60% of Parents With Young Kids Are Dreading the Holidays, as 44% of Them Say They’ve Lost Sleep Over How They’ll Afford Gifts

The holidays are meant to be a time of laughter and cheer, but Americans this year are focused on mistle-dough management — and it may be putting a damper on their holiday spirit. According to the latest LendingTree survey of 2,000 U.S. consumers, 47% of Americans are dreading the holidays this year due to the costs involved.

Here’s what else we found.

Key findings

- Decking the halls or dreading the halls? 47% of Americans are dreading the holidays this year due to the associated costs, with that percentage rising to 60% among parents with children younger than 18. Americans expect to spend an average of $654 on holiday gifts this year, and almost a third (31%) think it’s possible this spending could send them into debt. In fact, 10% of Americans are still paying off last year’s holiday bills.

- Parents fear cutting back on gift spending could be seen as Grinch-like. Half (50%) of parents with kids younger than 18 say they’re worried about disappointing their children if they don’t spend enough on their holiday gifts this year, and 44% of them say they’ve lost sleep worrying about how to pay for them. If given the option, 34% of these parents would skip gift-giving altogether.

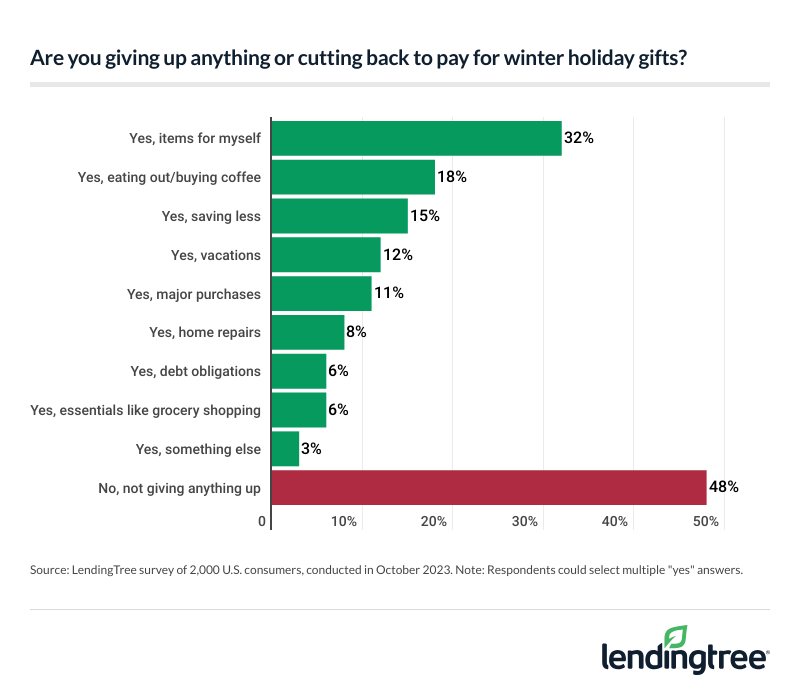

- It’s the most wonderful time of year … to cut back on other expenses. Over half (52%) of Americans are giving up other expenses to pay for the holidays, with the top sacrifices being items for themselves (32%), dining out or buying coffee (18%) and putting less into savings (15%). For some, spending less on gifts is a necessary evil — particularly among the 44% who’ve regretted overspending on past holidays. Among those with regrets, 75% say they’re making changes this year to prevent a repeat.

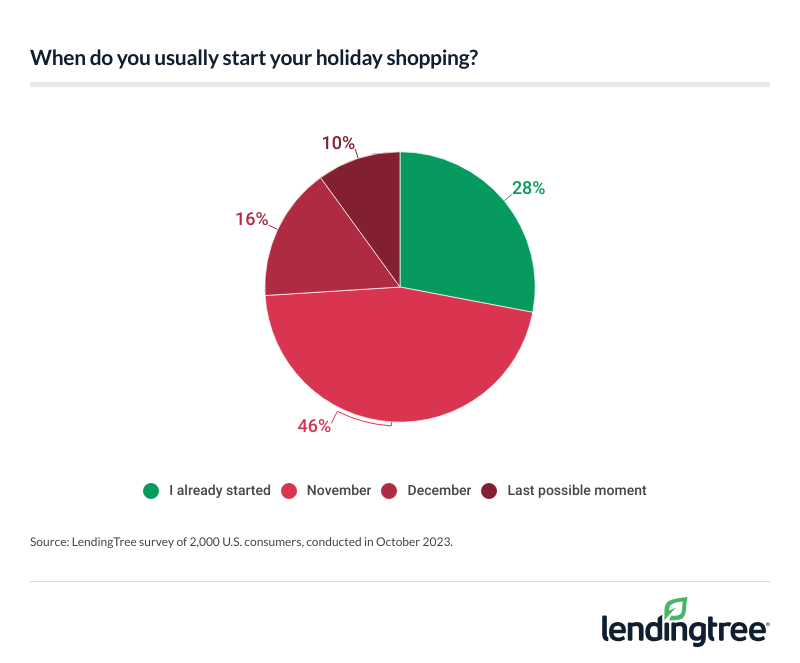

- Santa is checking his list for deals and sales. To space out spending, almost 3 in 10 (28%) Americans had already started their holiday shopping when this survey was conducted in early October. Meanwhile, 52% plan to take advantage of sales like Black Friday and 37% plan to use alternative gift-giving methods like Secret Santa or white elephant.

Nearly half of Americans are dreading the holidays

Inflation means it’s been an unforgiving year for Americans, and tighter budgets may be sapping some holiday joy. Overall, 47% of Americans are dreading the holidays this year due to the associated costs, with Christmas (42%) and Thanksgiving (19%) causing the most stress. Younger consumers are more likely to feel holiday stress than older consumers, leading with Gen Zers ages 18 to 26 (60%). That’s followed by:

- Millennials ages 27 to 42 (59%)

- Gen Xers ages 43 to 58 (43%)

- Baby boomers ages 59 to 77 (27%)

Additionally, parents with children younger than 18 (60%) are significantly more stressed about holiday costs than those without children (44%) and those with children older than 18 (36%). By income group, low earners are more stressed than high earners: While half (50%) of those earning between $35,000 and $49,999 say they’re worried about holiday costs, just 42% of six-figure earners say similarly.

According to LendingTree chief credit analyst Matt Schulz, there are several reasons why the holidays can be a financially stressful time.

Gifts certainly play a role in holiday financial stressors — Americans expect to spend an average of $654 on holiday gifts this year. (Broken down further, consumers plan to spend $125 per recipient, on average.)

Unsurprisingly, six-figure earners plan to spend the most on gifts this year: They plan to spend an average of $1,185 on gifts overall, or $199 per recipient.

How does that compare to last year’s spending? While half (50%) of Americans say they plan to spend the same amount this year, 30% plan to spend less and 20% plan to spend more. By demographic, Gen Zers (33%), six-figure earners (31%) and parents with kids younger than 18 (30%) are the most likely to up their spending this year.

With spending as high as it is, it may not be surprising that almost a third (31%) of Americans think it’s possible this spending could send them into debt. Among the 16% who are sure they’ll go into debt, 44% say it would take more than a month but less than six to pay it off — the most likely response. Following that:

- 24% say it would take more than six months but less than a year

- 23% say they’ll pay it off within a month

- 10% say it would take more than a year

It’s not just the potential debts consumers need to worry about — some are still paying for Santa’s previous visits. In fact, 10% of Americans are still paying off last year’s holiday bills.

The art of gift-giving: What consumers value most when shopping for others

What do consumers prioritize when shopping for gifts? Generally speaking, the thought counts the most — nearly 3 in 5 (58%) say they value the quality of the gifts they’re giving rather than the quantity, while 36% say they’re equally important.

For many, gift-giving is more than an art — it’s a competition. Overall, 30% say they’re competitive with gift-giving and feel like they have to give the best gifts. That’s particularly true among Gen Zers (47%), parents with kids younger than 18 (44%) and millennials (38%). Generally, though, consumers don’t like being told what to give: Just 22% prefer picking a gift from someone’s wish list, while 43% prefer giving a thoughtful surprise and 35% are indifferent.

When it comes down to it, though, consumers may not buy the most practical or well-liked gifts. Only about half (49%) of Americans say they use more than 50% of the gifts they receive, and only 37% use 75% or more of the gifts they get.

Parents worry about disappointing their young kids

Stress is significantly high for parents: Half (50%) of parents with kids younger than 18 say they’re worried about disappointing their children if they don’t spend enough on their holiday gifts this year. That’s particularly true among millennial parents (54%) and fathers (53%).

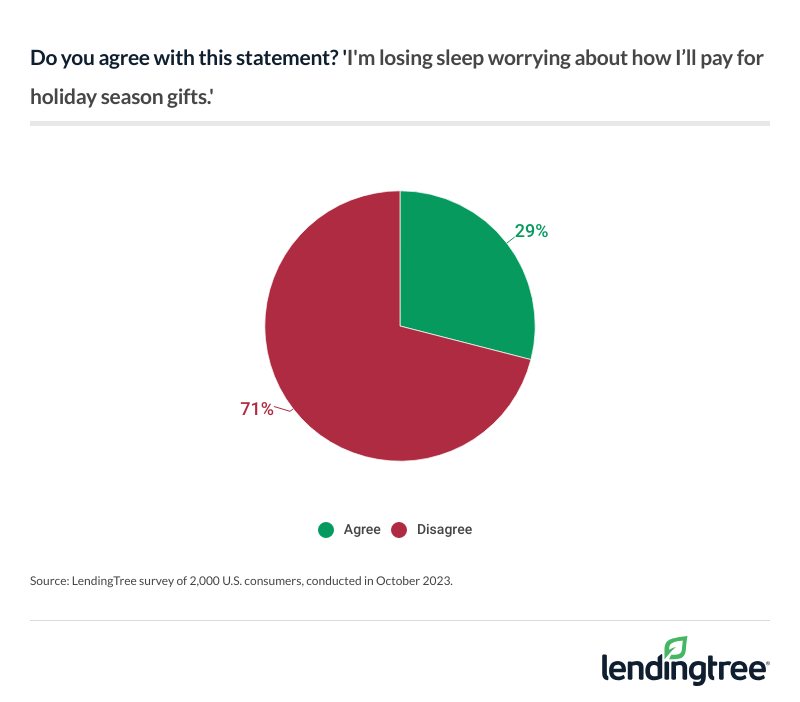

Meanwhile, 44% of parents say they’ve lost sleep worrying about how to pay for gifts in general. That’s significantly higher than the 29% of all consumers who say similarly.

Schulz says those concerns are completely understandable.

Given this stress, it may not be surprising that 34% of these parents would skip gift-giving altogether if given the option.

This comes as 18% of all consumers say family dynamics are the most stressful part of the holidays — the most common response. Not far behind, 17% say choosing the right gifts is the most stressful aspect of the holidays.

52% of consumers are penny-pinching for presents

While holiday costs are stressful, consumers are doing what they can to stretch their holiday budgets. In fact, 52% of Americans are giving up other expenses to pay for the holidays, with 32% cutting back on items for themselves — the most common response. That’s followed by dining out or buying coffee (18%) and putting less into savings (15%).

Schulz says the holidays are always expensive, but lingering inflation means they are even more expensive today. “The unfortunate truth is that the budget that you used for last year’s holiday spending isn’t going to go as far this year, so sacrifices may be necessary unless you’re able to bump up that budget a bit,” he says. “However, it’s disturbing that people are putting less into savings to help pay for the holidays. It’s easy to see why they would do it (and sometimes it’s your only choice), but reducing your savings should be one of your last choices.”

Parents with children younger than 18 (66%) are the most likely to cut back on spending to pay holiday expenses, with 41% cutting back on items for themselves. Meanwhile, 23% are eating out less and 19% are saving less.

Of course, spending less is vital for many consumers — especially those too familiar with debt. In fact, 44% have regretted overspending on past holidays. Of this group, 75% say they’re making changes to avoid overspending this year.

Holly jolly savings: Consumers plan to take advantage of sales and more

Consumers are making their lists — and many have already checked it twice. Across all Americans, 28% had already started their holiday shopping by the time this survey was conducted in early October. That percentage rises to 33% among parents with kids younger than 18. Meanwhile, 46% of Americans say they usually start in November.

Sales are also a great way to save — and Black Friday offers a great opportunity for many. In fact, 52% plan to take advantage of sales like Black Friday, with Gen Zers (68%) and parents with kids younger than 18 (67%) the most likely to do so. Meanwhile, 37% plan to use alternative gift-giving methods like Secret Santa or white elephant. These games and other gifting methods, like making presents rather than buying them, are more common among younger generations, with 61% of Gen Zers and 45% of millennials planning to use them.

On average, Americans are waiting to buy about half (46%) of their gifts until they’re on sale.

When it comes to where they’re shopping, 48% prefer to shop equally online and in store, while 29% prefer to buy all their gifts online. That means 23% prefer to do their gift shopping entirely in person.

Sleighing holiday expenses: Top expert tips

You may wish Santa’s workshop was a finance seminar rather than a toy factory — and while LendingTree experts don’t come with white beards and red coats, Schulz has a few tips for consumers looking to make their holiday budgets merry and bright. He recommends the following:

- Reassess your budget. “Stubborn inflation means that your budget from last year might not be sufficient this year,” he says. “Take the time to look for costs that you can cut — even temporarily — to free up extra money to put toward your holiday budget.”

- Take advantage of credit card rewards. “It may sound counterintuitive, but the right credit card can extend your holiday budget when used wisely,” Schulz says. For example, if you’ve already saved up for the holidays, consider using a new credit card to pay your expenses rather than cash. “Then you can use the cash you’ve saved to pay off the balance without paying interest. If you do that, you can reap the benefits of extra cash back and maybe even significant sign-up bonuses. For example, many card issuers will give you $100 or more back after spending $500 to $1,000 with your new card. That extra $100 can be a real boost to your holiday budget.”

- Get creative. “It’s a sappy old cliche, but it’s true that the best gifts don’t have to be the most expensive ones,” he says. “Anything from a homemade piece of art to a heartfelt poem or letter to offering to do someone’s least favorite yard work for a month can be a meaningful gift.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 77 from Oct. 5 to 10, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.