Nearly 70% of Americans Say They’re Dining Out Less Frequently Due to Inflation, and Almost a Third Are Tipping Less

Most Americans are feeling the severe effects of inflation, and the restaurant and grocery industries are experiencing residual impacts.

A new LendingTree survey of nearly 1,600 Americans shows that consumers are changing their dining and tipping habits, with 67% saying they’re dining out less and 31% tipping less when they are dining out. Plus, about two-thirds of consumers have worried in the past month about affording groceries.

For more insight into habits amid inflation, keep reading.

On this page

- Key findings

- Inflation is shifting consumers’ dining behaviors

- 85% of consumers say they’re shifting grocery shopping habits due to rising prices

- Nearly two-thirds worried about ability to afford groceries in the past month

- Majority of shoppers are missing out on credit card rewards at restaurants and grocery stores

- 5 ways to save money on food during record inflation

- Methodology

Key findings

- Inflation is shifting consumers’ dining and tipping habits. Nearly 7 in 10 (67%) consumers say they’re dining out less frequently due to inflation — and 31% say they’re tipping less than normal when they go out.

- In addition to changes in restaurant spending, 85% of Americans say inflation has impacted their grocery shopping habits. Top changes include buying more generic brands (47%) and strictly sticking to a list to buy only necessities (43%).

- Surging food prices are leading to affordability fears. About two-thirds of consumers (64%) say they’ve worried about their ability to pay for groceries at least once in the past month.

- Parents with children younger than 18 are especially challenged by rising grocery costs, with nearly 3 in 4 saying they worried about their ability to pay for groceries at least once in the past month. To adapt, these parents are employing money-saving strategies at higher rates than their peers who don’t have young kids, including turning to generic brands (54%), couponing more frequently (33%) and switching to stores with lower prices (24%).

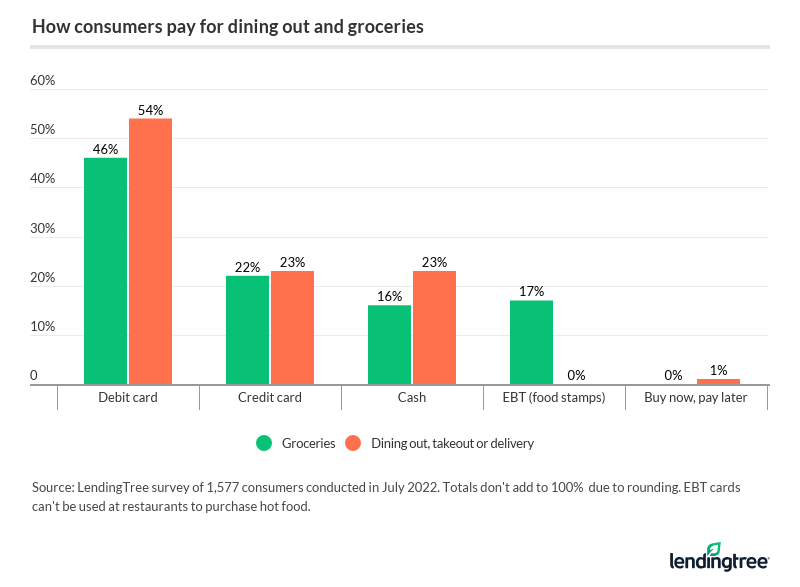

- Cash back rewards can help consumers stretch their budgets, but nearly 80% of Americans are missing out on these rewards when paying for groceries and restaurants. Fewer than a quarter say they primarily pay with a credit card when buying groceries (22%) or going out to eat (23%). Instead, the majority use a debit card.

Inflation is shifting consumers’ dining behaviors

Overall, 85% of Americans say inflation has impacted their approach to dining out. This is most common among parents with children younger than 18 (90%), people who earn $50,000 to $74,999 annually (89%) and Gen Xers (ages 42 to 56) (86%).

The biggest shift in habits is that 67% of Americans are dining out less because of inflation, which impacts what consumers pay — and what restaurants change.

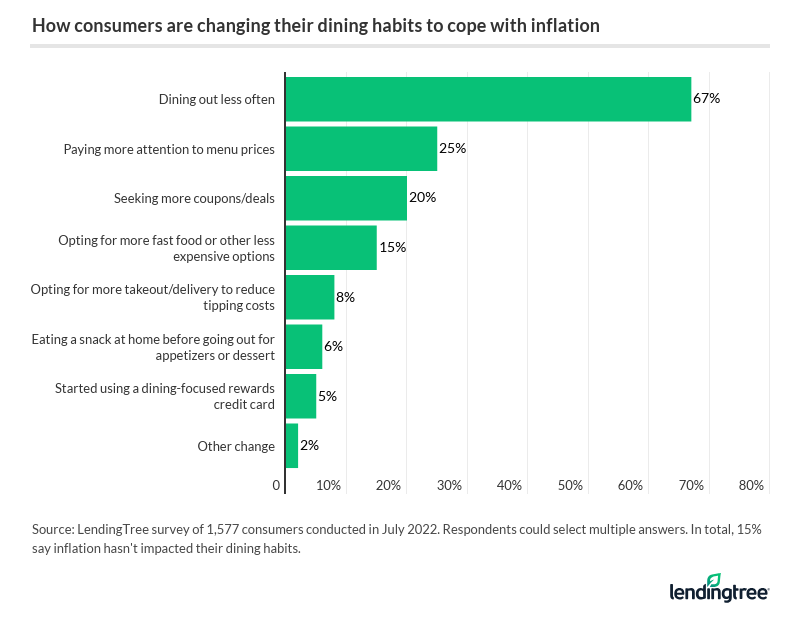

The following graphic covers how consumers have changed their dining behaviors due to inflation.

Gen Xers top the list of demographics dining out less frequently (73%), followed by parents whose children are all 18 or older (72%). Interestingly, consumers who make $100,000 or more a year are most likely to pay more attention to menu prices (32%).

Menu prices can impact how much Americans tip when dining out. The survey data backs this as 31% of people say they’re tipping less than normal. This is led by people with young children (38%) and millennials (ages 26 to 41) (36%). Meanwhile, baby boomers (ages 57 to 76) are least likely to say they’re tipping less at 23%. Separately, 14% aren’t tipping for takeout or delivery, opting to leave gratuity only for dine-in service.

Schulz says these changes are understandable but unfortunate.

85% of consumers say they’re shifting grocery shopping habits due to rising prices

Consumers’ food habits are changing across the board, including at grocery stores. Most consumers (85%) say inflation has impacted their grocery shopping behavior.

Demographic-wise, women are more likely than men to say their shopping is impacted — 87% versus 83%. Nearly 9 in 10 Gen Xers (88%) cite an impact, versus 85% of baby boomers and millennials and 82% of Gen Zers (ages 18 to 25).

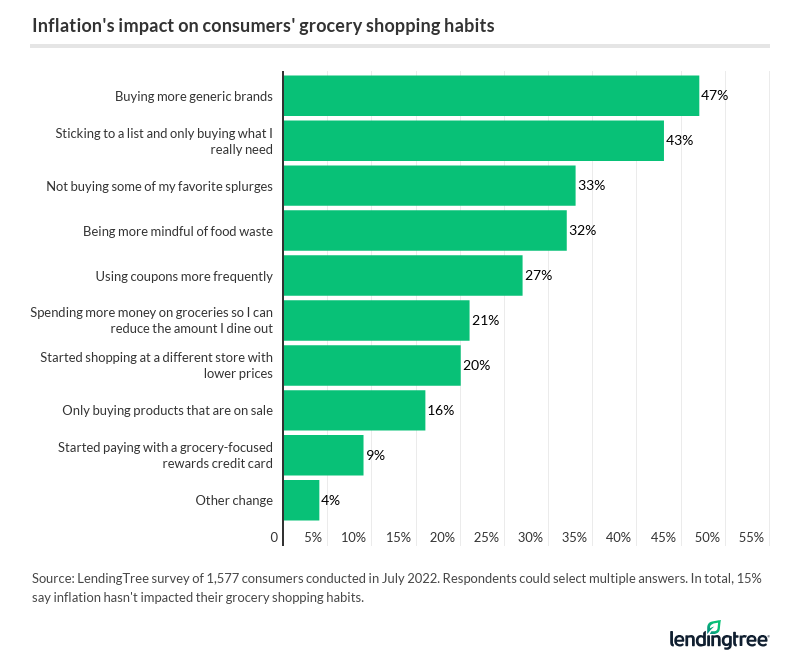

Similar to changing restaurant habits, we explored where people are making alterations with groceries. Nearly half of consumers (47%) are buying more generic brands, while 43% are sticking to their list and only buying what they need.

“It’s great that people are taking steps to deal with rising costs,” Schulz says. “Simple things like buying generic brands, sticking to a list and reducing food waste are all excellent steps to take, even in excellent economic times. But they become even more important when times are tougher and prices are higher.”

Parents with children younger than 18 lead the way among people buying generic brands (54%), followed by Americans who make $35,000 to $49,999 annually (52%). Meanwhile, baby boomers have cut back the most on their favorite splurges and are most mindful of food waste and reuse. Parents with young children are turning to stores with lower prices the most.

Nearly two-thirds worried about ability to afford groceries in the past month

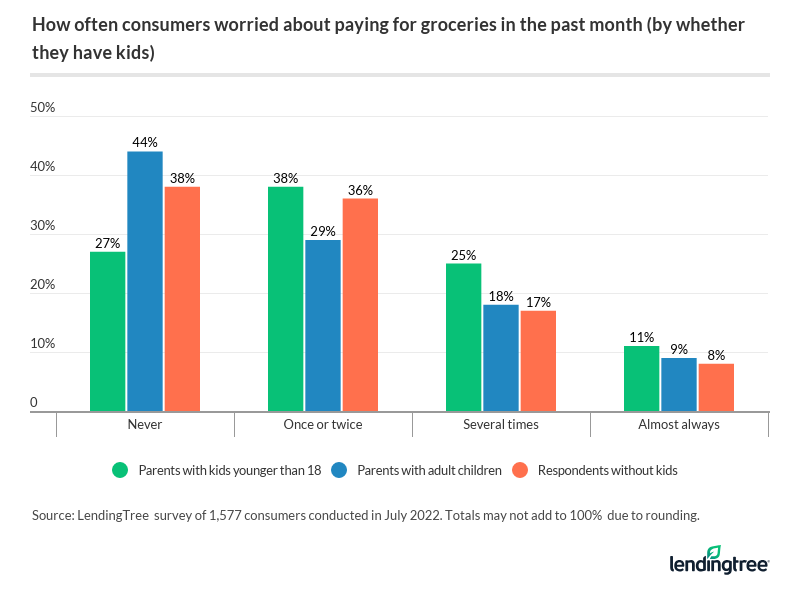

Nearly two-thirds (64%) of consumers say they’ve worried about their ability to afford groceries at least once in the past month. This is more common among women than men (70% versus 58%), as well as among Gen Zers (72%), millennials (71%) and Gen Xers (66%) than baby boomers (49%).

A lower household income can also lead to more financial concerns during difficult economic times. Households making less than $35,000 a year are most anxious about affording groceries at 74%. That percentage plummets to 51% among six-figure earners.

Parents with young children especially impacted by rising grocery costs

Another group greatly feeling the impact of inflation on food is parents with extra mouths to feed in their household. Households with children younger than 18 are especially impacted by rising prices, with 73% saying they were worried about their ability to afford groceries in the past month.

“Having young kids is expensive, even in the best of times,” Schulz says. “Mix in rampant inflation and it gets that much worse.”

Programs for children, like free breakfast or lunch at school, may be available to parents, depending on their situation and location.

Still, parents are making strategic changes to their grocery shopping routines these days. Those with children younger than 18 are turning to generic brands (54%), couponing more frequently (33%) and switching to stores with lower prices (24%) to save money on groceries and stretch their budgets.

Majority of shoppers are missing out on credit card rewards at restaurants and grocery stores

One way to help regain a bit of cash after making pricey grocery store and restaurant purchases is to take advantage of cash back rewards. Many lucrative cash back rewards cards that cater to restaurants and grocery stores exist, but a lot of consumers aren’t taking advantage of them. Nearly 80% don’t primarily pay with a credit card when paying for groceries or dining out.

“I understand why people might shy away from buying groceries with a credit card, but it really can be a missed opportunity,” Schulz says. “Used wisely, the right credit card can save you real money and help to extend your food budget.”

However, he notes that it’s crucial you don’t see the card as an excuse to splurge and spend more, as overspending with the card will only make things worse. But if you can pay off the card regularly while also earning some cash back or points, it can make a difference.

Unsurprisingly, consumers who are a bit more established in life are those most likely to use a credit card for these purchases (namely baby boomers and six-figure earners).

5 ways to save money on food during record inflation

Consumers looking to save on food spending while battling high inflation rates may want to consider one of Schulz’s tips for saving big.

- Stick to a list: It sounds simple, but making a shopping list and bringing it with you can reduce the likelihood of splurging and buying things on impulse. Cutting out those extra purchases can help leave more money available for the most important items on your list.

- Embrace credit card rewards: “If you’re not using a rewards credit card to buy groceries, you’re likely leaving money on the table — and that’s the last thing anyone should do today,” Schulz says. “If you feel that you’ll only be able to pay the minimum each month or that you won’t be able to resist the urge to spend all of that extra available credit, a rewards card probably isn’t the right choice for you. For others, however, it can really help.”

- Shop around: It could take a little bit of extra work, shopping around for the best deals before stocking up on groceries can be very worthwhile. Today, most grocery stores post their ads online, so it’s easy to see who has what you need on sale that week.

- Cut coupons: “They’re a great option any time, but they’re especially important when prices are rising,” Schulz says. “Focus on finding coupons for things that you already know you’ll be buying rather than simply looking for great coupon deals and buying things that you don’t really need.”

- Don’t be afraid to seek help: “It can be difficult for folks to admit that they need help in making ends meet, but difficult times sometimes require us to swallow our pride and let others help,” Schulz says. “For example, consider reaching out to a local food bank or another type of organization that provides meals to those in need of assistance.”

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 1,577 U.S. consumers ages 18 to 76 from July 26-29, 2022. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2022:

- Generation Z: 18 to 25

- Millennial: 26 to 41

- Generation X: 42 to 56

- Baby boomer: 57 to 76

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.