Half of Americans Say Inflation Is Forcing Them To Cut Back on Fourth of July Spending, but Those Celebrating Plan To Spend an Average of $270

The Fourth of July is approaching, and backyard grills aren’t the only things heating up this summer — consumer spending is red-hot, too. Although 50% of Americans say inflation is forcing them to cut back on Independence Day spending, celebrators plan to spend in the double digits, on average, this year.

We asked nearly 2,000 U.S. consumers about their Fourth of July plans. Here’s what we found.

On this page

Key findings

- The Fourth of July calls for celebration, but a “party in the USA” doesn’t come without a price. Although half of Americans say inflation is forcing them to cut back on Fourth of July spending, 86% of Americans plan to celebrate Independence Day and expect to spend an average of $270. Younger generations plan to shell out more than older generations, at an average of $394 among Gen Zers and $343 among millennials.

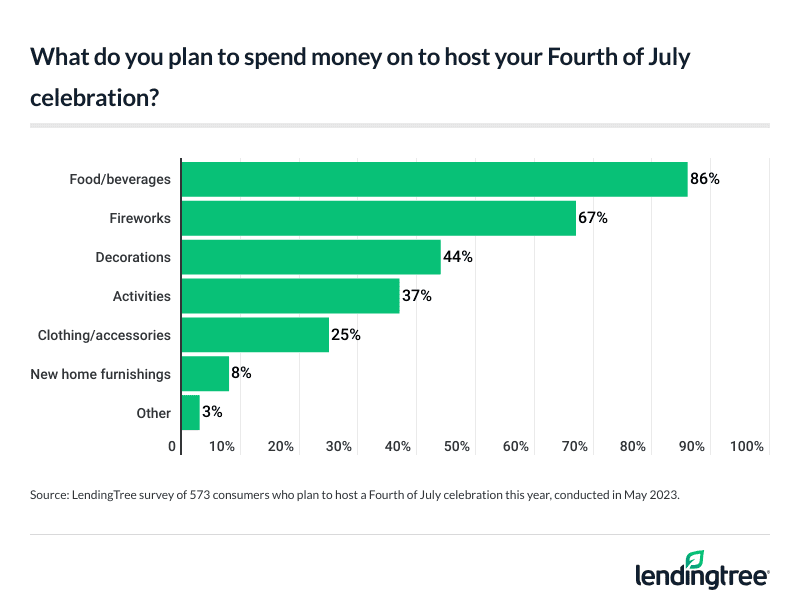

- Big spending on holidays has led to buyer’s remorse for some. Almost 1 in 5 (18%) Americans regret overspending on July Fourth celebrations in the past. However, the party will go on for the 34% of celebrators who plan to host a get-together this Independence Day. Of those hosting this year, 86% plan to spend money on food and beverages, followed by fireworks (67%), decorations (44%) and activities (37%).

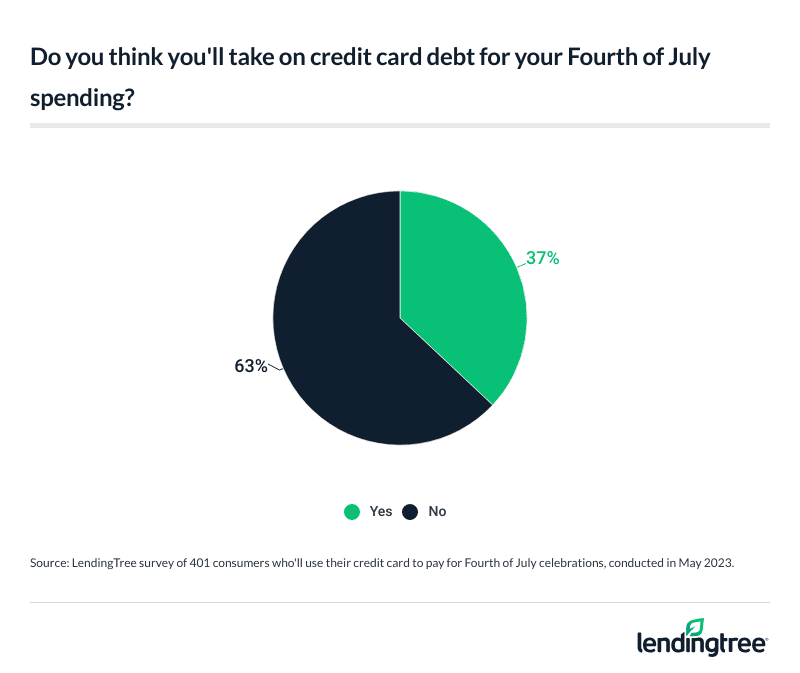

- Summer gatherings bring loved ones together, but they could put some consumers’ finances into the red. Even though more than half of celebrators (53%) say spending time with friends and family is their favorite part of Independence Day, almost 4 in 10 (37%) planning to pay for festivities with a credit card say they’ll likely take on debt.

- Inflation heats up but summer sales help cool off spending for some. While many are cutting back on celebration spending due to inflation, younger generations like Gen Zers (72%) and millennials (70%) plan to take advantage of special Fourth of July deals and sales to cut costs.

Fourth of July celebrations come at a cost

While the majority of Americans (86%) plan to celebrate the summer holiday, 50% of those surveyed say inflation is forcing them to cut back on their Independence Day spending. That’s particularly true of parents with children younger than 18 (59%), millennials ages 27 to 42 (57%) and consumers earning less than $35,000 annually (56%).

On average, those who plan to celebrate expect to spend an average of $270. Unsurprisingly, six-figure earners plan to spend the most, at $597. Parents with children younger than 18 also plan to spend a lot, shelling out an average of $402 on their Fourth of July celebrations.

By age group, younger generations plan to spend more than older generations. Gen Zers ages 18 to 26 plan to spend $394 — most of any age group. That compares with:

- Millennials: $343

- Gen Xers ages 43 to 58: $206

- Baby boomers ages 59 to 77: $134

Men plan to spend significantly more than women, at $336 versus $212.

LendingTree chief credit analyst Matt Schulz isn’t surprised that inflation is making people dial back their July Fourth spending, but he didn’t expect to see younger Americans planning to spend more than older Americans.

“I’d suspect parents with young kids are fueling a lot of that,” he says. “With the little ones out of school, summers are filled with pool parties, picnics in the park and backyard barbecues, especially around the Fourth of July. However, as fun as those parties may be, they’re not always cheap.”

18% regret overspending on previous Fourth of July parties

While Fourth of July celebrations may be fun, many Americans regret going out with a bang. In fact, almost 1 in 5 (18%) Americans say they regret overspending on prior July Fourth celebrations. That’s particularly true among Gen Zers (27%).

Still, though, that won’t stop the 34% of celebrators who plan to host a get-together this Independence Day. And while Gen Zers are the most likely to regret overspending, they’re also the most likely to host a Fourth of July bash at 49%. That’s followed by six-figure earners (48%) and parents with young children (47%).

What, exactly, do hosts plan to buy? Of those hosting this year, 86% plan to spend money on food and beverages — making it the most popular purchase.

Among Fourth of July hosts, adults with children younger than 18 (74%), Gen Zers (73%) and millennials (72%) are particularly likely to buy fireworks this year. Gen Zers are also significantly more likely than hosts overall to spend money on activities, at 50%.

37% of celebrators plan to take on debt to fund their festivities

Most consumers’ favorite part of the holiday is free, but celebrating the Fourth of July may still put many consumers in debt. Among those celebrating this year, 53% say spending time with friends and family is their favorite part of Independence Day. Meanwhile, 25% most enjoy the fireworks and 14% most enjoy the food.

While 61% of consumers will pay by cash or debit card for their Fourth of July purchases, 24% say they’ll use a credit card. Of those paying with a credit card, almost 4 in 10 (37%) say they’ll likely take on debt.

Six-figure earners (40%), Gen Zers (31%) and those earning between $75,000 and $99,999 a year (30%) are the most likely to put July Fourth purchases on their credit cards. Meanwhile, parents with children younger than 18 using a credit card are the most likely to say they’ll take on related debt this year, at 48%.

While debt isn’t always bad, Schulz cautions against overspending for the holiday.

“Few things rival Americans’ love for their country, but their love of a good party may come close,” he says. “That’s part of what makes July Fourth such a festive time. Just remember that you don’t have to go financially overboard to have a memorable Fourth, and when it comes down to it, your friends and family certainly wouldn’t want you to go into debt over a holiday party.”

Fourth of July sales help cool the burn of inflation

With many cutting back on celebration spending due to inflation, the majority of consumers plan to stretch their dollars as much as they can — particularly when it comes to finding good deals. Of those celebrating, 58% plan on taking advantage of Fourth of July sales this year. That’s particularly true among Gen Zers (72%) and millennials (70%).

“Taking advantage of July Fourth sales and deals is a great way to keep your costs down,” Schulz says. “Shopping around is almost always great advice whether you’re shopping for a new mortgage or some holiday party favors, so be sure to take the time to compare prices before you buy.”

Keeping costs down: Additional expert tips

Beyond shopping for deals, Schulz says there are a few other ways to cut costs this Fourth of July. For a little extra wiggle room, credit card rewards can offer some savings. For example, those planning to fire up the grill this Fourth can utilize a grocery rewards credit card to earn some cash back when buying the hot dogs and hamburgers.

Overall, though, Schulz emphasizes that friends and family can be a great help.

“Don’t be afraid to ask others to pitch in,” he says. “Turn the party into a potluck or a BYOB. Borrow chairs, tables and tents so you don’t have to rent them or buy extras. Have people bring their own flag decorations or let your kids make some. There are a million fun ways to keep costs down, so don’t be afraid to get a little creative.”

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 1,955 consumers from May 16-18, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.