Nearly 60% of Americans Say Inflation Is Impacting Thanksgiving, as More Americans Go Cold Turkey on Hosting

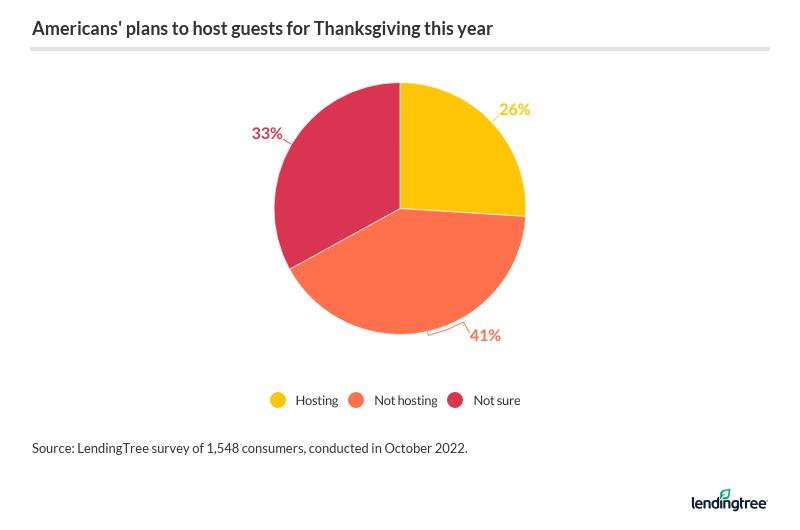

Another Thanksgiving approaches. Although life has relatively returned to normal, many consumers may struggle to feel the holiday spirit. As inflation remains high, only 26% of Americans expect to host Thanksgiving this year — a four-year low — according to the newest LendingTree survey.

We asked more than 1,500 U.S. consumers about their Thanksgiving plans. Keep reading to learn how much money potential hosts plan to put toward their Turkey Day celebration and who’s feeling financial strain this holiday.

On this page

- Key findings

- Only 26% of Americans plan to host Thanksgiving this year

- More than half say inflation is impacting their holiday plans

- Potential hosts expect to spend $396 on food, drink and new housewares

- Over a quarter of consumers say Thanksgiving is a financial strain

- Expert tips on celebrating Thanksgiving despite high inflation

- Methodology

Key findings

- Thanksgiving hosting is expected to hit a four-year low in 2022. Only 26% of Americans plan to host Thanksgiving this year, a 45% decrease from 2021, a 37% decrease from 2020 and a 21% decrease from 2019.

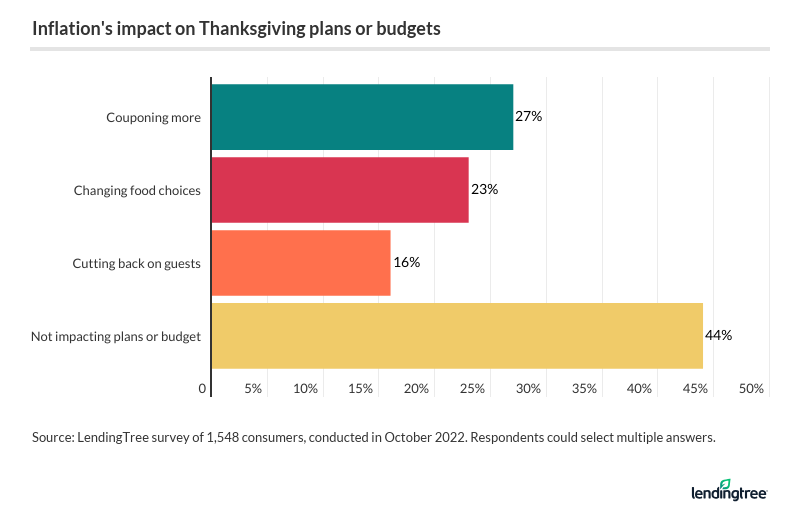

- 56% of Americans say inflation is affecting their Thanksgiving plans or budget. Potential hosts are searching for discounts or deals to help cut costs, with 80% saying they expect to use coupons and/or shop around.

- Potential Thanksgiving hosts plan to spend an average of $396 this year. This is highest among six-figure earners ($527), parents with kids younger than 18 ($500) and Gen Zers ($498). The cost of a whole frozen turkey is up 6.5% a pound from last year, which is costly for these potential hosts, who expect to serve an average of nine guests.

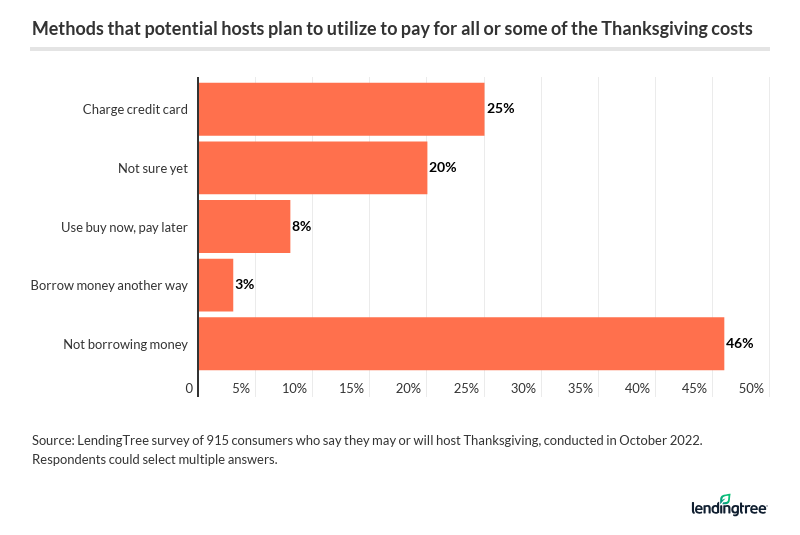

- Regardless of whether they’re hosting or attending the feast, 26% of consumers say Thanksgiving spending is a financial strain for them. In addition, 25% of potential hosts plan to use a credit card to cover at least some of their Thanksgiving expenses — with 42% of them expecting to accrue credit card debt by not paying it off in one billing cycle.

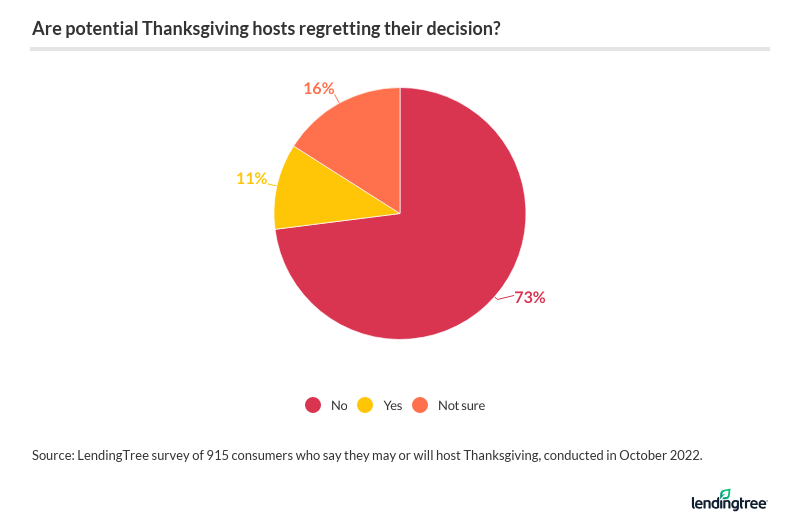

- The turkey hasn’t been carved, but potential hosts are already dreading the holiday. Six-figure earners and parents with kids younger than 18 are regretting their decision to host the most (both 16%), as well as millennials and Gen Zers (both 15%).

Only 26% of Americans plan to host Thanksgiving this year

Americans are feeling financial strain this year, and it’s evident in their holiday hosting plans. This year, just over a quarter (26%) of consumers say they plan to host Thanksgiving. That’s a 45% decrease from the 47% who planned to host in 2021. It’s also 37% lower than the 41% who planned to host in 2020 at the height of the COVID-19 pandemic and 21% lower than the 33% who planned to host in 2019.

Still, consumers have time to lock in Thanksgiving plans, so those figures aren’t set in stone. While 41% say they aren’t hosting Thanksgiving, 33% say they might — which could significantly boost the percentage of hosts.

Among those who plan to host, Gen Zers (ages 18 to 25) are the most likely to set the table this year, but millennials (ages 26 to 41) are the most likely to say they might host. Meanwhile, baby boomers (ages 57 to 76) are the least likely for both. Here’s a breakdown by generation:

- Gen Zers: 32% plan to host, 36% might host

- Millennials: 30% plan to host, 38% might host

- Gen Xers (ages 42 to 56): 26% plan to host, 31% might host

- Baby boomers: 18% plan to host, 27% might host

By income, six-figure earners (39%) are the most likely to host Thanksgiving, while those earning less than $35,000 are the least likely (18%). Meanwhile, adults with children younger than 18 (34%) are much more likely to host than those without children (23%) or those with adult children (22%).

More than half say inflation is impacting their holiday plans

Regardless of whether they’re hosting Turkey Day, 56% of Americans say inflation is affecting their Thanksgiving plans or budget. Parents with children younger than 18 (67%), millennials (65%) and those making less than $35,000 (61%) are the most likely to feel this way, while baby boomers (42%), six-figure earners (47%) and parents with adult children (48%) are the least likely.

Consumers are most likely to say they’re couponing more this time (27%), but they’re also likely to change food choices (23%). Though the question went to all respondents rather than those planning to host, 16% also say they plan to cut back on the number of guests at the dinner table.

Potential hosts, in particular, are likely searching for discounts or deals to help cut costs. This year, 20% of potential hosts say they plan to use coupons, while 13% plan to shop around for better deals. Notably, 47% of potential hosts say they expect to do both.

Potential hosts expect to spend $396 on food, drink and new housewares

It’s easy to understand why potential hosts are looking to cut costs: They expect to spend an average of $267 on food and drink and $129 on new housewares for Thanksgiving. Notably, men plan to spend more on average on Thanksgiving food and beverages ($306) than women ($228).

Regardless of what they’re prioritizing, potential hosts plan to spend an average of $396 in total, though some groups are more likely to shell out than others. Particularly, six-figure earners plan to spend the most. At an average of $527, they’re the only demographic group to spend above the $500 mark. Following that, parents with kids younger than 18 ($500) and Gen Zers ($498) expect to be big spenders this Turkey Day.

On the other end of the list, baby boomers plan to spend the least ($212). Other lower-spending groups include parents with adult children ($235) and potential hosts making less than $35,000 ($260).

But in spite of these expected costs, 57% of hosts say they have a flexible budget. That leaves 23% who’ll pay whatever they need and 20% that say they have a strict budget.

Thanksgiving food costs are on the rise

Rising food costs have been a common pain point for consumers throughout the year, and potential hosts are particularly likely to feel it in their wallets during the holiday. Overall, consumers can expect to spend 17.5% more on a typical Thanksgiving grocery list.

Your mashed and scalloped potatoes come at a particularly hefty price hike, with the cost of Russet potatoes up by 45.5% and red potatoes up by 38.2% compared to last year. And it wouldn’t be Turkey Day without the turkey, either — this year, you can expect to pay 6.5% more per pound of frozen turkey than last year.

| Item | Unit purchased | Change in cost between 2021 and 2022 |

|---|---|---|

| Butter | 1-pound package | 56.9% |

| Grade A large eggs | 1 dozen | 48.1% |

| Russet potatoes | 5-pound bag | 45.5% |

| Red potatoes | 5-pound bag | 38.2% |

| Gala apples | 3-pound bag | 32.5% |

| Lemons | Each | 30.0% |

| Yellow onions | 3-pound bag | 24.1% |

| Acorn squash | Per pound | 23.5% |

| Granny Smith apples | 3-pound bag | 22.8% |

| Butternut squash | Per pound | 22.4% |

| Green beans | Per pound | 19.3% |

| Celery | Each | 8.2% |

| White mushrooms | 8-ounce package | 6.6% |

| Whole frozen turkey | Per pound | 6.5% |

| Cranberries | 12-ounce bag | 4.9% |

| Milk | 1 gallon | 0.0% |

| Mixed salad greens | 10- to 12-ounce package | '-0.4% |

| Sweet potatoes | Per pound | '-10.1% |

| Sweet corn | Each | '-11.9% |

| Brussels sprouts | Per pound | '-15.5% |

| Pumpkins | Per pound | '-17.5% |

| Total basket | 17.5% |

Source: LendingTree analysis of U.S. Department of Agriculture (USDA) data. Excludes organic and specialty items. Compares data from the weeks ending Nov. 5, 2021, and Nov. 4, 2022.

These higher food costs notably impact potential hosts’ budgets, especially as they expect to serve dinner for an average of nine guests.

Potential Gen Z hosts, in particular, can expect to shell out — they plan to have the fullest dining rooms, with an average of 12 people attending. Six-figure earners are the only other demographic with an average number of guests in the double digits, seating an average of 10 people this year.

Over a quarter of consumers say Thanksgiving is a financial strain

Regardless of whether they’re hosting or attending the feast, just over a quarter (26%) of consumers say Thanksgiving spending is a financial strain. Across demographics, parents with kids younger than 18 (37%), those with an annual household income of less than $35,000 (34%) and millennials (34%) are most likely to feel the stress.

Potential hosts will likely rely on credit cards to ease the financial burden. This year, 25% of potential hosts plan to use a credit card to cover at least some of their Thanksgiving expenses.

That percentage is highest among six-figure earners (32%), those making $75,000 to $99,999 (31%), those making between $50,000 and $74,999 (28%), and baby boomers and men (both 27%)

However, it might be a problem when it comes time to pay the bills, as 42% of hosts who’re paying with their credit cards don’t expect they’ll pay off their debt in one billing cycle. To break it down:

- 58% expect to pay it off in a month (one billing cycle)

- 24% expect to pay it off in two months

- 12% expect to pay it off in three to six months

- 3% expect to pay it off in six months or longer

- 3% aren’t sure

LendingTree chief credit analyst Matt Schulz says rising costs could be to blame for the hefty amounts of debt that consumers expect to put on their cards.

“It’s not just the turkey, the decorations or the gas to drive to see your parents,” he says. “It’s all of it. That makes for a really big challenge for the average family who is already having to work harder to make ends meet because of rampant inflation.”

Potential hosts don’t shoulder all the financial stress, though. In fact, they hope their guests share the burden, as 63% of them think some of their guests will either offer money or bring food and beverages to offset the cost of hosting.

Potential hosts already regret their decision

With an arguably hefty financial burden this holiday season, some potential hosts are already regretting their decisions. Overall, 11% say they regret hosting already, while 16% aren’t sure. Six-figure earners and parents with kids younger than 18 are the most likely to regret their decision to host (both 16%). That’s followed closely by millennials and Gen Zers (both 15%).

Notably, men (13%) are more likely to regret their decision than women (9%). However, more women (19%) say they’re unsure if they regret hosting than men (13%).

Meanwhile, potential hosts making less than $35,000 are most likely to say they’re not sure if they regret hosting yet, at 22%. That’s followed by potential hosts making between $35,000 and $49,999 (21%) and Gen Zers (19%).

Expert tips on celebrating Thanksgiving despite high inflation

This Thanksgiving may be a financially stressful time for many, but just because costs are higher this year doesn’t mean you have to forgo the festivities entirely. To celebrate Turkey Day without taking on an unmanageable financial burden, Schulz recommends the following:

- Make a budget. “If you love Thanksgiving and tend to spend a lot of money on it, carve out a space in your budget for it,” he says. “That’s one of the best ways to avoid spending yourself into trouble.” Additionally, consider using rewards credit cards that offer cash back for grocery store purchases.

- Share the load. “Thanksgiving is an inherently social event,” he says. “Don’t feel like you have to bear all the expense of the party you throw. Have attendees pitch in, too. Maybe they just bring a bottle of wine, a dessert, a salad or even some games to play. All these things can help reduce the cost at least a bit to make the day more manageable financially.”

- Take on debt in moderation. Schulz says it’s OK to take on some debt if it means having a proper celebration. “From food and football to family and friends, Thanksgiving can be an amazing day filled with laughter on which memories can be made that will last a lifetime,” he says. “These experiences are why people are willing to take on a little bit of debt. As long as it’s done in moderation, it can be OK. But it can be troubling if you go too overboard.”

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 1,548 U.S. consumers ages 18 to 76 from Oct. 5 to 6, 2022. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2022:

- Generation Z: 18 to 25

- Millennial: 26 to 41

- Generation X: 42 to 56

- Baby boomer: 57 to 76

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.