Learn Where Refinancers Are More Likely to Get Approved, Plus How to Increase Your Odds

While mortgage rates have gradually increased since February, they are still more than 30 basis points lower than they were in March 2020. This means many homeowners might still be able to save on their monthly mortgage payments by refinancing into a loan with a lower interest rate.

To determine where homeowners are most likely to be approved for a refinance, LendingTree used data from the latest Home Mortgage Disclosure Act (HMDA) to analyze more than 2.8 million mortgage refinance applications in the nation’s 50 largest metropolitan areas.

What LendingTree found was that while most mortgage refinances were approved, many were declined for common reasons, including a high debt-to-income ratio, poor credit history and lack of collateral.

Key findings

- Across the nation’s 50 largest metros, nearly 83% of mortgage refinances were approved.

- For the 17% of applications that were not approved, the top four reasons for denial were debt-to-income (DTI) ratio, credit history, incomplete credit application and collateral.

- A too-high DTI ratio was the denial reason for 26.5% of denied applications. DTI can be an especially difficult-to-overcome barrier in expensive areas like Los Angeles, San Jose, Calif., and New York.

- A lackluster credit history held back 23% of failed applicants. Poor credit was a significant problem in southern metros like Louisville, Ky., Memphis, Tenn., and Birmingham, Ala.

- Incomplete credit applications were a problem for 18.5% of unsuccessful applicants. HMDA doesn’t specify why applications were left incomplete, so it’s difficult to say why so many applications are denied for this reason. Regardless, refinancers in Sacramento, Calif., Phoenix and Riverside, Calif., were the most likely to be denied because of an incomplete application.

- Insufficient collateral was the main reason that kept 14.9% of denied applications from being approved. Borrowers in areas where home prices are relatively low like Pittsburgh, Detroit and Buffalo, N.Y., struggled the most with collateral.

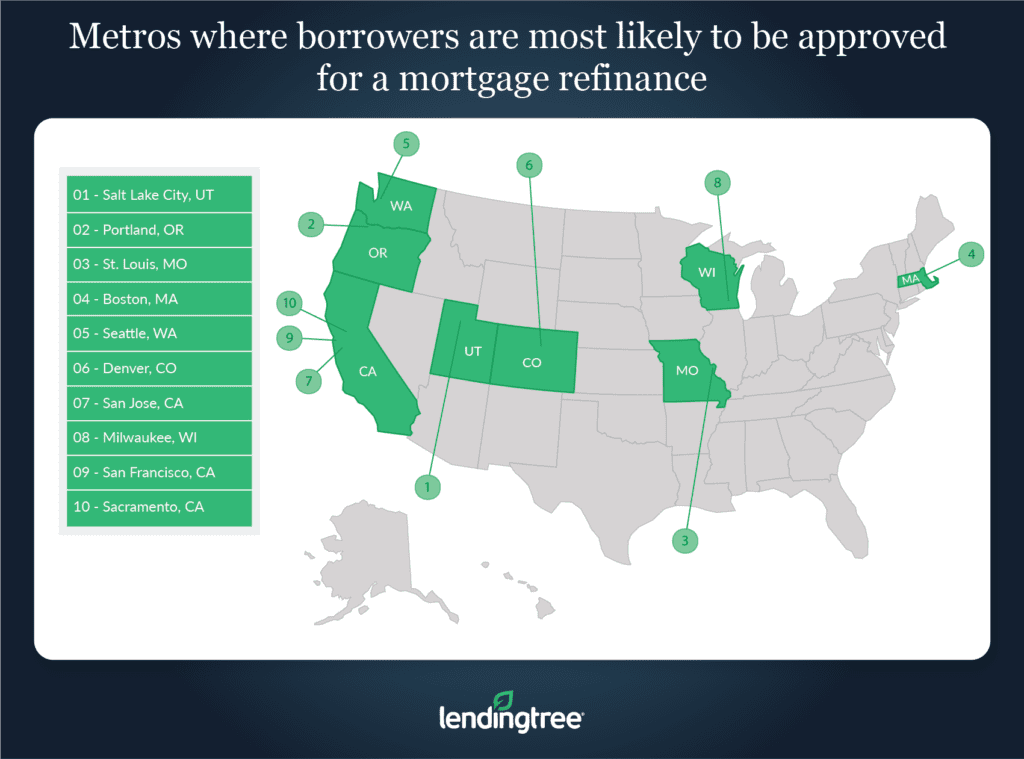

Metros where borrowers are most likely to be approved for a mortgage refinance

No. 1: Salt Lake City

- Mortgage refinance approval rate: 89.21%

- Leading cause of refinance denial: Debt-to-income ratio

- Share of refinances denied for leading cause of denial: 27.5%

No. 2: Portland, Ore.

- Mortgage refinance approval rate: 88.48%

- Leading cause of refinance denial: Debt-to-income ratio

- Share of refinances denied for leading cause of denial: 27.8%

No. 3: St. Louis

- Mortgage refinance approval rate: 88.41%

- Leading cause of refinance denial: Credit history

- Share of refinances denied for leading cause of denial: 26.4%

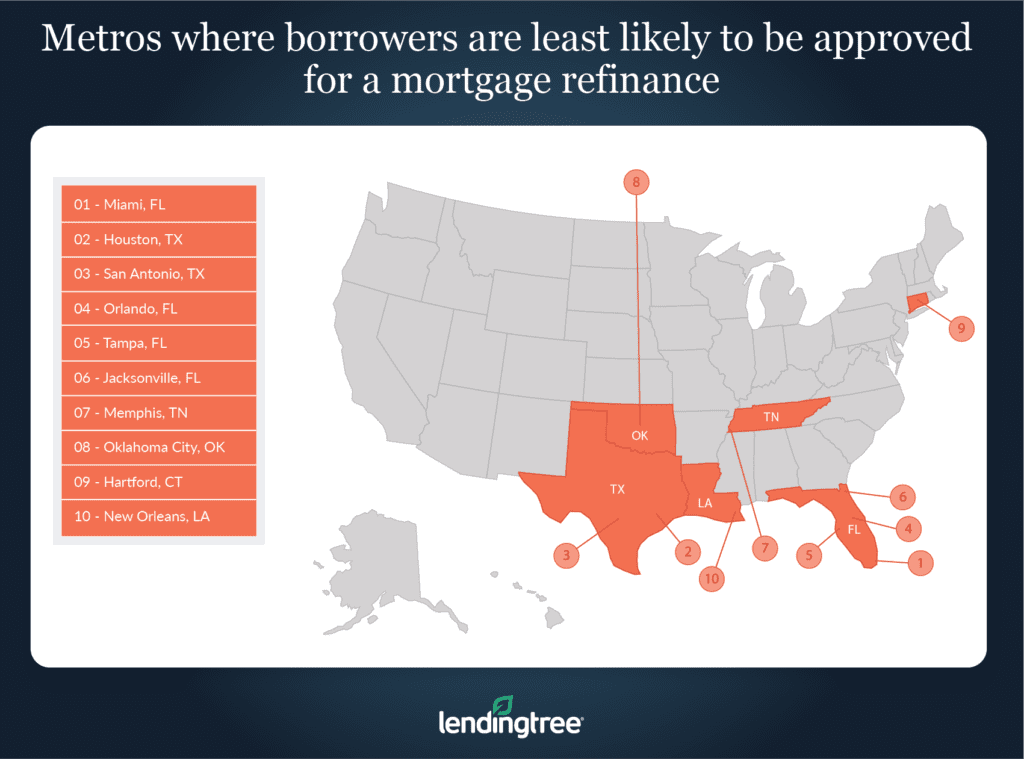

Metros where borrowers are least likely to be approved for a mortgage refinance

No. 1: Miami

- Mortgage refinance approval rate: 75.52%

- Leading cause of refinance denial: Debt-to-income ratio

- Share of refinances denied for leading cause of denial: 32%

No. 2: Houston

- Mortgage refinance approval rate: 76.28%

- Leading cause of refinance denial: Debt-to-income ratio

- Share of refinances denied for leading cause of denial: 25.7%

No. 3: San Antonio

- Mortgage refinance approval rate: 76.92%

- Leading cause of refinance denial: Credit history

- Share of refinances denied for leading cause of denial: 25.6%

How to increase the odds of a refinance approval

For some homeowners, being approved for a refinance can be a challenge, though not an insurmountable one. Below are a few tips to help you avoid the most common reasons why mortgage refinance applications are denied.

- Credit history: Before applying for a refinance, carefully review your credit history and ensure that it’s accurate. If you have a low credit score, take steps to improve it, such as paying down debt and making payments on time. In some cases, you might want to consider working with a credit repair company that can help you resolve issues on your credit report.

- Debt-to-income ratio: Don’t take out a new loan that stretches your ability to repay your new mortgage. Pay down debt prior to applying for a loan, and limit your spending.

- Collateral: If a borrower has insufficient collateral, it means that their home was appraised at a value too low for their requested loan amount. Asking for a smaller loan amount is often a good way to get around collateral issues.

- Incomplete applications: Make sure everything in your refinance application — from your tax records to your employment history — is both complete and accurate, and that you have paperwork to back up what you wrote down. Be proactive and gather all of the documentation you’ll need for a refi application so your loan approval isn’t derailed.

Methodology

To conduct this study, LendingTree analyzed more than 2.8 million mortgage application records from the Federal Financial Institutions Examination Council’s Home Mortgage Disclosure Act 2019 data set (the most recent available).

LendingTree research analyst Jacob Channel contributed to this report.