Hey Siri, Charge Mom and Dad’s Card: Kids’ Secret Spending Nears $700, on Average

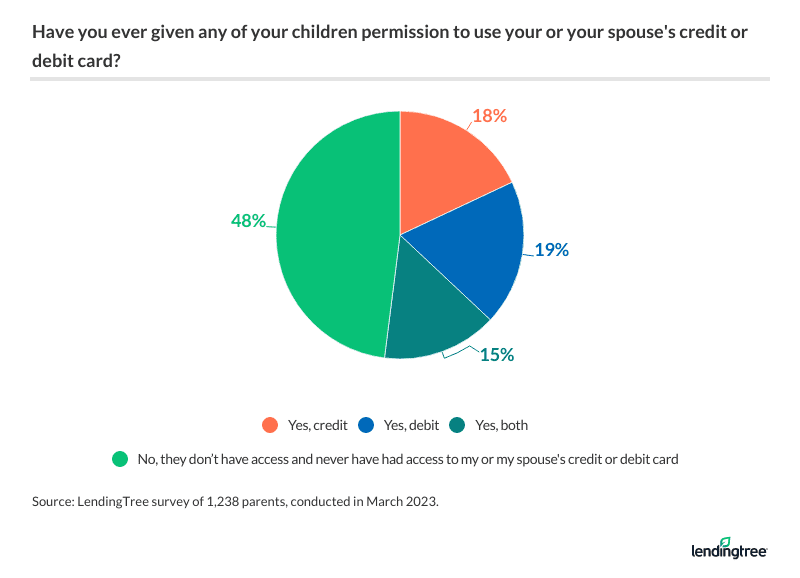

Kids and credit cards can sometimes be a recipe for disaster. Although more than half (52%) of parents have permitted their children to use their debit or credit cards, 29% of them say their kid made an unauthorized purchase — and many were big spenders.

We asked more than 2,000 U.S. consumers about their experiences giving kids access to cash — here’s what we found.

On this page

- Key findings

- 29% of kids with access to parents’ debit or credit cards have made unauthorized purchases

- How much are kids spending when parents aren’t looking?

- Some parents regret handing over the card

- Cards aside, the majority of kids have had an allowance

- Fighting over cash with your kid? You’re not alone

- Expert tips on navigating finances with the kids

- Methodology

Key findings

- Kids are pressing “pay” without permission. Of the 52% of American parents who’ve permitted their children to use their debit or credit cards, 29% said their kid made an unauthorized purchase. Among those who’ve given their children permission, mothers are nearly twice as likely as fathers to provide unlimited card access (11% versus 6%). Parents with an annual household income of $100,000 or more are the most likely income group to give their kids permission to use their debit/credit cards at 62%.

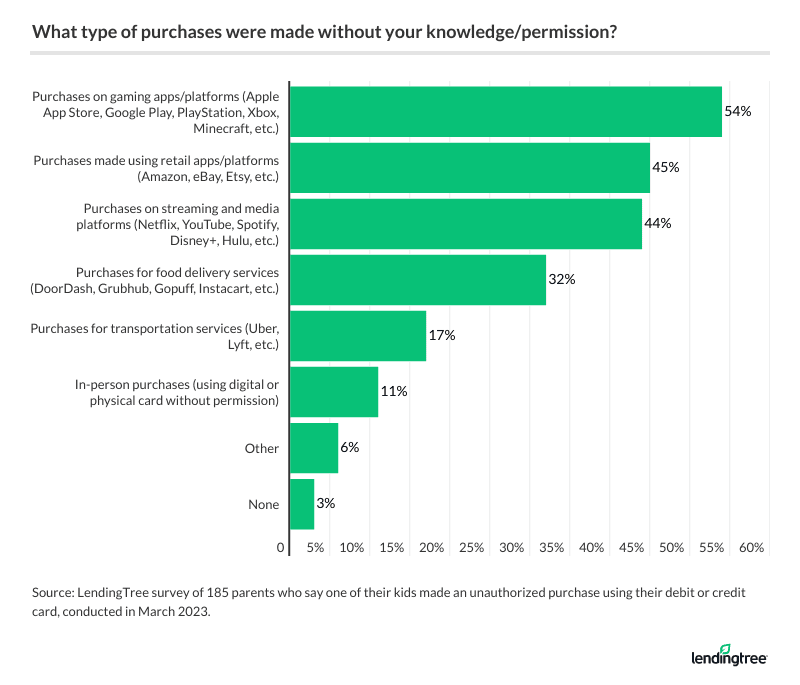

- Children are spending big when their parents aren’t looking. Kids that used their parents’ cards without asking spent an average of $693 at the high end. Technology has made sly spending easier. Gaming apps (54%), retail apps like Amazon and eBay (45%), streaming platforms like Netflix and Hulu (44%) and food delivery services like DoorDash and Grubhub (32%) are where kids are secretly spending the most.

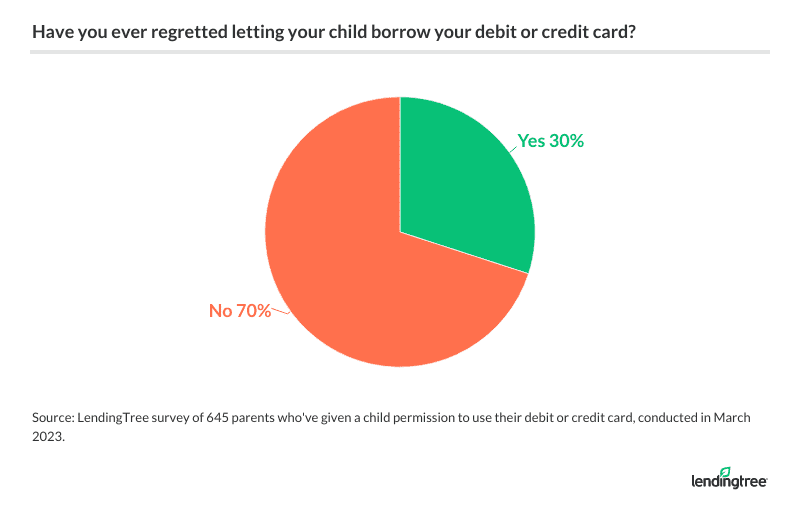

- Handing over a card might be easiest for parents, but convenience often comes with remorse. Among parents who’ve let a child borrow their card, 30% regret doing so. After doling out the plastic, regret is prevalent among parents with young children (36%), while in general dads are more likely to feel it than moms (33% versus 26%).

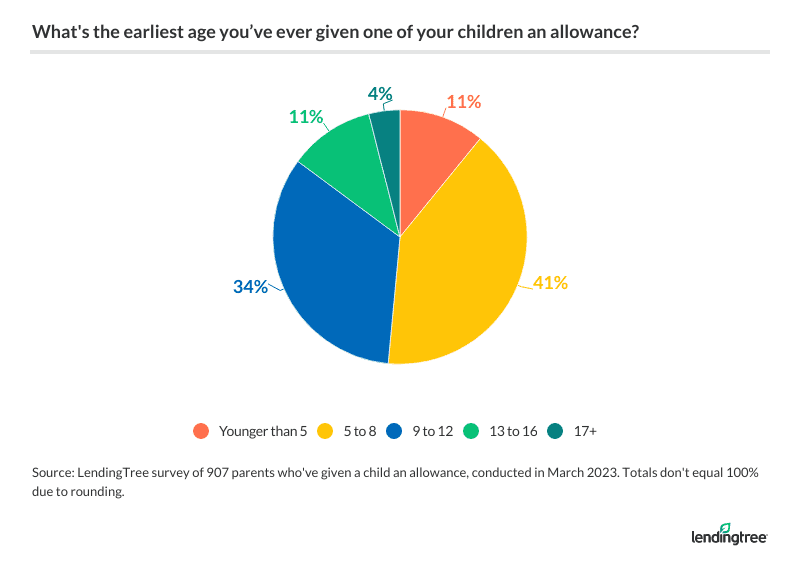

- Although they might prefer to use the bank of Mom and Dad, the majority of American kids have had an allowance — yet most have to work for it. 73% of parents say they’ve given their children a monthly allowance, at an average of $47 monthly. 88% of parents who’ve given allowances say they tie them to chores, with moms more often making their kids work for it than dads (91% versus 85%).

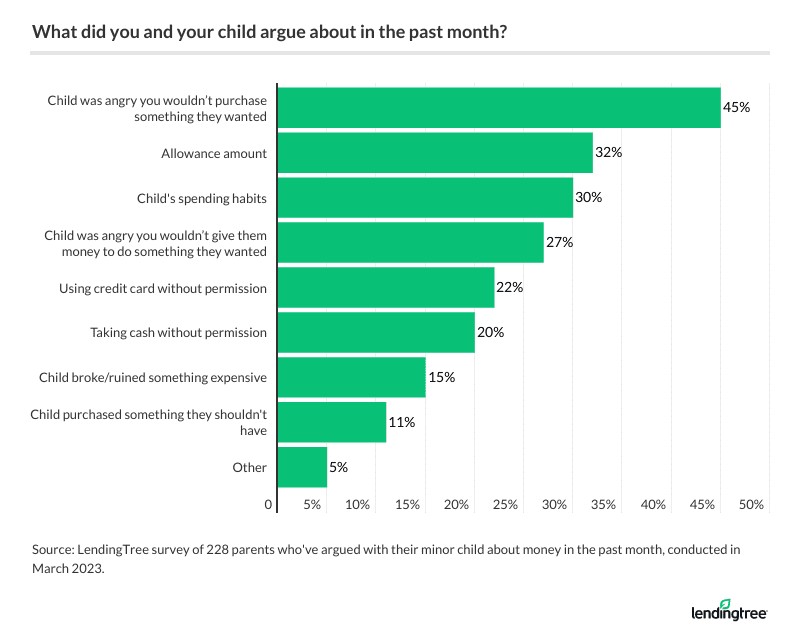

- Fights surrounding money are common among families. Nearly a third of parents with underage children (32%) say they’ve argued with them about money in the past month. 45% say they fought because the parent wouldn’t purchase something the child wanted.

29% of kids with access to parents’ debit or credit cards have made unauthorized purchases

Although kids may not always be the most responsible, giving them access to a card is particularly common. Among parents, 52% have permitted their children to use their (or their spouse’s) debit or credit cards. By income group, six-figure earners are the most likely to give their kids permission to use their credit or debit cards at 62%. Meanwhile, parents earning less than $35,000 a year are the least likely at 43%.

According to LendingTree chief credit analyst Matt Schulz, the likelihood of different income groups granting card access probably boils down to credit.

Who’s the favorite parent? If your kid’s love language is gift-giving, it’s Dad. Men are more likely to give their kids access to their cards than women, at 56% versus 49%.

Is giving access a regular thing or a rare occurrence? For most, it’s the latter. Among those who’ve given their kids access to their cards, 39% have given them permission to use their cards more than once but fewer than five times. Following that:

- 27% have permitted their kids to use their card between five and 10 times

- 14% have given their kids permission to use their card once

- 11% have permitted their kids to use their card more than 10 times

- 9% have given their kids unlimited access to their card

Notably, 15% of parents with an annual income between $50,000 and $74,999 have given their children unlimited access to their debit or credit cards — making them the most likely group to do so. In comparison, only 5% of six-figure-earning parents give unlimited access. In addition, mothers are nearly twice as likely as fathers to provide unlimited card access (11% versus 6%).

Still, not all kids are honest about using their parents’ cards as intended. Of those who’ve given their kids access to their cards, 29% say their kid made an unauthorized purchase — a figure that rises to 42% among millennial parents (ages 27 to 42). In the same vein, parents with kids younger than 18 are also particularly likely to see unauthorized charges from their children (37%).

A quarter of parents make their kids authorized users on a card

Granting kids access to cards is one thing — making them an authorized user is another. A quarter of American parents (25%) say they’ve made their underage children an authorized user on their debit or credit card. Men are more likely to do so than women — 30% versus 20%.

When is it time to let your kid take card responsibility? The majority think it’s right at the cusp of adulthood. In fact, 35% of Americans say the right age for someone to get a credit card is between 18 and 20 years old. Meanwhile, 24% say someone should get a credit card between 21 and 23 years old.

How much are kids spending when parents aren’t looking?

When it comes to unauthorized spending, children are shelling out big bucks. At the high end, kids have spent an average of $693 in one go behind their parents’ backs — and among parents with children younger than 18, the figure rises to $743.

Technology may be to blame for that financial battle royale between parents and children. Kids may have gotten better at sneaking around from Fortnite and PUBG — or, at least, that may be where they’re spending their parents’ money. Gaming is to blame for the majority of purchases made behind a parent’s back, making up 54% of unauthorized purchases.

That’s followed by retail apps like Amazon and eBay (45%), streaming platforms like Netflix and Hulu (44%) and food delivery services like DoorDash and Grubhub (32%).

According to Schulz, those apps may be why kids’ unauthorized spending has increased in the past year.

“Apps and websites make it so easy for us to pay with just a click, so we shouldn’t be surprised when our kids do it, too,” he says. “With that in mind, it’s crucial you have a conversation with your kids about what the expectations are when it comes to buying online and what the consequences will be if they spend when they’re not supposed to. Makes for some awkward dinner-table conversation, but it’s way better than talking about it for the first time when a real problem arises.”

Some parents regret handing over the card

That unauthorized spending doesn’t only dig holes in parents’ pockets — it sometimes leads to regret. Among parents who’ve let a child borrow their card, 3 in 10 (30%) regret doing so — and it’s particularly true among parents with young children (36%). In addition, dads (33%) expressed a sense of regret more than moms (26%) did.

“If a kid goes off the rails after borrowing a credit card, it can lead to serious financial problems, especially for families on a tight budget,” Schulz says. “That could lead to serious regrets. Parents may regret even just lending the card to the kid, but it may also go beyond that. They could also regret not doing a better job of talking about money with their son or daughter as well as not adequately telling the kid about the expectations around their usage of the card and what the consequences would be for overstepping those boundaries.”

Cards aside, the majority of kids have had an allowance

Although parental plastic may feel like an unlimited resource, the majority of parents (73%) have given their kids an allowance — though most are going to earn it. Of parents who’ve given allowances, 88% say they’re given for chores, with moms more often making their kids work for their money than dads do (91% versus 85%).

That may be to reinforce good behavior, especially considering that 41% of Americans started giving their children an allowance between the ages of 5 and 8. Moms are more likely than dads to start giving allowances at that age — 46% versus 36%.

On the other hand, dads are evenly split between ages 5 and 8 and ages 9 and 12 at 36%. Another 13% say they started doing so between the ages of 13 and 16. Meanwhile, 31% of mothers start doing so between the ages of 9 and 12 and 9% start doing so between the ages of 13 and 16.

How much money do these children get? On average, parents who give allowances pay their kids $47 monthly. Among the age groups, millennials give their kids the highest allowances, at $58 a month. And while moms are more likely to start giving allowances early on, they typically give less cash than dads — $39 a month, versus $55 a month among dads. That $55 is the same monthly amount among parents with children younger than 18.

Fighting over cash with your kid? You’re not alone

Fighting isn’t all that uncommon when it comes to young kids and cash. Nearly a third of parents with underage children (32%) say they’ve argued with them about money in the past month, a figure that rises to 34% among millennial parents.

What were these fights about? Among those who’ve fought with their younger kids over finances recently, 45% say they fought because the parent wouldn’t purchase something the child wanted. Allowance amounts came second (32%), followed by the child’s spending habits (30%).

Expert tips on navigating finances with the kids

Helping your kids understand financial responsibility can be a challenge. While giving them access to your debit or credit card can teach them a few lessons, Schulz warns it comes with risks. To help navigate the world of finances with your children, he offers the following tips:

- Communicate, communicate, communicate. “If you give your kid access to a credit card, you absolutely, positively must talk with them about how you expect them to handle it and what the consequences will be if things go awry,” he says. “It’s simply too easy for something to go wrong.”

- Consider an allowance instead. “There are definitely circumstances where an allowance may be an easier option than granting the kid access to a credit card,” he says. “Yes, it will limit the kids’ spending power, but it also limits the risk. That’s a big deal. Instead of giving them a credit card, consider opening them a checking account and letting them use their allowance via a debit card instead. That can be a powerful teacher as well, but it’s far less dangerous than a credit card because their spending potential will likely be significantly lower.”

- See if you can set further spending limits on the kids’ usage. “If your son or daughter is an authorized user on your credit card, you may be able to set spending limits for them that are significantly smaller than the card’s overall credit limit,” he says. “That can be an effective way to rein in spending even further. Not all card accounts offer this type of feature, but if it’s something you’re interested in, it’s worth calling the card issuer and asking them about it.”

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 2,044 U.S. consumers ages 18 to 77 from March 7 to 8, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.