American Consumers’ Average Weekly Grocery Spending Increased by 17% During the Pandemic, Despite Fewer Trips

The pandemic has reshaped so much of our lives, including the way we shop for groceries. From how often people shop to how much they spend, to which products they buy, the COVID-19 crisis has had an impact, according to a recent LendingTree survey.

LendingTree asked more than 1,000 consumers in the U.S. about how their grocery shopping behavior and spending has changed, and we offer up tips on how to trim your grocery bills.

Click below to learn more:

Key findings

- Stuffing the carts. American consumers’ average weekly grocery spending increased by 17%, from $163 pre-pandemic to $190 now.

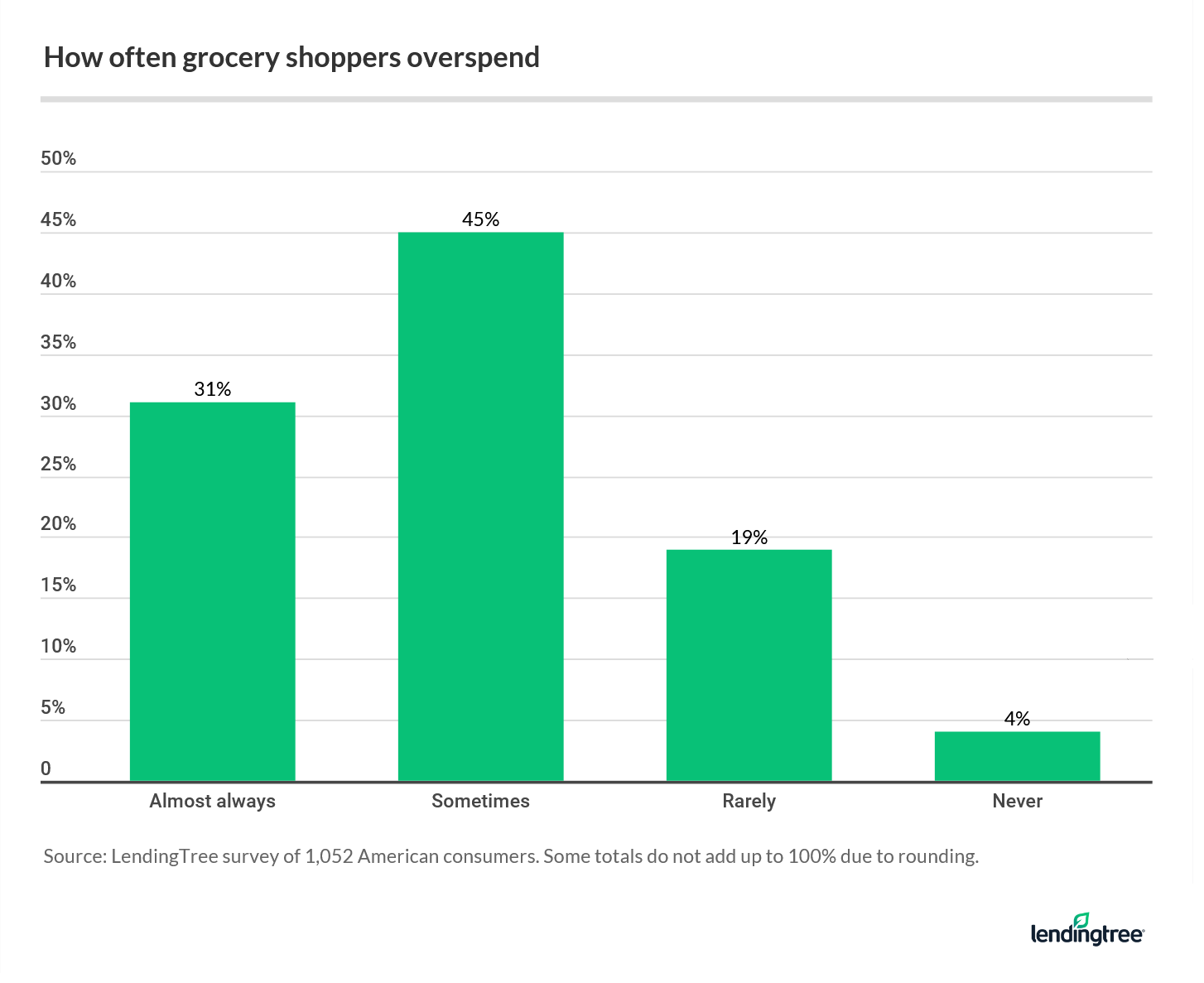

- Big spenders. Nearly a third of respondents (31%) say they “almost always” overspend at the grocery store. Men (44%) are twice as likely as women (20%) to exceed their food budget.

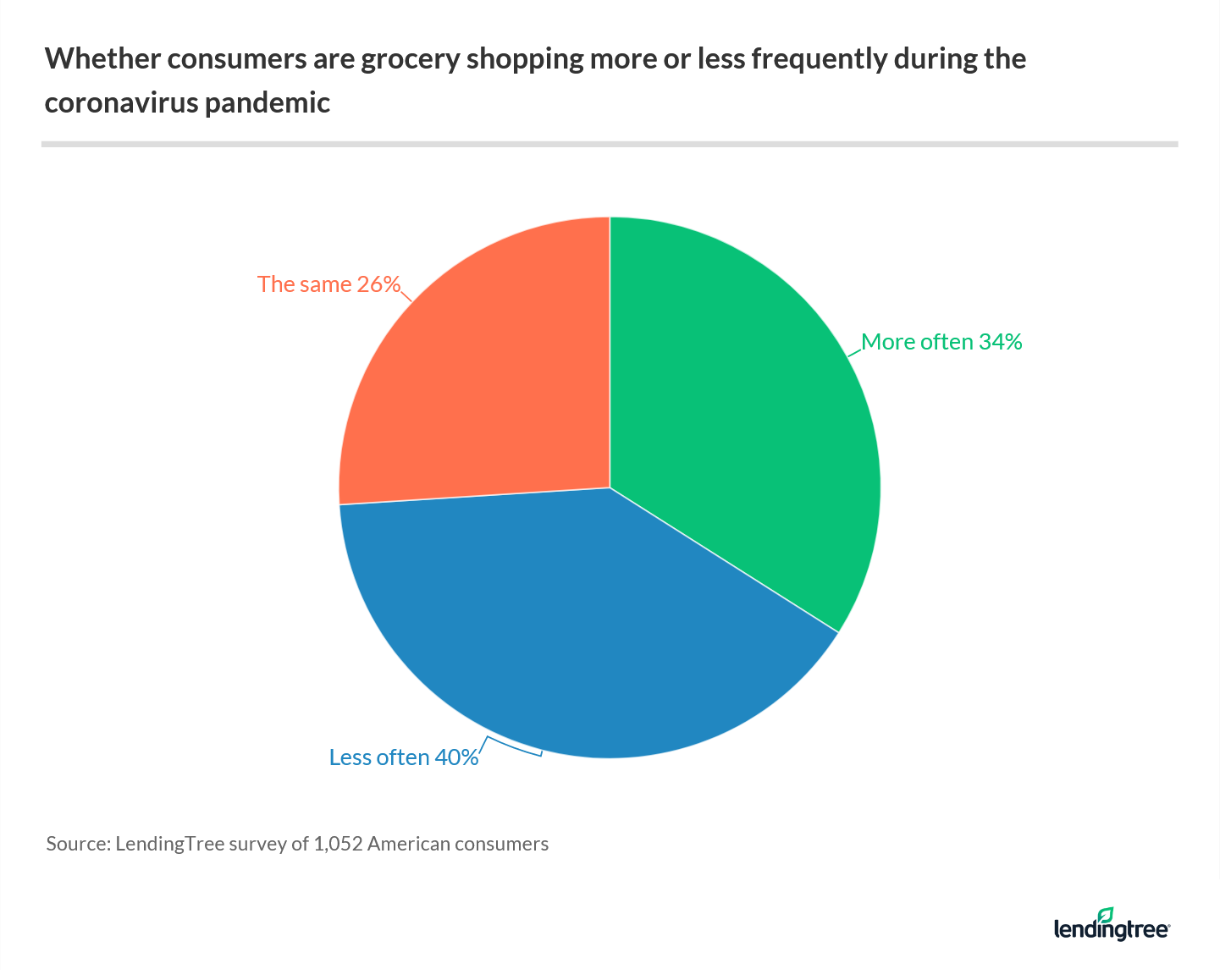

- Fewer shopping trips. About 4 in 10 consumers say they are going to the grocery store less often than they did pre-pandemic. However, men (51%) say they are going grocery shopping more often – women (49%) are the ones taking fewer trips.

- Shopping around. More than half (53%) of our respondents say they hit up multiple grocery stores per shopping trip. For example, they head to wholesale stores for bulk items and then the supermarket for everyday needs.

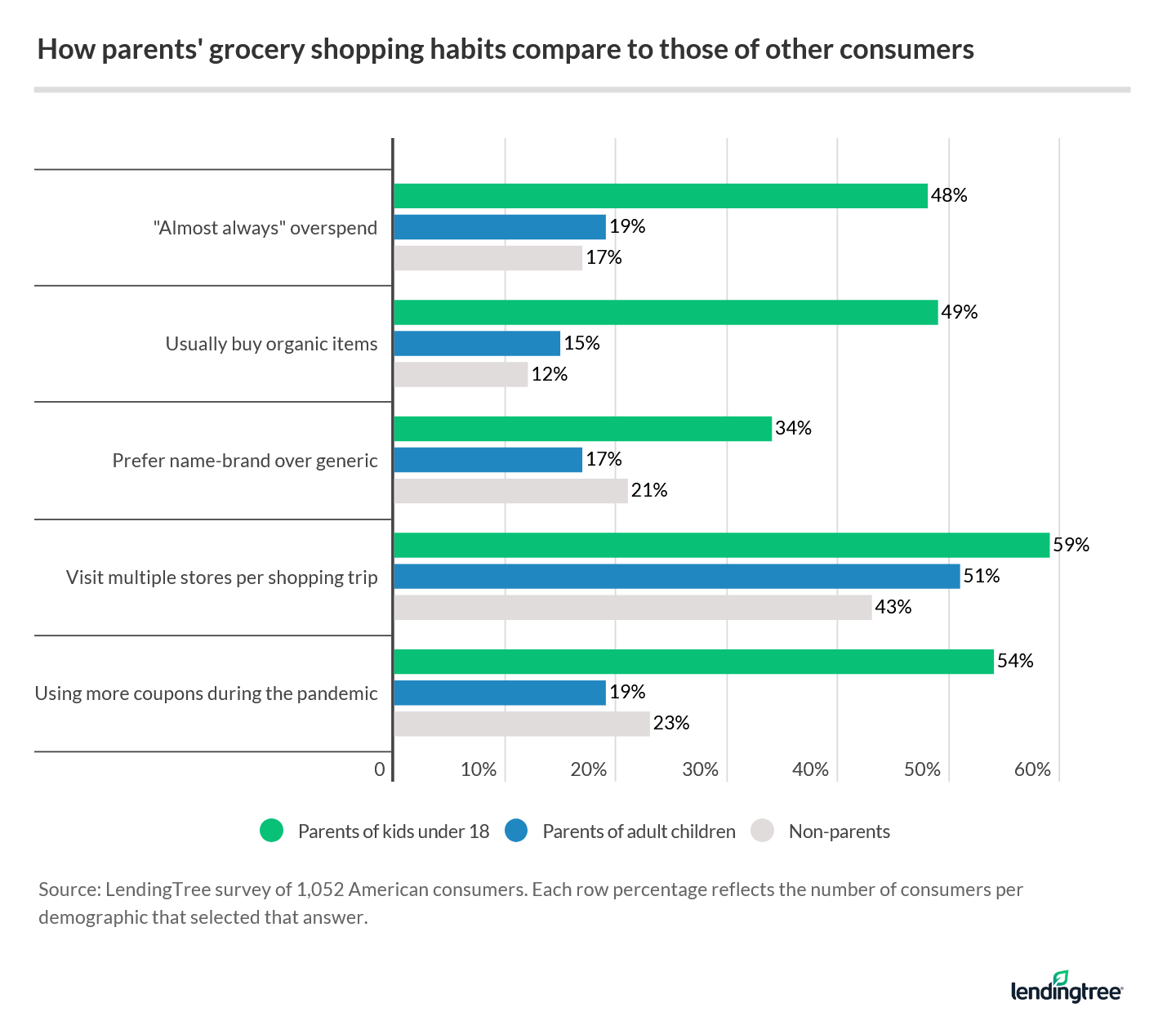

- Kids at home mean more groceries. Parents overspend most often, and also shop more frequently due to the pandemic than non-parents. To make up for it, 54% are couponing more frequently, and 60% say they visit multiple stores in search of sales items.

- Contactless shopping. To cut down on shopping trips, 63% of consumers order food delivery at least once a week. Generation X orders delivery the most – 86% do so at least once per week, and of that group, 21% do so three or more times.

Grocery store spending is up despite fewer trips

Whether it’s due to having more family members at home for every meal or because consumers tend to panic shop and stock up in times of crisis, the pandemic has definitely brought with it increased grocery spending costing households around $100 more a month than before the spread of the coronavirus. In fact, another LendingTree study found grocery store spending is up in 49 states.

What’s also noteworthy is that more people say they are taking fewer shopping trips (40%) than those who say they are going out more frequently (34%). If you look at those groups combined, it illustrates that the pandemic has impacted nearly three-quarters of people’s shopping habits.

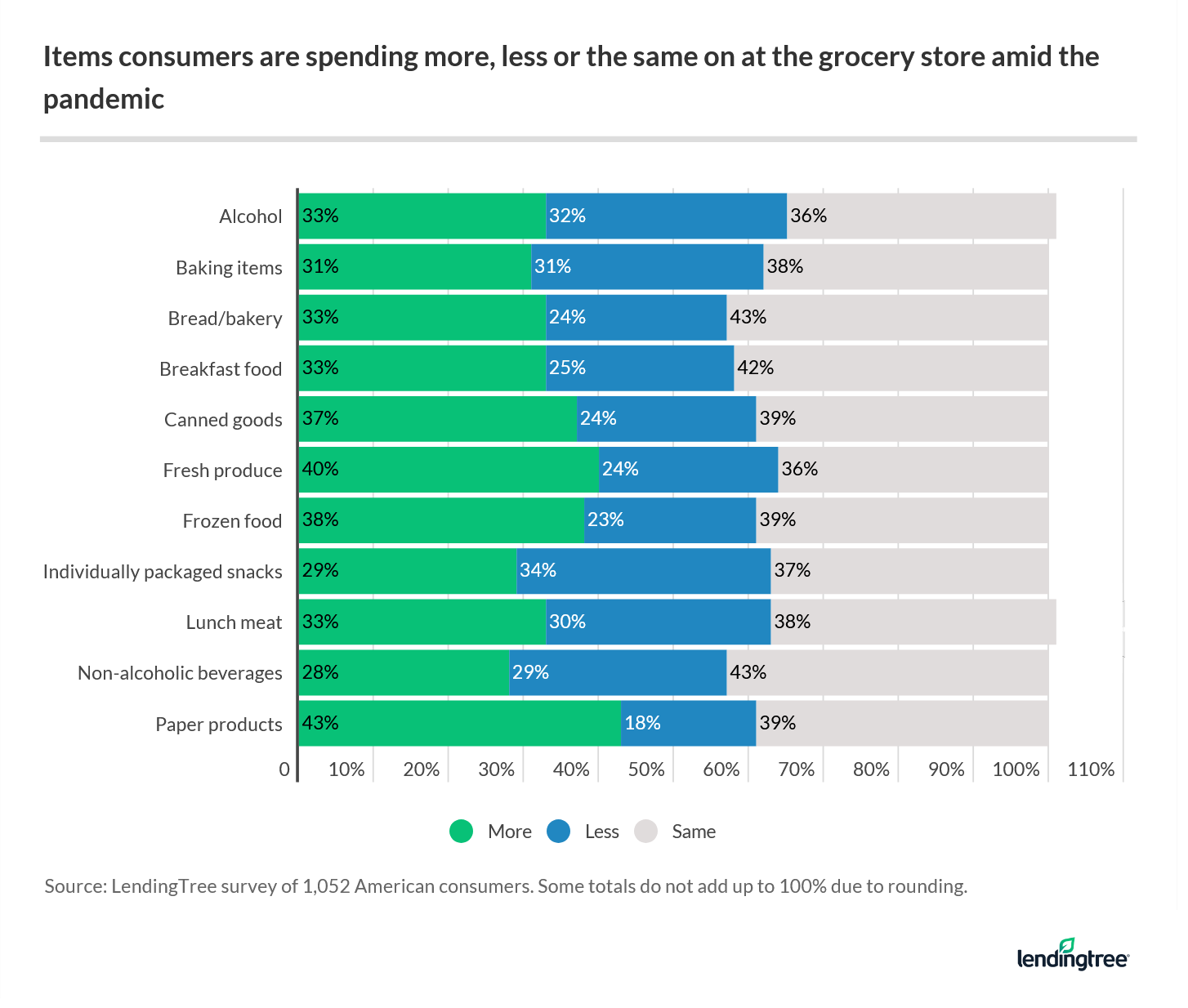

The COVID-19 crisis has also had an effect on how much money people are spending on specific items. Some findings that stand out:

- Gen X (57%) are spending more on alcohol than other groups, and men (48%) outnumber women (19%) when it comes to adult-beverage buying.

- Parents with children under 18 were most likely to say they are spending more on baking items (42%) and cereal (48%).

- And, perhaps it comes as no surprise that across all categories, paper goods and toilet paper was the category that people were most likely to increase spending on (selected by 43% of all survey takers).

Nearly a third of Americans almost always overspend on groceries, despite using shopping lists and coupons

Consumers are using tried-and-true game plans for saving money at the checkout counter like shopping from a list and cutting coupons, but despite their best efforts, they are still spending more.

Consider this: 87% of consumers say they head to the grocery store armed with a shopping list and they stick with it at least some of the time. Even still, respondents say overspending happens sometimes (45%) or almost all the time (31%).

Among the different age groups, Gen Xers (59%) were most likely to say they always make a list and stick to it, yet are also most likely to say they almost always overspend.

“It’s no secret that avoiding impulse buys at the grocery store requires major self-control,” said Matt Schulz, chief industry analyst for LendingTree. Not to mention that it can be harder to stay focused when you’re dealing with the various stressors of 2020.

“The stores are designed to tempt you to buy at every turn. You don’t have to give in, though,” said Schulz. Try rethinking your shopping trip as an organized mission rather than a casual browse, he said. “That helps keep your focus away from the impulses.”

Other ideas are not going to the store when you’re hungry since that tends to cause you to buy more tasty treats than you need.

“Shopping with a buddy can help keep you on point, too,” said Schulz. You and your shopping partner can keep one another in check while going down the aisles. And if at all possible, leave the kids at home when you shop. “Any parent knows that a kid in a grocery store is 1,000 impulse buys waiting to happen,” said Schulz.

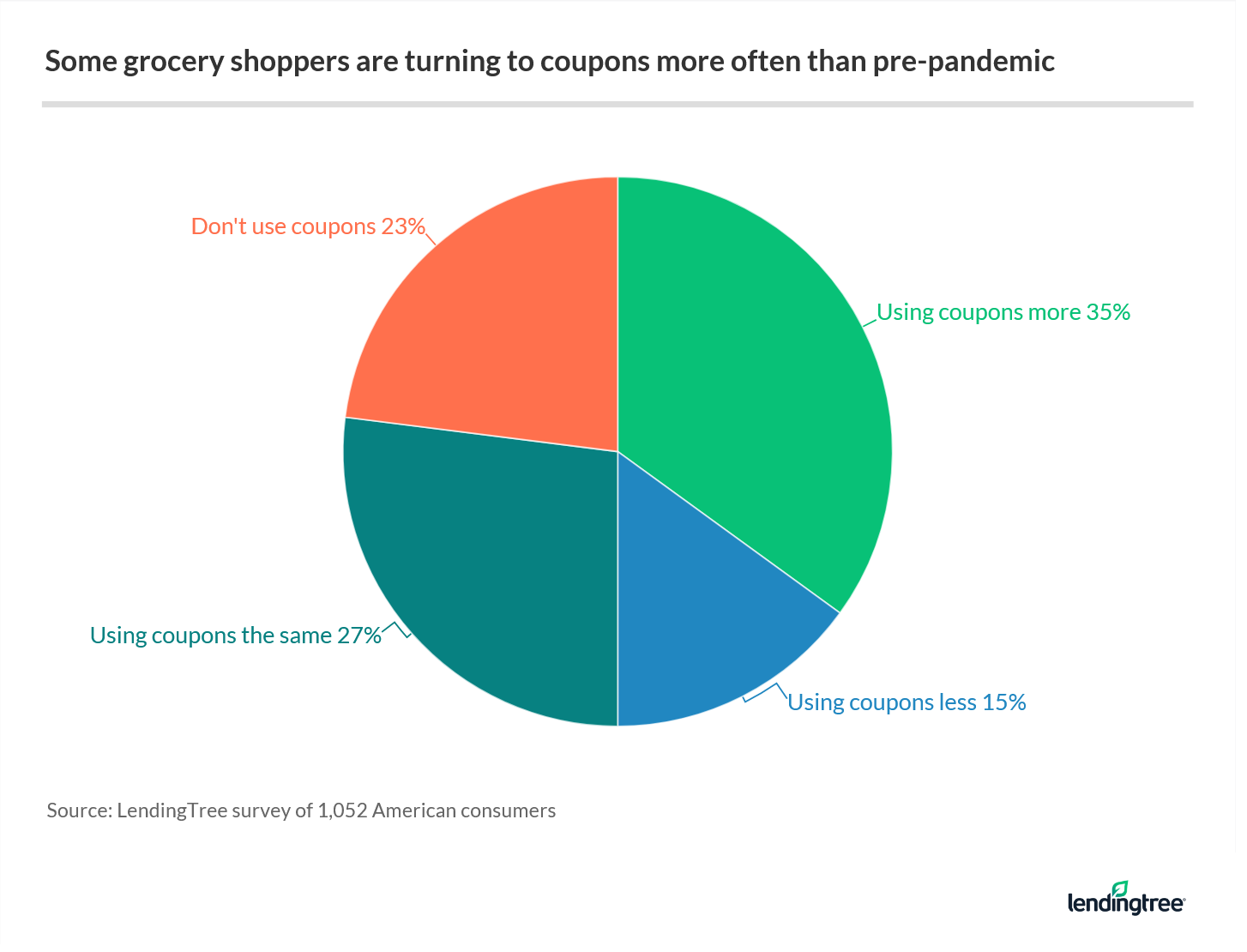

On the positive side, 35% of all shoppers are using coupons more now than they did before the pandemic.

“As any couponer can tell you, it doesn’t take many coupons for the savings to really add up,” said Schulz. For the millions of Americans whose financial lives have been shattered by the pandemic, coupons can be a crucial way to extend a limited budget.

All of this extra grocery spending can also pay off for those who shop with cashback credit cards. The survey found that 49% of shoppers are earning rewards for their grocery spend.

“Cashback cards can be a big deal for folks trying to extend their budget,” said Schulz.

For example, he points out that the card is allowing new cardholders to

There are a few other grocery rewards cards that offer a strong earnings rate for groceries, so shop around. “Just make sure you read the fine print,” said Schulz. For example, a credit card offering rewards as a grocery bonus category might not include purchases made at Walmart or Target — and since 34% of respondents said they shop at these big box retailers, it’s important to understand that distinction.

Homebound kids are costing parents more

In another LendingTree survey, it was revealed that 56% of parents are in debt due to the pandemic. That could have something to do with the disproportionate amount of increased spending on groceries that parents of kids under 18 are doing with 48% of parents with young children at home versus 31% of total respondents.

Besides having to feed children meals that would normally be eaten at school, having kids in tow while you’re shopping or dealing with picky eaters can get expensive. For instance, the survey found that parents are more likely to buy organic and name-brand items.

“Shopping without the kids means there’s no one to complain about buying the generic version or the store version instead of the name brand,” said Schulz. It also means no pushback should you decide to take your time checking prices, or want to go to a second or third store in search of a better deal.

In fact, parents say they actually do go to more stores and shop more often, which can be a good way to get the best sales. On the other hand, more trips can backfire if you end up tossing in a few additional items each during every visit.

To compensate for the higher bills, 54% of parents are couponing more often, which is always a good thing.

Of course, you shouldn’t feel guilty for all the overspending at the grocery store you may do, said Schulz. “If buying that box of brightly decorated cookies your daughter loves can help brighten her day after a difficult week of remote learning, it can be worth it,” he said. Go ahead and treat your family once in a while in these unusual times. “Just don’t do it too much or too expensively.”

How to shop smarter at the grocery store

If you’re feeling the pinch of pumped-up pandemic grocery bills, with a few practical moves, you can get back to pre-pandemic spending levels.

- Buy online. About three-quarters (73%) of respondents say they still buy groceries in-store, which can often lead to impulse buys. Maybe try shopping online and then picking up your order curbside so you won’t be inclined to grab random off-list items, said Schulz.

- Try generic brands. If you’re used to brand names, it might be worth trying a store brand instead, or choosing based on available coupons. Even if it’s just a 50 cent difference here, a dollar off there, a bunch of those savings added up each week can make an impact.

- Leave the cart, take the basket. One trick some savvy shoppers use is grabbing a small hand basket rather than a large cart when they have a short list. It’s a good way to make you think twice about picking up extras.

- Plan your menu (and shopping list) around what’s on sale. Instead of coming up with dinner ideas at random, let the sales circulars inspire you. Chicken and tortilla wraps on sale? Sounds like the perfect week to make enchiladas. Also, try incorporating a meatless night that relies on lower-priced staples like pasta, rice, beans or eggs.

The bottom line? The more you plan and avoid impulse purchases, the better off you’ll be, said Schulz. Add in some coupons, watch for sales, and earn cash back, and you can maximize your grocery spend even more.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 1,052 consumers in the U.S., with the sample base proportioned to represent the overall population. The survey was fielded Sept. 18-22, 2020.

We defined generations as the following ages in 2020:

- Millennial: 24 to 39

- Gen X: 40 to 54

- Baby boomer: 55 to 74

Our survey also included responses from members of Generation Z (ages 18-23) and the silent generation (ages 75 and older). Their responses were factored into the overall percentages but excluded from the generational breakdowns, due to the low sample size among both age groups.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.