71% of Summer Travelers Say Inflation Has Impacted Their Plans, With Most Opting for Closer Destinations

Summer is in full swing, and that means it’s finally time for vacation for many Americans — but budgets are tighter this year. In fact, 71% of those with summer travel plans say rising costs and inflation have made them change their plans.

LendingTree asked nearly 2,000 U.S. consumers about their summer travel plans. Here’s what else we found.

On this page

Key findings

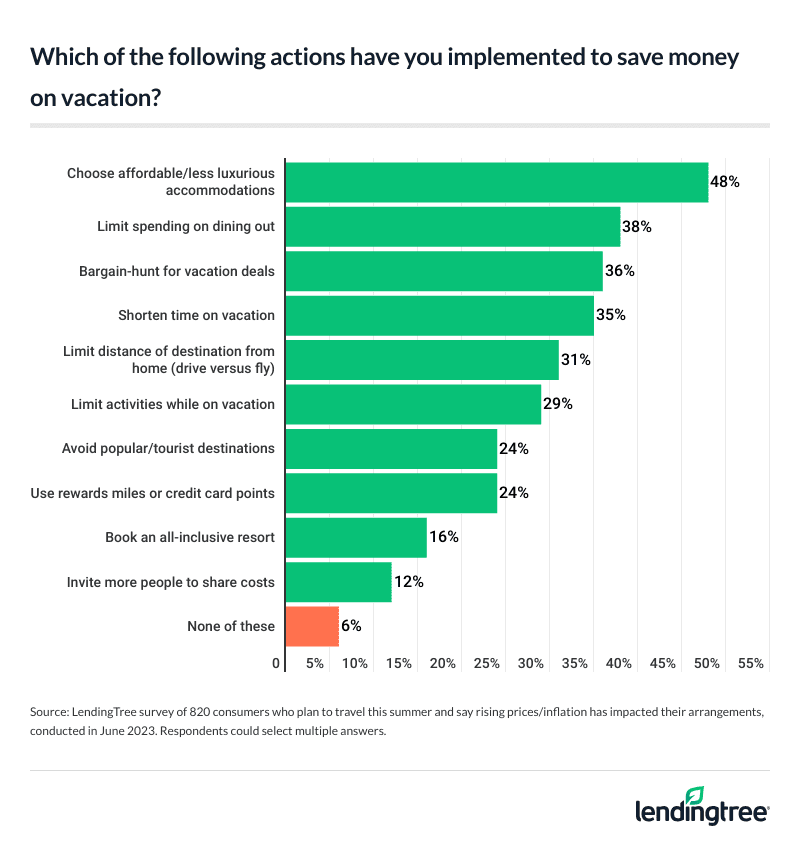

- Summer calls for vacation, but inflation is still an uninvited guest. 71% of Americans planning to travel this summer say rising prices and inflation have impacted their plans, and 78% are opting for closer destinations to offset costs. Additionally, impacted travelers are opting for more affordable accommodations (48%), limiting their spending on restaurants (38%) and bargain-hunting for vacation deals (36%).

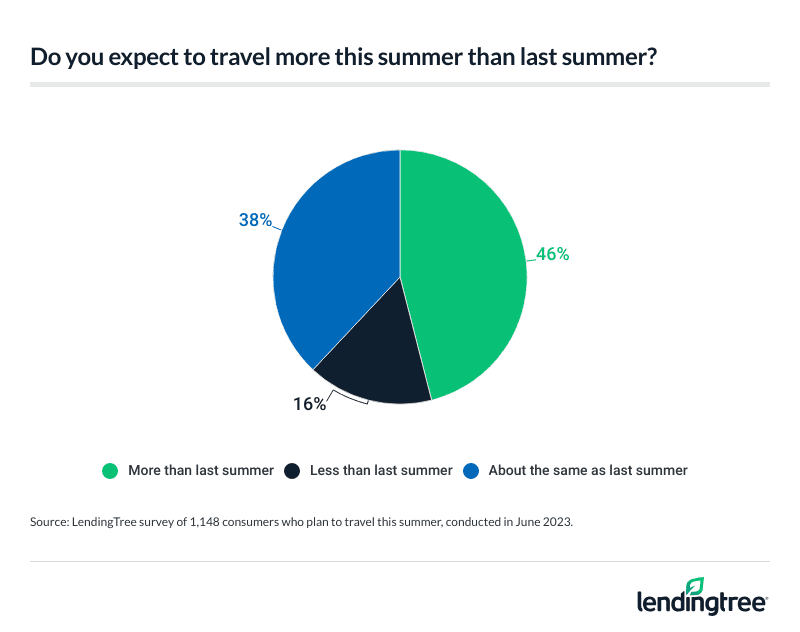

- Although many plan to cut back on their travel costs, that doesn’t necessarily mean they’re traveling less. Of the 59% of Americans planning to get away this summer, almost half (46%) say they’re traveling more this summer than last. Most of this year’s travelers are planning trips outside their state but within the U.S. (63%). Driving is the most popular mode of transportation at 58%, followed by flying at 35%.

- When it comes to planning travels, Americans have differing opinions on how much time is needed to prepare. 69% of Americans prefer a well-planned trip over a spontaneous vacation, but 51% have taken an impromptu trip with less than one week’s notice. Weekend getaways require the least time to plan — 47% of this summer’s travelers say they typically plan their trips less than a month prior. Unsurprisingly, international travel requires the most time to plan, with 21% saying it takes them six months or more to plan.

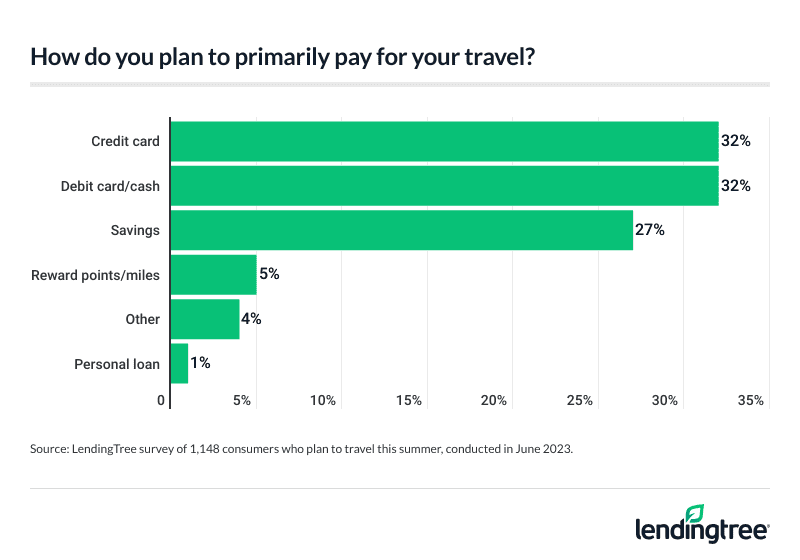

- Despite hopes to travel frugally this summer, some still say they would splurge on the perfect trip — but they may be relying on credit to do so. Over half of summer travelers (55%) say they’d still go over budget to plan the vacation they want. However, many may be leaning on their credit as 32% say they plan to pay for their upcoming travels with credit cards (tying with debit cards or cash as the most popular payment method). Additionally, about 1 in 4 travelers plan to open a new card to pay for their expeditions.

Rising prices are impacting summer travel plans

School’s out, the days are longer and the summer heat is in full force — and that means many Americans are hitting the road (or the skies). Overall, 59% of Americans plan to travel this summer. Younger consumers are more likely to have summer plans, with 65% of millennials ages 27 to 42 planning trips. That’s followed by:

- 64% of Gen Zers ages 18 to 26

- 54% of Gen Xers ages 43 to 58

- 52% of baby boomers ages 59 to 77

Those with children younger than 18 (68%) are more likely to have travel plans than those with adult children (54%) and those without children (54%). Additionally, six-figure earners are the most likely income group to plan a summer trip at 79%. Comparatively, 43% of those making less than $35,000 say similarly.

It’s not all fun and sun, though — travel comes at an increased cost this year. Of those planning to travel this summer, 71% say rising prices and inflation have impacted their plans. That’s particularly true of parents with children younger than 18 (80%) and millennials (78%).

To help mitigate rising costs, 78% of those impacted say they’re planning vacations closer to home — particularly impacted parents with underage children (86%), millennials (85%) and those who make $35,000 to $49,999 yearly (85%). That’s not the only way impacted travelers are offsetting costs. In fact, 48% say they’re choosing more affordable accommodations. Meanwhile, 38% say they’re limiting their spending on restaurants and 36% are bargain-hunting for vacation deals.

Those cost-cutting methods vary by demographic. Women (41%) are much more likely to cut back on eating out than men (34%). Additionally, 41% of Gen Xers say they’re bargain-hunting for deals — making it the second most popular option for this group behind choosing more affordable accommodations.

According to LendingTree chief credit analyst Matt Schulz, cutting back isn’t necessarily bad.

“It seems like everything is more expensive these days, and travel is no exception,” he says. “That doesn’t mean you need to scrap all your plans and stay home all summer. It just means you may need to be a little more cost-conscious in your planning.”

Summer travelers say they’re planning more trips this year

Still, cutting back on vacation budgets doesn’t mean cutting out trips. Of the 59% with travel plans, 46% say they’re traveling more this summer than last year. Younger consumers are significantly more likely to say they’re upping their travel this summer, with millennials the most likely group to say so at 56%. That compares with:

- 54% of Gen Zers

- 36% of Gen Xers

- 36% of baby boomers

Those with children younger than 18 (54%) are more likely to say they’re traveling more this year than those without children (46%) and those with adult children (35%). Additionally, men (52%) are more likely to say they’re traveling more this year than women (41%).

By income group, six-figure earners (54%) are the most likely to say they’re upping their travel plans this summer. Despite being the least likely income group to have travel plans, consumers making less than $35,000 are the next most likely income group to say they’re traveling more this summer than last at 51%.

Meanwhile, 16% of summer travelers are planning fewer trips this year and 38% are planning the same as last summer.

Where are this year’s travelers going? While European destinations have been making headlines, the majority (63%) say they’re vacationing out of state but staying within the U.S. and 29% say they’re staying within their state. Just 8% plan to travel out of the country, though baby boomers (12%) and Gen Zers (11%) are the most likely to go abroad.

Given that most aren’t leaving the country, it’s unsurprising that driving is the most popular mode of transportation at 58%. That’s followed by flying at 35%.

As far as accommodations, 47% of travelers plan to stay at a hotel — making it the most popular option. Meanwhile, nearly a quarter (23%) plan to stay with family. With Airbnb fees continuing to climb, just 14% plan to stay at a short-term rental.

69% prefer a well-planned trip over a spontaneous one

Not many Americans prefer spontaneity when it comes to their trips. Of those who plan to travel this summer, 69% prefer a well-planned trip over a spontaneous vacation. Older generations are much more likely to prefer planning their vacations — while 76% of baby boomers and 71% of Gen Xers say they prefer planning, just 64% of millennials and 63% say similarly.

Of course, how much time consumers need to prepare varies by trip type. Among this summer’s travelers, 47% say they typically plan their weekend getaways less than a month prior. Meanwhile, 25% of summer travelers say they plan their romantic getaways one to two months in advance. Meanwhile, travelers plan the most for their international trips — 21% say it takes six months or more to plan their vacations abroad.

Despite these preferences, 51% of Americans have taken an impromptu trip with less than one week’s notice. That’s especially true of six-figure earners (61%) and those earning between $75,000 and $99,999 (60%).

By age group, millennials are the most likely to take a last-minute trip at 56%, followed by Gen Xers at 52%. Meanwhile, those with children younger than 18 (58%) are more likely to have taken an impromptu trip than those with adult children (50%) and those without children (45%).

Majority would go over budget to plan the perfect vacation

This year, the majority of travelers seem to believe money is temporary but memories are forever. Despite many feeling the heat of rising costs, 55% of this year’s travelers say they’d go over budget for the vacation they want. Perhaps because they’ve got more wiggle room in their budgets, six-figure earners are the most likely to share this sentiment at 69%. By age group, millennials (61%) are the most likely to say they’d splurge for their ideal trips. That’s followed by:

- Gen Zers (56%)

- Gen Xers (51%)

- Baby boomers (49%)

Meanwhile, men (62%) are more likely to say they’re willing to go over budget for their summer vacations than women (50%).

That leniency may be because many travelers are relying on credit. Among this summer’s travelers, 32% say they plan to pay for their upcoming trips with credit cards — tying with debit cards or cash as the most popular payment method. Meanwhile, 27% plan to pay with savings.

With credit cards a popular payment method this year, it isn’t much of a surprise that 1 in 4 (25%) travelers plan to open a new card to pay for their expeditions. That’s particularly true of adults with children younger than 18 (42%) and millennials (39%). Additionally, men (37%) are much more likely to say they’ll open a new credit card for their travels than women (12%).

Frugal travel amid inflation: Expert tips

The costs of travel may feel painfully high, but you don’t have to break the bank to have a good time with your summer travel. To help cut travel costs, Schulz recommends the following:

- Consider how much debt is too much. “I believe that travel debt can be good debt, but only in moderation,” he says. “That’s because the return on investment with that debt, in terms of memories created and bonding time spent with family and friends, can be immense. Of course, that doesn’t mean you should go crazy and spend years in debt for that Disney trip or that European holiday. Before making those plans, check your budget and consider how much debt you might be willing to take on. If the answer is none, great. If it’s a little bit more than that, that can be OK, too, as long as you’re thoughtful about it.”

- Credit card rewards can make a huge difference. Whether you’re talking about free airfare, hotels or some extra cash back, the right credit card can help you extend your travel budget.

- Get a credit card with no foreign transaction fees. “International travel is expensive enough,” Schulz says. “The last thing you need is to pay another 3% on top of everything you buy for no reason. The good news is that most travel credit cards forgo these fees. However, many popular cash back cards still have them. If you’re not sure, call your card’s issuer and ask.”

- Fun doesn’t have to mean expensive or far away. “Chances are that there are amazing places a short drive from where you live,” he says. “If money is tight this summer, skip the airport and head out to that quirky little town a few hours away or maybe to the state or national park.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 1,952 U.S. consumers ages 18 to 77 from June 5-6, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.