Nearly 70% of Americans Make Sacrifices to Afford Housing Costs

Consumers are giving up more to keep up with their rent and mortgage payments, despite eviction moratorium and mortgage forbearance relief being available during the thick of the coronavirus pandemic.

In fact, nearly 7 in 10 (69%) Americans with a monthly rent or mortgage payment have made a sacrifice to pay for housing, according to the newest LendingTree survey. And 1 in 5 say they’ve opted to pay their rent or mortgage rather than have enough to eat.

LendingTree surveyed nearly 1,400 U.S. consumers with monthly rent or mortgage payments to find out what they’ve had to give up to budget for their housing costs.

TABLE OF CONTENTS

Key findings

- Nearly half (48%) of Americans with a monthly rent or mortgage payment say they were worried about that payment during the past month. Those most worried include Gen Zers (67%), millennials (59%), parents with kids younger than 18 (59%), households that make less than $35,000 (57%), women (57%) and renters (57%).

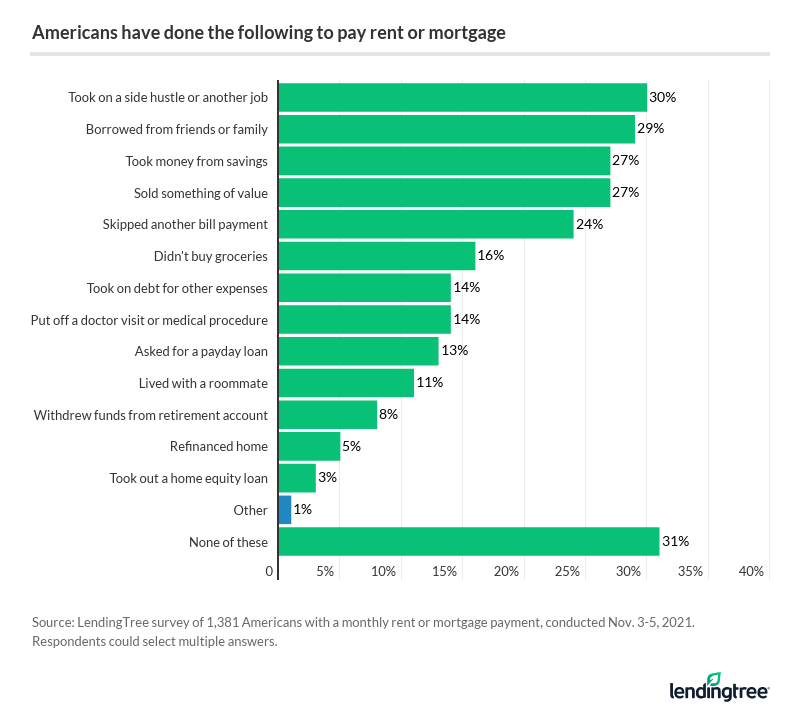

- 30% of consumers have taken on a side hustle or other job to afford monthly housing costs. Others report borrowing from loved ones (29%), taking money from savings (27%) and selling something of value (27%).

- About 7 in 10 Americans (69%) have made sacrifices to pay their rent or mortgage. Notable examples include skipping a vacation (37%), staying in a bad job (22%) and not having enough to eat (20%).

- Overall, women, renters and parents with kids younger than 18 generally struggle the most with monthly housing costs. These groups are most likely to report making sacrifices to increase income or cut spending and being concerned about affording their rent or mortgage payments.

- 45% of consumers are considering moving to a less-expensive living situation. Those most likely to think about moving include Gen Zers (62%), New Englanders (59%) and renters (57%).

Gen Zers worry more about making housing payment ends meet

Among every demographic — from gender to age to household income to region — Gen Zers (ages 18 to 24) are most worried about making ends meet for their housing expenses. About 2 in 3 Gen Zers (67%) cite worries, nearly 20 percentage points higher than the 48% across all respondents with rent or mortgage payments.

Millennials ages 25 to 40 (59%), parents with children younger than 18 (59%), households that make less than $35,000 (57%), women (57%) and renters (57%) also lose sleep about whether they’ll have the means to make their housing payments.

Here’s a closer look at some of those breakdowns:

One job isn’t enough for 30% of consumers to cover housing expenses

According to the survey, 3 in 10 consumers have taken on a side hustle or other job to help earn income toward monthly housing costs. This was necessary for some, as a July 2020 LendingTree survey found that more than half of mortgage borrowers lost income amid the pandemic.

“Companies mandating that their employees return to their offices could result in people having less free time to get a second job,” Channel says.

Not being able to go this route could lead consumers to continue to:

- Rely on loved ones (29%)

- Tap their savings (27%)

- Sell their valuables (27%)

Here’s a deeper look overall:

By demographic, the main thing people say they did to make rent or mortgage payments varied:

- Men: Take on a side hustle or other job (23%)

- Women: Borrow from friends or family (37%)

- Gen Zers: Take on a side hustle or other job (51%)

- Millennials: Take on a side hustle or other job (38%)

- Gen Xers ages 41 to 55: Borrow from friends or family (32%)

- Baby boomers ages 56 to 75: Take money from their savings (15%)

- Renters: Borrow from friends or family (42%)

- Owners: Take money from their savings (24%)

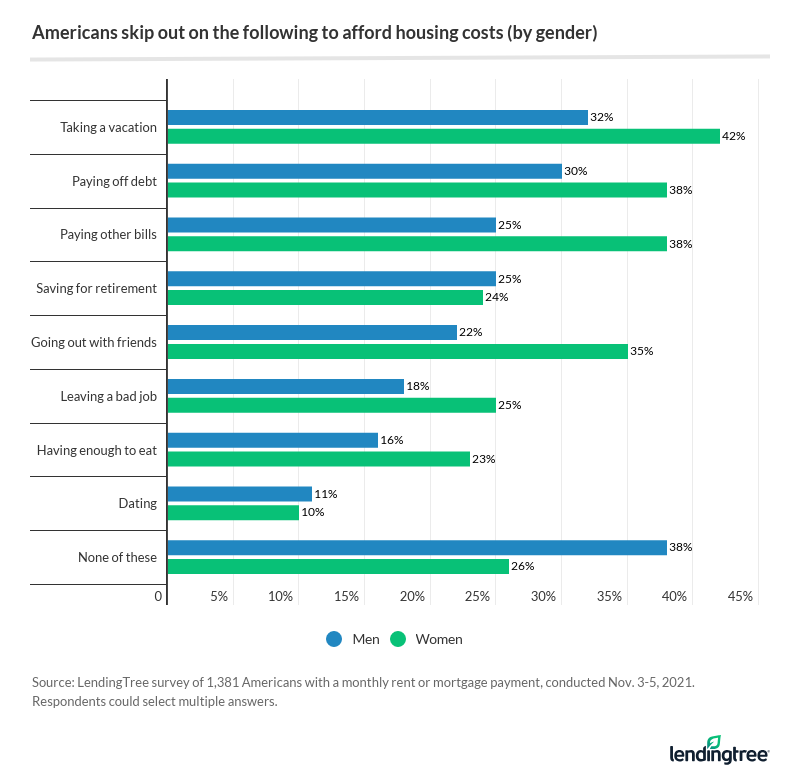

Women more likely to act on housing affordability problems

One in 5 (20%) Americans surveyed say their housing payments aren’t affordable. Of this group, 23% of women cite a lack of affordability, versus 15% of men.

Whether it’s the right decision or not, women are more willing than men to put off taking a vacation, hanging out with friends, paying off debt or even having enough to eat to make rent or mortgage payments.

Here’s a closer look:

Overall, nearly 7 in 10 (69%) have made sacrifices to make rent or mortgage payments, including:

- 37% skipping a vacation

- 22% staying in a bad job

- 20% skipping having enough food

In 2021, some renters and owners leaned on government relief to stay afloat. More than 3 in 10 (31%) renters say the eviction moratorium provided significant relief during the pandemic. Meanwhile, 22% of owners say they applied for mortgage forbearance during the crisis, with 19% approved.

Unfortunately, homeowners and renters aren’t likely to get much payment relief from housing expenses in 2022.

“Prices will probably become somewhat more manageable, but rent and mortgage payments will remain steep in many parts of the country,” Channel says.

Is moving to a less expensive living situation the answer for some?

The data above shows that Gen Zers are most worried about their housing expenses, regardless of demographics. It also shows that Gen Zers make up the largest percentage of consumers (62%) considering moving to a less-expensive situation, whether a smaller apartment or a cheaper home.

Gen Zers are followed by:

- New Englanders, or those who live in Maine, New Hampshire, Vermont, Massachusetts, Rhode Island or Connecticut (59%)

- People who pay $2,000 or more a month in rent or mortgage payments (59%)

- Renters (57%)

Overall, 45% of Americans are thinking about this kind of change.

If you’re looking for a new location rather than a new housing type, you may consider a move south.

For those unable to move, Channel suggests living with other family members or roommates to defray rising housing prices.

“Being able to split monthly payments between multiple income earners can drastically reduce an individual’s cost burden,” he says.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 1,381 U.S. consumers with a monthly rent or mortgage payment, from Nov. 3-5, 2021. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2021:

- Generation Z: 18 to 24

- Millennial: 25 to 40

- Generation X: 41 to 55

- Baby boomer: 56 to 75

While the survey also included consumers from the silent generation (those 76 and older), the sample size was too small to include findings related to that group in the generational breakdowns.