Where Small Business Cost Increases Will Hurt Consumers the Most

The COVID-19 pandemic is still ongoing, but the economy is on relatively solid ground at the moment. The unemployment rate is low — even if the labor force participation rate remains depressed — and Americans seem eager to spend money and stimulate the economy.

However, there’s a downside to the economic recovery that we’ve seen since the start of the pandemic. Namely, factors including rising wages and global supply chain issues have forced businesses to contend with extra costs to stay afloat. And, unfortunately for consumers, businesses have passed many of these extra costs onto them. It’s for this reason that we’ve seen the fastest 12-month increase in inflation since the 1980s.

Because higher costs are usually first felt by businesses before they’re passed onto consumers, one way to gauge where rising prices will most impact consumers is to look at how many businesses are experiencing cost increases. In this LendingTree study, we do just that by looking at the states with the highest rate of businesses facing moderate to severe price increases. We also offer tips — from creating a budget to taking out a debt consolidation loan — to help consumers deal with rising costs.

Key findings

- More than three-quarters of small businesses have seen moderate to large increases in the prices they pay for goods and services compared to before the coronavirus pandemic. 35.9% of businesses say they’ve paid large increases for goods and services, while 39.6% cite moderate increases — totaling 75.5%.

- Rhode Island has the highest percentage of businesses that report moderate to severe increases in prices paid. Rhode Island tops the list with 87.1% of businesses reporting moderate to large increases for goods and services. Behind Rhode Island are Arkansas (83.6%) and Kentucky (82.6%).

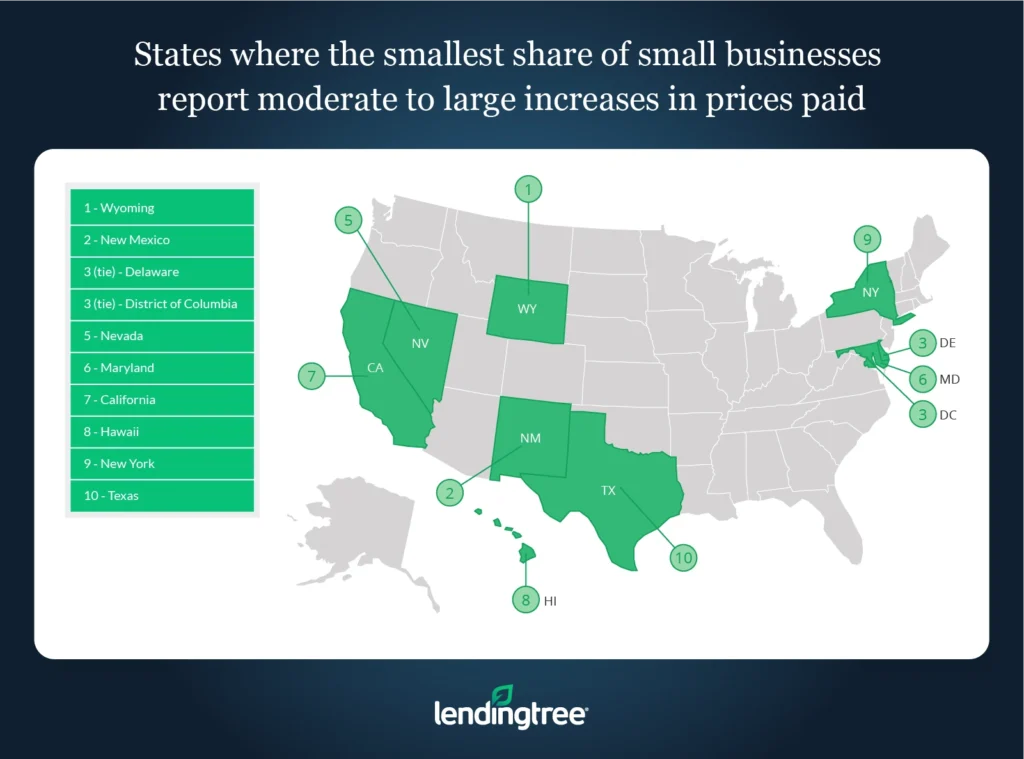

- Wyoming has the lowest percentage of businesses that report moderate to severe increases in prices paid. Wyoming is the only state below 60% — at 57.4%. Joining Wyoming at the bottom are New Mexico (61.4%) and Delaware and the District of Columbia (both 68.2%).

- The manufacturing industry is facing the most price increases. 91.0% of small businesses within the industry report moderate to large increases in the prices they pay for goods and services.

| Rank | Industry | % that report moderate to large increases | % that report large increases | % that report moderate increases |

|---|---|---|---|---|

| 1 | Manufacturing | 91.0% | 57.3% | 33.7% |

| 2 | Retail trade | 88.3% | 47.0% | 41.3% |

| 2 | Accomodation and food services | 88.3% | 52.3% | 36.0% |

| 4 | Construction | 87.5% | 59.2% | 28.3% |

| 5 | Wholesale trade | 84.7% | 49.8% | 34.9% |

| 6 | Other services | 81.6% | 36.0% | 45.6% |

| 7 | Transportation and warehousing | 75.7% | 41.0% | 34.7% |

| 8 | Administrative and support and waste management and remediation services | 74.9% | 34.9% | 40.0% |

| 9 | Utilities | 73.2% | 38.9% | 34.3% |

| 10 | Mining | 71.3% | 30.7% | 40.6% |

| 11 | Health care and social assistance | 68.7% | 24.0% | 44.7% |

| 12 | Arts, entertainment and recreation | 67.3% | 21.9% | 45.4% |

| 13 | Real estate rental and leasing | 66.1% | 22.1% | 44.0% |

| 14 | Professional, scientific and technical services | 59.5% | 14.1% | 45.4% |

| 15 | Educational services | 56.0% | 12.8% | 43.2% |

| 16 | Information | 55.3% | 12.0% | 43.3% |

| 17 | Finance and Insurance | 47.4% | 9.3% | 38.1% |

States where largest share of small businesses report moderate to large increases in prices paid

No. 1: Rhode Island

- Share of small businesses that report moderate increases in prices paid: 43.4%

- Share of small businesses that report large increases in prices paid: 43.7%

- Share of small businesses that report moderate to large increases in prices paid: 87.1%

No. 2: Arkansas

- Share of small businesses that report moderate increases in prices paid: 49.6%

- Share of small businesses that report large increases in prices paid: 34.0%

- Share of small businesses that report moderate to large increases in prices paid: 83.6%

No. 3: Kentucky

- Share of small businesses that report moderate increases in prices paid: 40.1%

- Share of small businesses that report large increases in prices paid: 42.5%

- Share of small businesses that report moderate to large increases in prices paid: 82.6%

States where smallest share of small businesses report moderate to large increases in prices paid

No. 1: Wyoming

- Share of small businesses that report moderate increases in prices paid: 34.7%

- Share of small businesses that report large increases in prices paid: 22.7%

- Share of small businesses that report moderate to large increases in prices paid: 57.4%

No. 2: New Mexico

- Share of small businesses that report moderate increases in prices paid: 30.8%

- Share of small businesses that report large increases in prices paid: 30.6%

- Share of small businesses that report moderate to large increases in prices paid: 61.4%

No. 3 (tie): Delaware

- Share of small businesses that report moderate increases in prices paid: 33.9%

- Share of small businesses that report large increases in prices paid: 34.3%

- Share of small businesses that report moderate to large increases in prices paid: 68.2%

No. 3 (tie): District of Columbia

- Share of small businesses that report moderate increases in prices paid: 50.5%

- Share of small businesses that report large increases in prices paid: 17.7%

- Share of small businesses that report moderate to large increases in prices paid: 68.2%

| Rank | State | % that report moderate to large increases | % that report large increases | % that report moderate increases |

|---|---|---|---|---|

| 1 | Rhode Island | 87.1% | 43.7% | 43.4% |

| 2 | Arkansas | 83.6% | 34.0% | 49.6% |

| 3 | Kentucky | 82.6% | 42.5% | 40.1% |

| 4 | South Carolina | 81.3% | 39.6% | 41.7% |

| 5 | Ohio | 81.2% | 42.4% | 38.8% |

| 6 | Indiana | 80.8% | 38.2% | 42.6% |

| 7 (tie) | Idaho | 80.7% | 43.5% | 37.2% |

| 7 (tie) | Wisconsin | 80.7% | 44.7% | 36.0% |

| 9 | Vermont | 80.3% | 39.0% | 41.3% |

| 10 (tie) | Maine | 79.7% | 43.8% | 35.9% |

| 10 (tie) | Pennsylvania | 79.7% | 35.5% | 44.2% |

| 12 | Alaska | 79.6% | 32.7% | 46.9% |

| 13 | Nebraska | 79.4% | 34.2% | 45.2% |

| 14 | Oregon | 79.2% | 33.0% | 46.2% |

| 15 | North Carolina | 79.1% | 40.2% | 38.9% |

| 16 (tie) | Michigan | 79.0% | 39.8% | 39.2% |

| 16 (tie) | South Dakota | 79.0% | 25.6% | 53.4% |

| 18 | Missouri | 78.7% | 39.7% | 39.0% |

| 19 | Kansas | 78.4% | 34.7% | 43.7% |

| 20 | New Hampshire | 78.2% | 39.4% | 38.8% |

| 21 (tie) | Connecticut | 78.1% | 37.5% | 40.6% |

| 21 (tie) | Massachusetts | 78.1% | 35.1% | 43.0% |

| 23 | Louisiana | 77.7% | 38.9% | 38.8% |

| 24 (tie) | Washington | 77.3% | 39.7% | 37.6% |

| 24 (tie) | Utah | 77.3% | 35.9% | 41.4% |

| 26 | Montana | 77.0% | 33.2% | 43.8% |

| 27 | Alabama | 76.1% | 34.9% | 41.2% |

| 28 | Arizona | 76.1% | 39.0% | 37.1% |

| 29 | New Jersey | 76.0% | 40.1% | 35.9% |

| 30 | Georgia | 75.9% | 36.5% | 39.4% |

| 31 | Iowa | 75.6% | 35.5% | 40.1% |

| 32 | Colorado | 75.3% | 36.2% | 39.1% |

| 32 | Illinois | 75.3% | 35.0% | 40.3% |

| 34 | Tennessee | 75.2% | 37.3% | 37.9% |

| 35 | Virginia | 75.1% | 33.7% | 41.4% |

| 36 | Florida | 74.9% | 40.1% | 34.8% |

| 37 | Oklahoma | 74.8% | 35.2% | 39.6% |

| 38 | Mississippi | 74.7% | 35.1% | 39.6% |

| 39 | West Virginia | 74.5% | 33.8% | 40.7% |

| 40 | Minnesota | 74.2% | 35.8% | 38.4% |

| 41 | North Dakota | 73.3% | 31.1% | 42.2% |

| 42 | Texas | 73.0% | 33.3% | 39.7% |

| 43 | New York | 72.6% | 32.4% | 40.2% |

| 44 | Hawaii | 72.5% | 28.4% | 44.1% |

| 45 | California | 71.5% | 32.4% | 39.1% |

| 46 | Maryland | 70.8% | 28.9% | 41.9% |

| 47 | Nevada | 70.5% | 30.6% | 39.9% |

| 48 (tie) | District of Columbia | 68.2% | 17.7% | 50.5% |

| 48 (tie) | Delaware | 68.2% | 34.3% | 33.9% |

| 50 | New Mexico | 61.4% | 30.6% | 30.8% |

| 51 | Wyoming | 57.4% | 22.7% | 34.7% |

Why are small businesses paying more — and how does that impact consumers?

While the effects of the COVID-19 pandemic have lessened significantly in recent months and the economy has begun to recover, there are still many ways in which the coronavirus continues to impact small businesses.

Due to disruptions in global supply chains, many businesses have struggled to gain access to — and, in turn, found they need to spend more money on — the raw materials they need to produce goods. Not only that, but they’ve had to contend with a tight labor market where a lack of available workers has made hiring difficult and put upward pressure on wages.

These two factors have put businesses in a difficult position where they need to spend more and more money before they can even sell a product. This is especially true for small businesses in major industries like manufacturing and retail trade.

To offset these higher costs, businesses have passed them on to consumers as higher prices on goods and services. Though rising wages have somewhat offset higher prices, many people have been forced to stretch their dollars or even go into debt to afford necessities like food and clothing.

Even with the steps that have been taken at the federal and state levels to try to help relieve some of the pressure caused by these higher costs, there’s no telling how much longer inflation will remain rampant. As a result, both businesses and consumers will likely need to deal with steep prices well into 2022.

Tips to help consumers deal with rising costs

- Create a budget and do your best to stick with it. Budgeting is often one of the best tools a person can use to handle a difficult financial situation. Not only can a budget give you a better idea of how much money you can afford to spend each month, but it can also make it easier for you to pay off your debts. Of course, sticking to a budget can be tricky, especially when inflation is as high as it is, and there will likely be times when you’ve got to go over budget to make ends meet. But knowing what you can and can’t afford can help you avoid unnecessary expenses that worsen your financial situation.

- Know when to take out a loan and when to avoid one. With prices on the rise, there may be instances where you need to take out a loan to pay for necessities. For example, you may find yourself in a situation where you need a personal loan to pay for medical debt or an emergency car repair. With that said, while taking out a loan can be an appealing option, it isn’t always the best choice. You should always carefully weigh your other options before rushing into debt.

- Take steps to take care of your debt. The less debt you owe, the more money you’ll have left to deal with rising inflation. As a result, even if you need to allocate more of your money toward keeping up with increasing costs, you can’t neglect your debt. With that in mind, be sure that you’re actively taking steps to reduce the amount of money you owe, either by keeping up with your current monthly payments or looking into lower-cost debt consolidation loans.

Methodology

LendingTree researchers analyzed data from the U.S. Census Bureau Small Business Pulse Survey to estimate the percentage of businesses in each state that report medium to large increases in prices paid for goods and services. Researchers also analyzed the percentage by industry. The data was collected between Jan. 10-16, 2022.

Get debt consolidation loan offers from up to 5 lenders in minutes