5 Factors That Affect Your Credit Score

Whether you’re looking to build your credit profile, apply for a new car loan, mortgage or credit card, it’s good to know about the factors that influence your credit score. Learning these factors can help you qualify for the best rates and terms.

There are five key criteria that determine your credit score, which we will cover in-depth to help you maximize your credit score potential.

On this page

What is a good credit score?

A FICO Score is a three-digit number that’s used to determine your creditworthiness in over 90% of lending decisions. It is determined by the information lenders supply to the big three credit bureaus (Equifax, Experian and TransUnion) in your credit reports. FICO Scores range from 300 to 850, and while the credit ratings of poor to exceptional vary depending on the credit-scoring model, the ratings determined by FICO are as follows:

| Credit rating | Credit score range |

|---|---|

| Exceptional | 800-850 |

| Very good | 740-799 |

| Good | 670-739 |

| Fair | 580-669 |

| Poor | 579-300 |

A “good” credit score is one that falls anywhere from 670 to 739, while a credit score below 670 may prevent you from obtaining the most desirable interest rates and terms on loans and credit products.

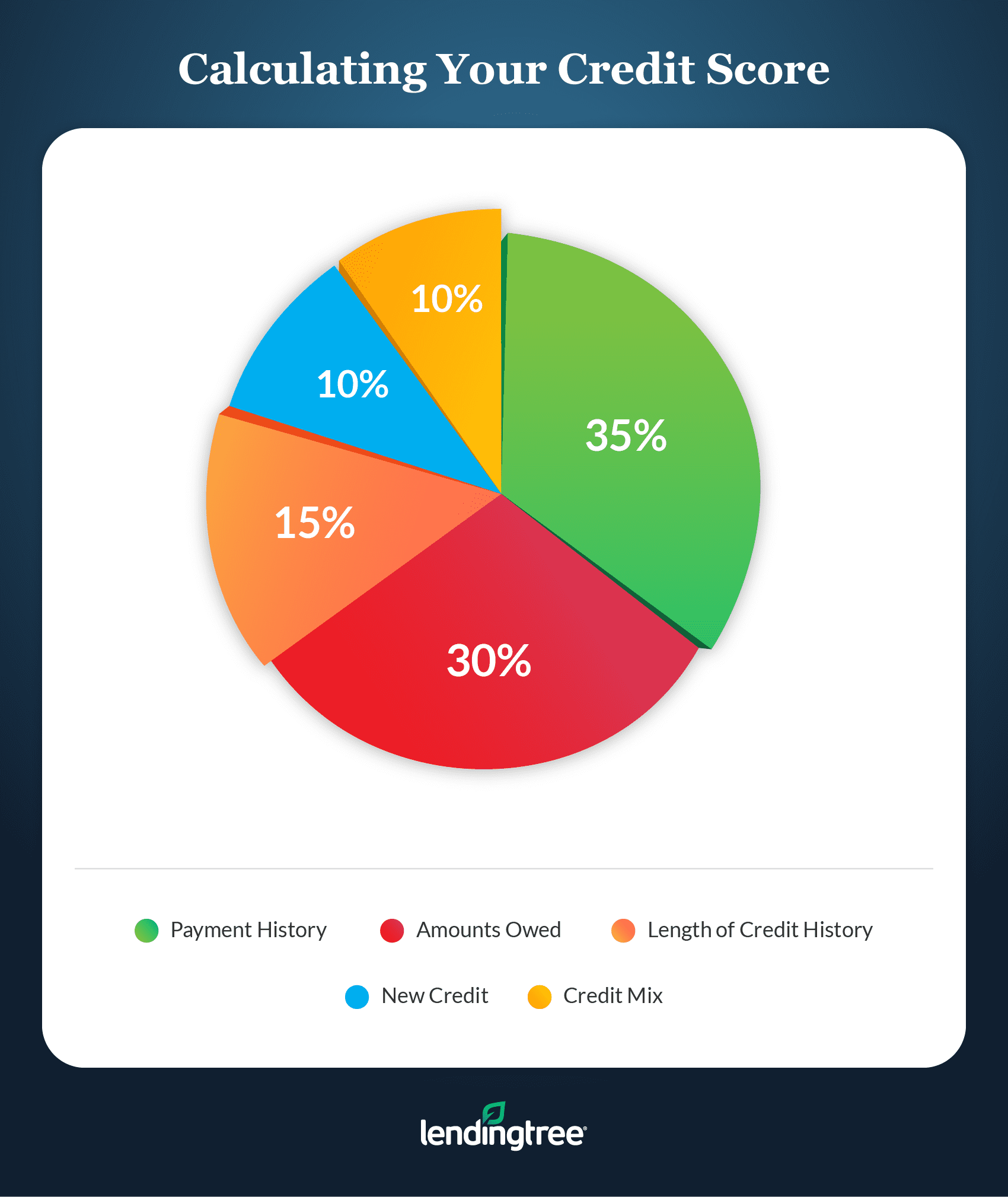

The 5 factors that impact your credit score

Knowing how credit scores are calculated can help you boost your standing if you pay close attention to these five criteria:

1. Payment history

Payment history is the most important factor influencing your credit score – accounting for 35% of the total score. Your payment history includes whether you’ve made past credit card or loan payments on time, as well as the specifics around any late payments, such as the length of time the payment has been past due and the number of times you’ve been late. This information helps future lenders predict the likelihood that you’ll repay your debt.

2. Amounts owed

The second most important factor of your credit score – making up 30% – is how much debt you’re carrying relative to how much you can borrow, which is also called your credit utilization ratio.

This refers to the amount of credit you use compared to your total credit limit per account as well as across all your credit accounts. To calculate your credit utilization ratio, divide any balance you are carrying on your credit card by the credit limit to get a percentage of how much credit you’re using.

For example, if you have a card with a $4,000 balance with a $10,000 credit limit, you’re using 40% of your credit limit. Financial experts recommend that you keep your credit utilization ratio well below 30% for optimal credit scoring results.

Know that your credit utilization ratio also takes into account the total credit used compared to total credit available across multiple credit accounts. So if you have several credit cards, add all your balances together and divide that amount by all your credit limits added together. If either your individual or total credit utilization is too high, your credit score will suffer.

One of the fastest ways to boost your credit score is by reducing the amount of revolving debt you’re carrying on your credit cards. It’s also important to know that installment loans, such as for a car or mortgage, do not factor into your credit utilization ratio.

3. Length of credit history

How long you’ve had credit makes up 15% of your credit score. According to FICO, this takes the following three factors into account:

- How long your credit accounts have been open, including the age of your oldest account, the age of your newest account and an average age of all your accounts.

- How long specific credit accounts have been established.

- How long it has been since you used certain accounts.

For example, if the current year is 2023, and you opened credit cards in 2009, 2014 and 2022, the average length of time you’ve had credit is eight years. Each time you open a new account, the average length of your credit history drops.

![]()

![]()

![]()

![]()

![]()

![]()

To avoid having an issuer close an older account due to inactivity, make it a point to keep it active by making a small charge on it regularly, such as a recurring subscription or utility charge, and set up autopay so you don’t miss the payment.

4. New credit

The number of new credit accounts you apply for impacts 10% of your credit score. Each time you apply for a new credit card, loan or mortgage, a hard inquiry appears on your credit report when the lender checks your credit file. This lowers your credit score by a few points every time it occurs and stays on your credit report for two years (although the negative impact lessens over time).

If lenders see too many hard inquiries on your credit report in a short period of time, it may signal to them that you are a high-risk consumer and may deny your application.

A caveat: If you are rate-shopping for the best deal on a car or student loan or mortgage over a 30- to 45-day period, the credit reporting companies lump those into one hard inquiry once you apply.

Also, it’s important to know that checking your own credit reports and scores are considered “soft” inquiries and do not negatively impact your credit in any way.

5. Credit mix

The various types of credit accounts you have opened make up 10% of your credit score. FICO classifies the different types of accounts as credit cards, retail accounts, installment loans, finance company accounts and mortgages.

While credit mix is a minor factor of your credit score and various accounts aren’t required, maintaining a diverse range of credit accounts that have been handled responsibly shows lenders you are able to manage a variety of financial obligations.

![]()

![]()

![]()

![]()

![]()

![]()

While you shouldn’t take on new debts just to diversify your credit mix, know that once your credit reports show your experience responsibly managing a variety of credit products, your credit score should benefit.

How to check your credit score

Knowing where your credit score stands before applying for a new credit card or loan can help give you insight into which products you may qualify for and what interest rates you can expect.

You can check your credit score in a variety of ways, knowing it won’t hurt your credit by doing so. For example, you can request a free copy of your FICO Score every 30 days through Experian. You can also access your free credit score by signing up for LendingTree Spring.

Your bank or credit card issuer may also offer the ability to check your credit score for free.

Additionally, the Fair Credit Reporting Act (FCRA) requires each of the three major credit bureaus (Experian, Equifax and TransUnion) to provide individuals with free credit reports through AnnualCreditReport.com. Due to the COVID-19 pandemic, the credit bureaus are now allowing you to pull your credit reports weekly until the end of 2023. Checking your reports regularly can help identify potential fraud and identity theft, as well as legitimate errors that may be dragging your scores down.