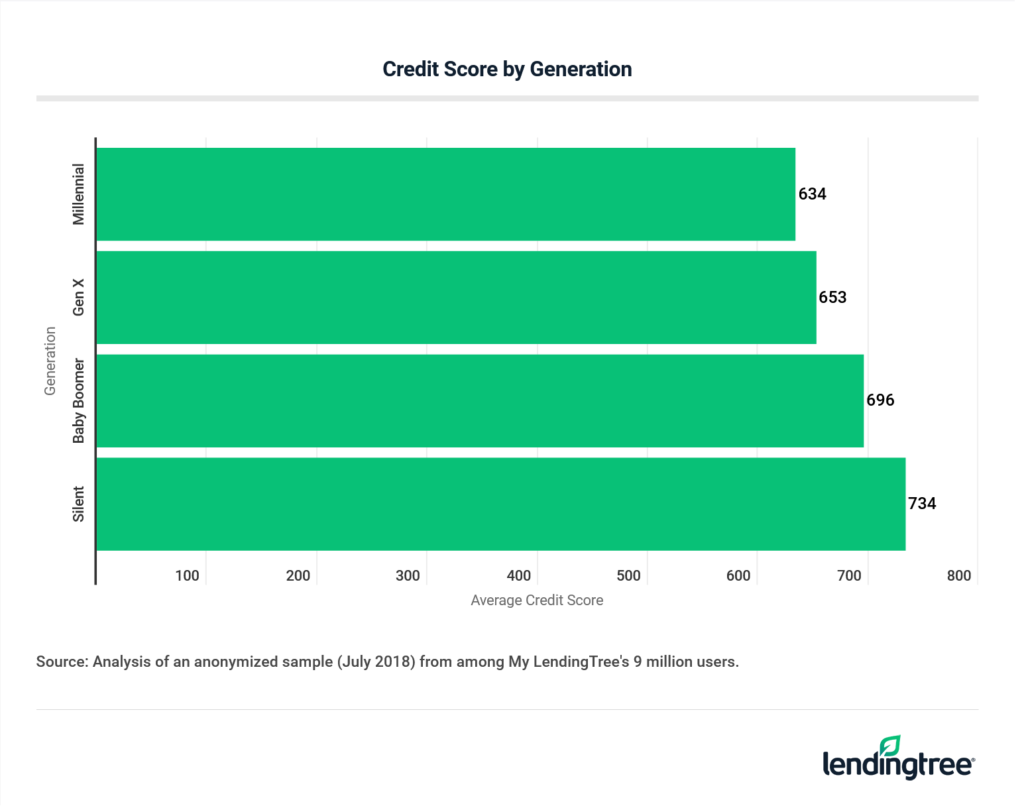

Credit Scores by Generation

In a new LendingTree study, we analyzed Americans’ credit scores by generation and found that the older someone is, the better their credit tends to be. On average, members of the silent generation (the oldest cohort) have credit scores 100 points higher than those of millennials.

- Millennials and Gen Xers have, on average, “fair” credit scores.

- Baby boomers have “good” scores.

- Members of the silent generation have “very good” scores.

Average credit scores by generation

| Generation | Avg. credit score | Range |

|---|---|---|

| Millennial | 634 | Fair |

| Gen X | 653 | Fair |

| Baby boomer | 696 | Good |

| Silent | 734 | Very good |

Why older people have higher credit scores

“One possible reason for higher scores among older people is cultural. In general, they may use credit less and may be more disciplined savers and spenders,” said Kali McFadden, senior research analyst at LendingTree.

“Another reason is that older Americans are more settled financially, with lower monthly costs,” McFadden added. In general, the older someone is, the lower their mortgage payments and student loan debts are (or they don’t have such payments at all). Older Americans may also not need new furniture or have child care costs. That means they are less likely to have urgent financial costs that can result in delinquencies, which can hurt credit scores.

The younger generations, in contrast, are likely saddled with higher amounts of debt. Additionally, they may have higher living costs — potentially associated with caring for families — and fewer savings. That could lead to limited financial wiggle room to cover unexpected expenses, so they could be more likely to be late on bills that can lead to negative marks on their credit.

It’s also a matter of the length of credit history. Millennials, who are as young as 22, haven’t had the time to build up the credit history that is necessary to achieve a stellar score.

“Even someone who has handled their finances impeccably will have lower credit scores until they’ve demonstrated that across a mix of debt products over an extended period of time,” McFadden said.

Millennials and Gen Xers may have to pay more for loans

Banks, credit card issuers and other lenders make lending decisions based on a borrower’s creditworthiness. They offer much better rates to borrowers with higher scores.

As another study revealed, individuals with fair credit scores pay far more in interest on a host of debts, including from credit cards, mortgages and student loans, than those who have very good scores.

Total interest paid over lifetime of loans

| Debt type | Avg. loan amount | Very good credit | Fair credit | Cost difference |

|---|---|---|---|---|

| Personal | $11,258 | $2,217 | $6,007 | $3,790 |

| Auto | $21,778 | $2,267 | $7,050 | $4,783 |

| Credit card | $5,265 | $3,794 | $9,423 | $5,629 |

| Student | $37,525 | $7,059 | $9,035 | $1,976 |

| Mortgage | $234,437 | $197,161 | $226,266 | $29,106 |

| Total | $310,263 | $212,498 | $257,781 | $45,283 |

Gen Xers and millennials both fall into the “fair” score range, while the average silent generation score is in the “very good” range. Based on findings in both studies, we estimate that it would cost millennials and Gen Xers $29,106 more than it would silent generation members for the same average-sized mortgage loan ($234,437), and $5,629 for the same amount of credit card debt ($5,265).

Boomers aren’t much better off

While the higher credit score of baby boomers (average credit score: 696) is a sign of better financial stability than the younger generations, there’s still room for improvement. The average boomer score trails that of the elder generation by 38 points.

The concern about boomers is that lower scores can mean that people are struggling to manage their monthly finances by keeping low revolving credit balances and paying their bills on time, McFadden explained.

“Ideally, people should be in a stable position to manage the expenses they already have before losing a portion of their income through retirement,” McFadden said.

How to increase your credit score

Our previous research estimated that raising a credit score from “fair” (580-669) to “very good” (740-799) saves $45,283 on a common array of debts. Even though millennials and Gen Xers have shorter credit histories than the older generations, they can improve their credit scores.

Pay off balances on time

The No. 1 rule in improving your credit is making on-time payments because payment history is the largest component (35%) of your score. If you are concerned that you may miss payments, set up payment reminders or autopay to pay your monthly bills.

Use as little of your available credit as possible

The amount of debt you owe makes up 30% of your score, and a major component of that is something called your credit utilization ratio. That’s the percentage you use of your available revolving credit. Using a high percentage of your available credit could indicate that you are overextended and may be more likely to miss payments. A good utilization ratio is generally considered at or below 30%, but the lower you keep your credit utilization rate, the better it is for your credit score.

Don’t close old credit cards

Lenders generally view someone with a longer credit history as a lower lending risk. But it’s a factor over which you have little control — you cannot travel back with a time machine to apply for accounts. One thing you can do, though, is not close your old credit cards, even if you don’t use them. Credit scoring models consider the age of your oldest and newest accounts, as well the average age of all your accounts. Closing your old credit cards will likely lower your average account age. If anything, you can charge one small item to your accounts each month and set the bill to be paid in full via autopay.

Have a mix of credit accounts

The type of credit accounts you use makes up 10% of your FICO Score. The more diverse your credit mix, the higher your score is likely to be. Besides credit cards, many consumers have mortgages, car loans and other installment loans. But if you have a fairly healthy score and don’t need these other loans, it’s not necessary to apply for them just for the sake of having a stellar credit score. After all, the impact of credit mix is relatively modest.

Avoid opening new accounts frequently

While it’s important to have a number of accounts, it’s not wise to apply for a bunch of new credit cards in a relatively brief period. Lenders may see a spate of new accounts as a risk factor, and the new accounts will also reduce the average history of your credit accounts.

Credit categories

The TransUnion New Account Score — the credit score model used in this analysis — is based on data from TransUnion and determines an individual’s risk on new accounts. It has a 300-to-850 score range.

A “poor” score typically falls between 300 and 579. “Fair” credit scores are in the range between 580 and 669. “Good” scores are between 670 and 739. “Very good” ones are between 740 and 799. And “excellent” scores fall between 800 and 850.

Credit ranges

| Category | Range |

|---|---|

| Excellent | 800-850 |

| Very good | 740-799 |

| Good | 670-739 |

| Fair | 580-669 |

| Poor | <580 |

Methodology

Average credit scores were calculated using the July 2018 credit report data of a sample of anonymized LendingTree users, which has over 9 million users. Credit scores are TransUnion New Account Scores (formerly known as TransRisk 2.0) provided by TransUnion.

Generations are defined as follows: Millennials were born between 1981 and 1996, Gen Xers were born between 1965 and 1980, baby boomers were born between 1946 and 1964, and members of the silent generation were born between 1928 and 1945.

Credit score quality ranges are defined as follows: “Poor” scores fall between 300 and 579, “fair” between 580 and 669, “good” between 670 and 739, “very good” between 740 and 799, and “excellent” between 800 and 850.

Learn more about your credit score

Want to know your credit score? Click here.

Learn more about credit repair companies!

How is my credit score calculated?

Get debt consolidation loan offers from up to 5 lenders in minutes