Inflation Wins Again as Americans Plan To Spend an Average of $115 on the Super Bowl This Year

It’s February, which means the most important football game of the year is approaching. Although fans around the U.S. are excited for the Super Bowl, one winner is already clear: inflation. In fact, the latest LendingTree survey of more than 2,000 consumers found that Americans plan to spend an average of $115 on game-related expenses this year — a 31% jump from 2022.

We looked into which consumers are spending the most money for the Super Bowl and how they’re spending it. Whether you’re watching the game for the ads, Rihanna or — what else? — football, here’s what to expect this year.

On this page

- Key findings

- Super Bowl spending is on the rise

- More consumers are hosting watch parties this year

- 43% say they’re not primarily watching the Super Bowl for the football

- 39% plan to bet — here’s how they’ll do it

- Most Americans aren’t betting much

- Expert tips on limiting your Super Bowl spending

- Methodology

Key findings

- Inflation might be the real winner of Super Bowl LVII as Americans plan to spend an average of $115 on game-related expenses this year — a 31% increase from 2022. Six-figure earners ($246), parents with children younger than 18 ($204) and millennials ($176) top the list of spenders. Meanwhile, a higher rate of consumers expects to tune in this year (77%) than last (72%).

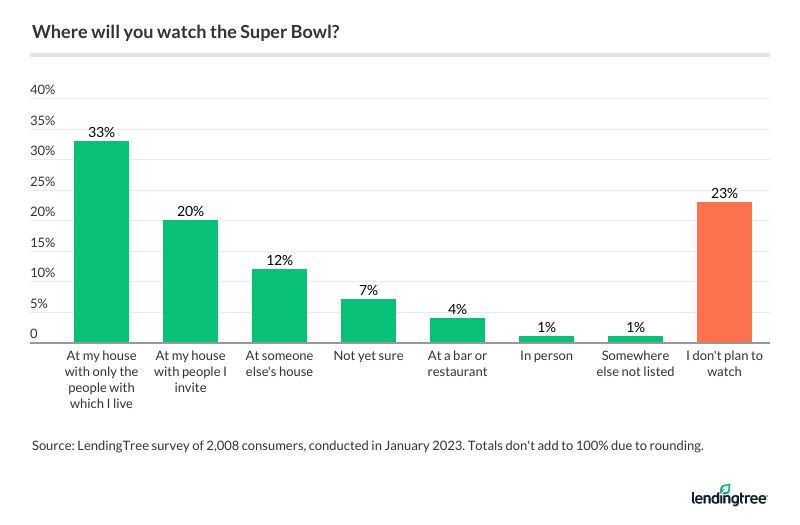

- Watch parties might contribute to the increased spending. While 52% plan to watch from home, 20% of Americans will invite others — an 82% increase from 11% last year. Gen Zers are the most likely age group to host a party (24%), get a streaming subscription to watch (18%) and buy electronic equipment for the big game (14%).

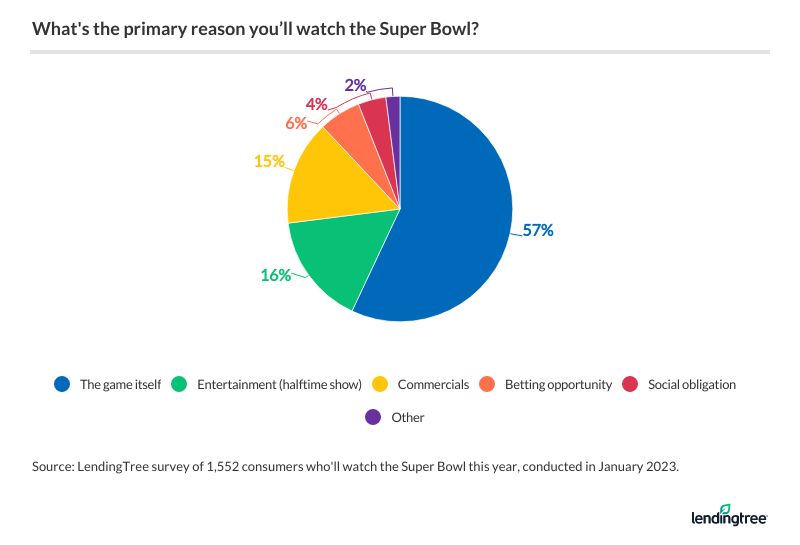

- The game is the main attraction, but not everyone tunes in to watch football. 43% say their primary reason for watching isn’t sports-related. 16% are most looking forward to Rihanna’s halftime show, 15% want to see the game’s best commercials, 6% are hoping to win big on bets and 4% say they feel obligated to watch.

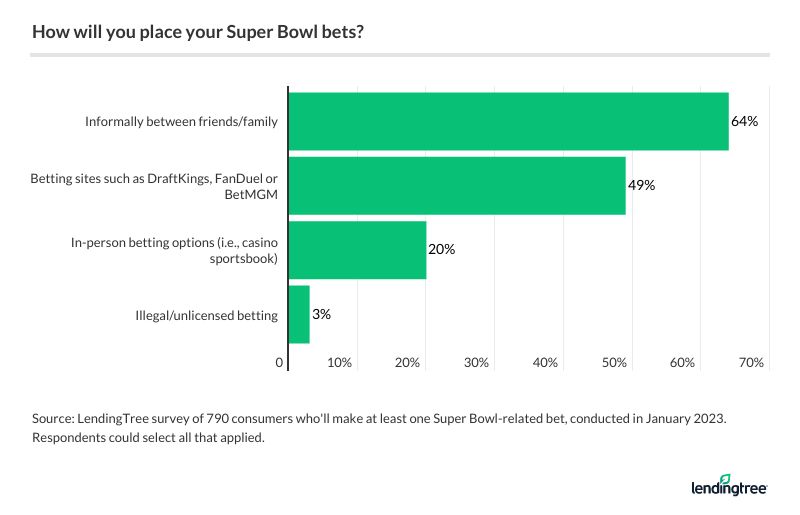

- As accessibility to betting increases, 39% of Americans will make some type of wager this year, a 30% jump from 2022. Most (64%) of those placing bets will keep it between friends and family, while 60% of millennials will bet on the big game via apps or websites.

- Although some have bet millions in the past, the amount most Americans plan to wager isn’t close. Of those wagering on the game, only 37% plan to risk $100 or more. Men and parents with young children are among the groups most likely to bet in the triple digits at 47%. Additionally, 47% of Gen Zers and 45% of parents with young children plan to put their wagers on a credit card.

Super Bowl spending is on the rise

Americans plan to spend an average of $115 on Super Bowl-related expenses. (The Kansas City Chiefs will face the Philadelphia Eagles on Sunday, Feb. 12.) That’s a 31% increase from the $88 Americans planned to spend in 2022. Among the demographics, six-figure earners plan to spend the most ($246) on the Super Bowl. That’s followed by parents with children younger than 18 ($204) and millennials ages 27 to 42 ($176).

Still, some demographics are particularly likely to splurge this year, while others are tightening their Super Bowl budgets. By age group:

- 30% of Gen Zers ages 18 to 26 plan to spend more on this year’s Super Bowl than last year’s — up 36% from last year.

- 23% of millennials plan to spend less on the Super Bowl this year.

- 73% of baby boomers ages 59 to 77 expect to spend the same amount, making them the most likely age group to maintain the same budget.

Unsurprisingly, high earners are the most likely income group to say they’re spending more this year, and low earners are the most likely to tighten their budgets. While 28% of those who make $75,000 or more annually say they’re planning to spend more, 28% of those earning less than $35,000 say they’re going to spend less. Additionally, parents with children younger than 18 (29%) are more likely to spend more money this year than those with adult children (14%) or no children (20%).

According to LendingTree chief credit analyst Matt Schulz, inflation is likely to blame for the overall rise in spending — but that’s not the only factor at play.

At the same time, a higher rate of consumers expects to tune in this year (77%) than last year (72%), signaling that enthusiasm for the big game may be higher this time around.

This comes amid controversies on NFL concussion protocols, including Miami Dolphins quarterback Tua Tagovailoa’s head injuries after two big hits just days apart — the second of which saw him carted off the field. Still, 72% of those planning to watch the Super Bowl say those injuries didn’t affect their plans to watch the game this year. Just 5% say they were going to watch the Super Bowl but changed their mind because of injuries this season.

More consumers are hosting watch parties this year

Another possible reason for the rise in spending could be more consumers planning to host watch parties this year. While 52% plan to watch the Super Bowl from home, 20% of Americans will invite others to watch with them — an 82% increase from 11% last year. By demographics, parents with children younger than 18 (26%) and Gen Zers (24%) are among the most likely to host watch parties this year.

“This is just another sign of the slow, steady return to normalcy for many people after the darkest days of the pandemic,” Schulz says. “About the only thing Americans love more than football is a good party, so the idea of combining those two things again after a few years of shying away from it is appealing to a lot of people. Plus, watching sports is just way more fun with others, right?”

Meanwhile, 1 in 3 (33%) plan to watch it with just their housemates. Another 12% say they’re going to someone else’s house for the game — a popular choice among Gen Zers (15%) and millennials (14%). Notably, men are twice as likely to watch the Super Bowl at a restaurant than women — 6% versus 3%, respectively.

When it comes to what consumers are purchasing for the game, think chicken wings and beer. Nearly two-thirds (66%) of consumers are shelling out on food and drinks, making it the most common response by a wide margin. That’s followed by:

- Clothing or accessories in team colors (17%)

- Decorations (12%)

- Streaming subscriptions to access the game (10%)

- Electronic equipment such as a TV, speakers or a projector (7%)

Those most likely to host are also most likely to shell out some cash on watching the game, as 18% of Gen Zers and 16% of parents with young children are shelling out for streaming services this year (the latter tying with millennials). Gen Zers are also the most likely group to buy electronic equipment for the big game, at 14%.

Additionally, millennials and parents with kids younger than 18 are the most likely to spend some cash to show some team spirit via accessories or clothing, with both groups at 27%.

43% say they’re not primarily watching the Super Bowl for the football

While anticipation for this year’s Super Bowl is high, not everyone who plans to watch it is doing it mainly for the sport. In fact, 43% say their primary reason for watching isn’t football-related.

Of those tuning in this year, 16% are most looking forward to Rihanna’s halftime show, 15% are looking forward to the ads, 6% are hoping to win big on bets and 4% say they feel obligated to watch. (If the last one sounds like your partner, don’t forget: Valentine’s Day is only two days after the Super Bowl).

Men (68%) are more likely than women (47%) to be most excited about the game. Meanwhile, women (22%) are more likely than men (10%) to say they’re watching the game for the halftime show. On the other hand, consumers making between $75,000 and $99,999 and women are the most excited for the ads, at 19% for both.

39% plan to bet — here’s what they’re betting on

Sports betting — particularly mobile betting — has been legalized across dozens of states in recent years. Now, with mobile betting legal and operational in four new states since last year’s Super Bowl, many fans plan to take advantage of the books this year. In fact, 39% of Americans will make some type of wager this year — up 30% from 2022.

Although most (64%) of those placing bets will keep it between friends and family, it’s worth noting that 49% plan to bet online. Millennials (60%) are particularly likely to bet on the big game via mobile apps or websites.

But what are they betting on? The majority (24%) of bettors say they’re putting their cash on which team will win. Other popular bets include:

- The final score (14%)

- A parlay bet, or a bet that combines multiple wagers (11%)

- The coin toss (7%)

- Entertainment, such as bets involving the halftime show or national anthem (6%)

Notably, 36% of parents with young children and 31% of millennials plan to bet on which team will win the big game. Additionally, 19% of men plan to bet on the final score — a 90% increase from last year.

Generally, though, a fair amount of bettors win their wagers. While 70% say they didn’t bet last year, 1 in 5 (20%) Americans said they won money on a Super Bowl bet in 2022 — making it the most common response among last year’s bettors. That figure’s highest among parents with young children (29%), which may explain why a high percentage plan on betting this year.

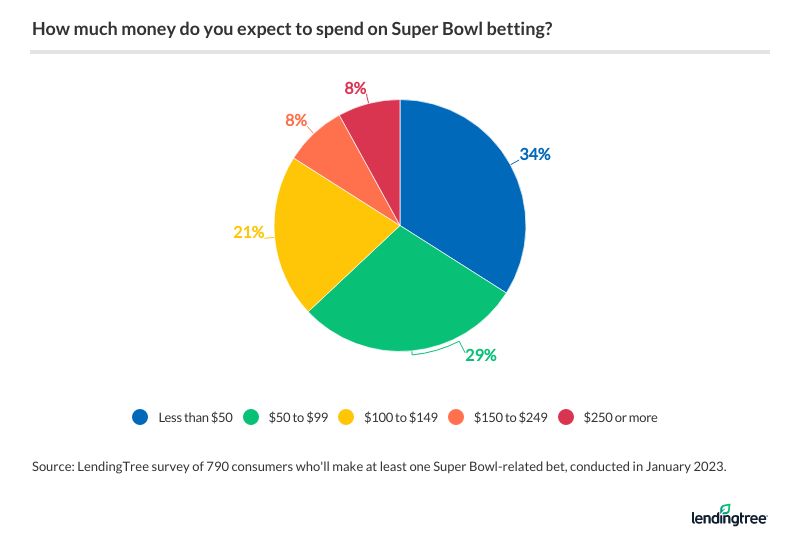

Most Americans aren’t betting much

Although it’s not uncommon to see big bets in the news, most Americans don’t plan to put down millions. Of those wagering on the game, only 37% plan to risk $100 or more. Men and parents with young children are among the groups most likely to be doing so, at 47% for both.

Broken down, 26% of betting men plan to spend between $100 and $149, while 12% of parents with young children plan to wager $250 or more. Meanwhile, baby boomers and women are the most likely to keep their bets low. Of these bettors, 70% of baby boomers and 42% of women say they’ll put down less than $50.

Although most bettors (60%) say they won’t use a credit card to bet, 36% say they’ll use their plastic for at least one bet they’re making. That’s particularly true for Gen Zers (47%) and parents with young children (45%).

On the other hand, 64% of women placing bets will skip using their credit cards this year — making them among the most likely groups to play it safe.

Rather bet on the Puppy Bowl? You’re not alone

While the Super Bowl is all fun and games, that’s not the only major event on Feb. 12 — those who prefer furry friends over football may be putting their money on the Puppy Bowl this year.

While 72% of Americans would rather bet on the Super Bowl than the Puppy Bowl, 28% say they’d rather bet on the four-legged players. Women and baby boomers are the most likely to say they’d rather bet on the Puppy Bowl than the Super Bowl, at 37% for both.

Expert tips on limiting your Super Bowl spending

If you’re planning to shell out on the Super Bowl this season, you don’t have to break the bank to make the most of it. For those looking to keep their spending low this year, Schulz recommends the following options:

- Turn the party into a potluck. “You don’t have to take on all the costs of throwing the big Super Bowl bash,” he says. “Have friends and family pitch in by bringing food or drinks. Let them bring that homemade chili they’re always telling you about or those brownies that your kids loved at the birthday party a few years ago. It’s cost-efficient and fun.”

- Make a list and a budget. “If you’re going to go all-out with your Super Bowl party, take the time to make a plan,” Schulz says. “If you think through what you need to get and how much you’re comfortable spending on all of it, you can go a long way to controlling your costs. Otherwise, you risk heading to the grocery store or party store and getting swept up into impulse purchases you didn’t need.”

- Consider which credit card you’re using. Although it’s easy to overspend with credit cards, using a cash back credit card can provide a little bit of wiggle room in your budget. For those planning to splurge on food, using a grocery store rewards credit card can particularly help you save some cash in the long run.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 2,008 U.S. consumers ages 18 to 77 from Jan. 19 to 23, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77

Regarding expected Super Bowl spending, respondents were limited to $5,000.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.