The larger the share of requests from Gen Xers, the higher ranking a metro area received.

Borrower data was derived from mortgage requests and offers given to users of the LendingTree platform across the nation’s 50 largest metropolitan areas from Jan. 1, 2020, to Dec. 31, 2020.

LendingTree research analyst Jacob Channel contributed to this report.