77% of Daters Say Dating Could Be Easier if They Had More Money, With Some Going on Fewer Dates Due to Inflation

Inflation is impacting almost every aspect of Americans’ lives, and dating is included. According to the latest LendingTree survey, the majority of Americans who are dating say it would be easier if they had more money — and nearly 1 in 5 of them say they’re going on fewer dates because of inflation.

We asked 1,578 U.S. consumers about their dating habits. In addition, we’ll highlight who’s most likely to take on debt to afford their dates.

Finally, we’ll discuss what financial expectations Americans have for their partners — including when they think they should know their partner’s salary.

- Key findings

- Majority of daters think dating would be easier with more money

- Inflation means fewer dates for some

- Who should pay for the first date?

- Millennials are the most likely to take on debt for their dates

- Some Americans don’t want to know how much their beau’s bringing in

- Expert tips for dating amid inflation

- Methodology

Key findings

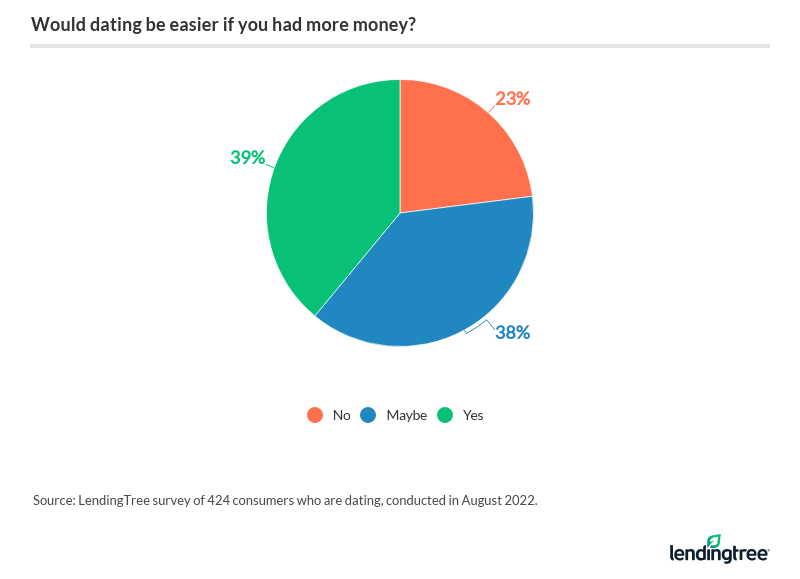

- 77% of daters say dating could be easier if they had more money. This is more common among men (83%) than women (73%). Regardless, 32% say they’d still go on a date even if they couldn’t pay for it, with men (36%) more likely to do so than women (30%).

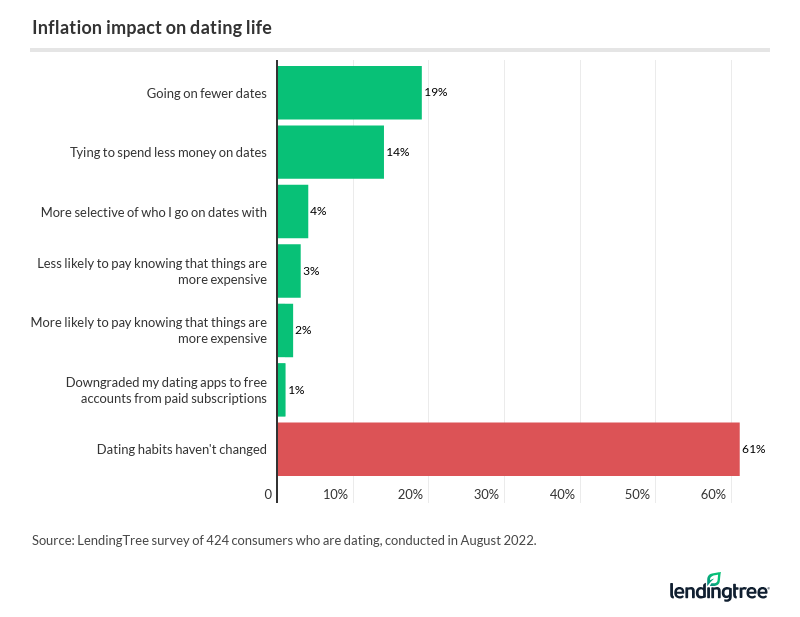

- A lack of money directly impacts some, as nearly 1 in 5 (19%) who are dating say they’re going on fewer dates because of inflation. Another 14% are trying to spend less on dates.

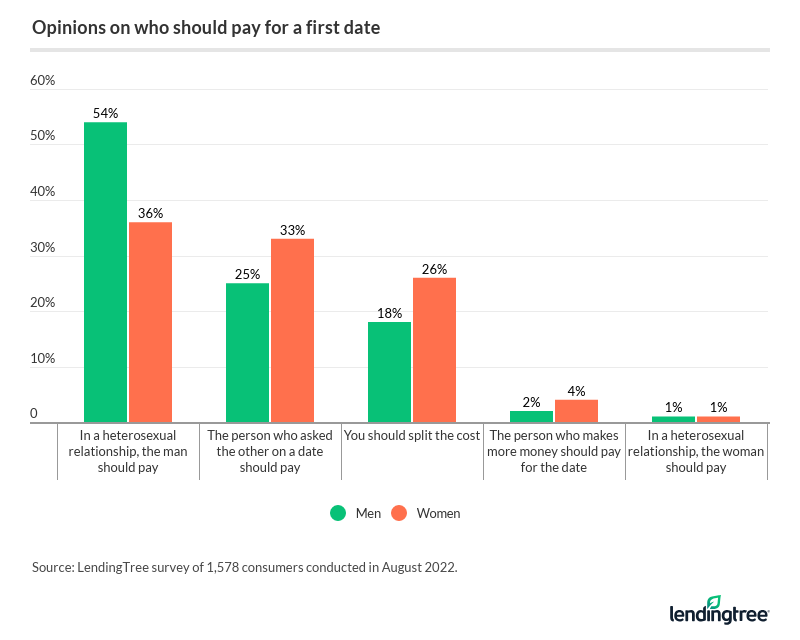

- Regardless of whether they’re actively dating, more than half of men (54%) say the man should pay for a first date. Meanwhile, 26% of women say date costs should be split between the two. Gen Zers are most likely to say the person who asked the other on the first date should pay (34%) or that costs should be split (32%).

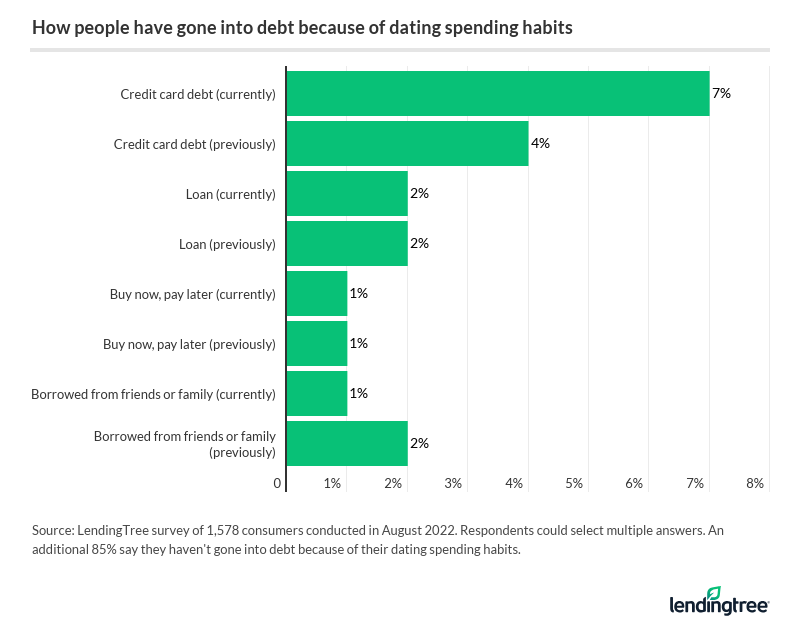

- Millennials (22%) are most likely to incur debt because of their dating spending habits. Additionally, 6% of Americans have had their card declined on a first date, but six-figure earners and those with an annual household income between $75,000 and $99,999 are most likely to snag a second date regardless (6% for both).

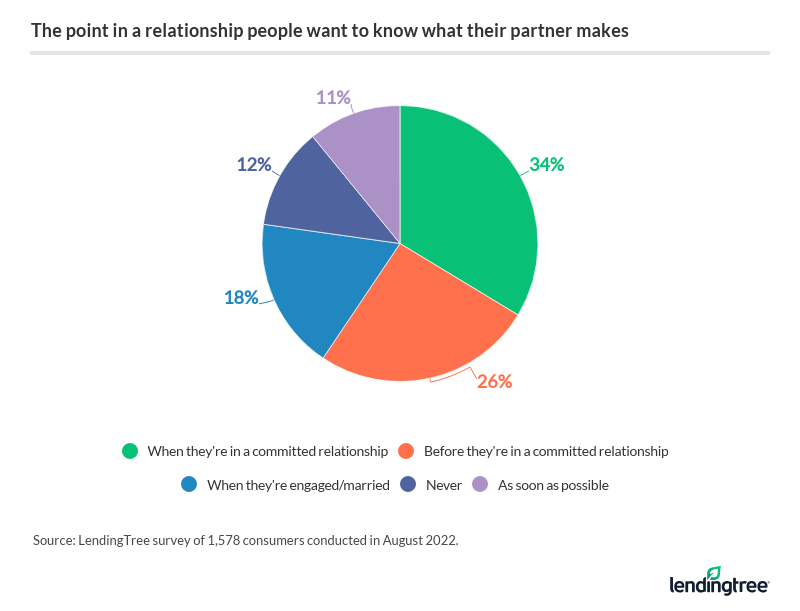

- 12% of Americans never want to know how much their partner makes. Beyond that, 34% of consumers want to know how much their partner makes when they’re in a committed relationship and 26% want to know beforehand.

Majority of daters think dating would be easier with more money

Daters are feeling financial pressure. Of those actively dating, 77% say it could be easier if they had more money, with 39% strongly believing so. Generally, men who are dating (83%) are more likely to say it would be easier with more money than women who are dating (73%).

According to chief credit analyst Matt Schulz, it’s understandable that many people struggle with dating costs — particularly amid inflation.

“Dating has always been expensive,” he says. “Throw rampant inflation into the mix and it can make an already challenging situation even tougher.”

Still, the financial difficulties of dating haven’t deterred some. Of the Americans actively dating, 32% say they’d still go on a date even if they couldn’t afford it, with men (36%) more likely to do so than women (30%).

Inflation means fewer dates for some

While 61% of daters say inflation hasn’t impacted their dating lives, nearly 1 in 5 (19%) say they’re going on fewer dates because of inflation. That makes it the biggest impact inflation has had on dating Americans among the responses we included.

According to Schulz, rising costs are a major challenge dating Americans face today.

“Everything is getting more expensive,” Schulz says. “It’s not just the new clothes, roses, ride-share, fancy dinner, concerts or the after-show coffee — it’s all of it. Even a quiet night at home with a bottle of wine and some takeout is pricier than it used to be. The extra cost of each of these things individually may not be earth-shattering, but added together, they can be a very big deal, especially when you’re living on a budget.”

Meanwhile, some daters say they’re adjusting their budgets. Of those dating, 14% say they’re trying to spend less money on dates because of inflation, with women more likely to say so than men (15% versus 11%).

Dating men more likely to shell out for first dates

Generally, many daters prefer to spend less than three figures on a night out with a new match. When asked what they’d spend on a first date, daters said they’d spend an average of $91 at most. However, men might feel the pressure to impress more than women. While dating women would spend an average of $81 at most, dating men would spend an average of $104 at most.

Still, shelling out might not be necessary. Overall, 85% of daters say they wouldn’t be offended if someone took them on a date that didn’t cost money. But dating women are more likely to say they would be somewhat offended if someone took them on a cost-free date than men (15% versus 9%).

Who should pay for the first date?

Regardless of whether they’re actively dating, 44% of Americans say that in a heterosexual relationship, the man should pay for the first date — making it the most popular response. Men are more likely to have this opinion than women, though. More than half (54%) of men say the guy should pay for a first date, compared with 36% of women.

Following that, 29% of Americans say the person who asked the other on a date should pay, while 22% say costs should be split. Generally, women are more likely to prefer splitting the cost than men — just over a quarter (26%) of women say date costs should be split, compared with 18% of men.

By generation, older Americans are more likely to hold traditional beliefs than younger Americans. While baby boomers ages 57 to 76 are most likely to say the man should pay for the first date (52%), Gen Zers ages 18 to 25 are most likely to say the person who asked the other on the first date should pay (34%) or that costs should be split (32%).

Millennials are the most likely to take on debt for their dates

While most (85%) Americans haven’t gone into debt because of their dating spending habits, 22% of millennials ages 26 to 41 say they have — the most of any age group. Following that, Gen Zers are the second most likely to take on dating-related debt, at 19%. Meanwhile, just 13% of Gen Xers ages 42 to 56 and 4% of baby boomers have had debt from dating.

Schulz attributes millennials’ dating debt to the major milestones most Americans expect to achieve in that age range.

Of Americans who’ve gone into debt because of their dating spending habits, credit card debt was the most likely culprit — 7% say they currently have related debt, while 4% say they had it previously. However, some have relied on loans to cover their dating expenses, too — 2% currently owe on a loan and 2% previously had dating-related debt from a loan. Additionally, 2% have previously borrowed from friends and family, and another 1% currently owe their loved ones.

Some daters have had their card declined, but most went on another date

Not only are credit cards the top cause of dating-related debt among Americans, but some daters have had their cards declined while on a first date, too. But regardless of the potentially awkward situation, most who’ve had this happen were able to snag another date. Of those currently dating, 7% say they’ve had their card declined on a first date, and 6% say it happened and they took their date out again anyway.

Millennials are the most likely to go on a second date after their card is declined. While 10% of them have had their card declined on a first date, 9% had their card declined and went on a second date afterward. By income level, six-figure earners and those with an annual household income between $75,000 and $99,999 are most likely to snag a second date after their card was declined, at 6% for both.

Some Americans don’t want to know how much their beau’s bringing in

Money is often a delicate topic in the early stages of a relationship, particularly regarding income levels. Popping the big financial question (“How much money do you make?”) may seem daunting, but some Americans don’t plan on asking. In fact, 12% of Americans never want to know how much their partner makes.

Of those who want to know how much money their partner brings to the table, most (34%) say they want to know when they’re in a committed relationship. Meanwhile, just over a quarter (26%) want to know beforehand.

Overall, Gen Zers (15%) and men (13%) are most likely to say they don’t want to know how much their partner makes. On the other hand, those with an annual household income of $100,000 or more are the least likely to say the same, at just 5%.

Regardless of whether they want to know what their partner makes, the majority (65%) say their partner’s answer wouldn’t change anything. Meanwhile, 33% want their partner to make the same or more money than they do.

By demographic, here are some other notable findings:

- Men (76%) are more likely to not care what their partner makes than women (55%).

- Women (30%) are more likely to want their partner to make more money than they do compared to men (8%).

- Gen Xers (72%) are the most likely to say they don’t care what their partner makes, while Gen Zers and millennials are the least likely (both 61%).

- 19% of Gen Zers want their partner to make more money than they do — second only to baby boomers (25%).

- People with an annual household income of $100,000 or more are the most likely to say they want their partner to make more money than they do (22%).

Nearly 2 in 10 Americans who are dating or married have no idea what their partner makes

Despite the percentage of Americans saying they want to know what their partner makes, fewer consumers who are dating or married say they know what their partners bring in. Overall, 67% of people who are dating or married say they know how much their partner makes. Another 15% have a vague idea, while 19% have no idea.

While Schulz believes it’s OK to be left in the dark about your date’s financial situation at first, he says financial secrecy could ruin a relationship in the long run.

Broken down by income group, there are some particularly stark differences between high and low earners. Across all income groups, people with an annual household income of less than $35,000 are the least likely to know how much their partner makes, at 43%. On the other hand, people with an annual household income of $100,000 or more are the most likely to know how much their partner makes, at 85%.

Expert tips for dating amid inflation

With inflation driving up the cost of many common date activities, it may feel increasingly hard to shell out for your dates. To help pay for your next night out, Schulz offers the following tips:

- Make a budget. Whether you’re in a committed relationship or dating around, setting aside any leftover cash can help relieve the financial stress of going out on a date. Even a little bit can help in the long run.

- Utilize your available credit card rewards. To save on your next date, Schulz says you should first check if you have any unused rewards from your credit cards. “You may have points to put toward a nice dinner, a concert or even your car ride home,” Schulz says. “The truth is that if you’re not leveraging your current credit card rewards, you’re leaving money on the table, and that’s the last thing anyone should be doing today.”

- If you’re short on points, consider shopping for a new rewards credit card. “The right card, used wisely, can really extend your dating budget,” Schulz says. Beyond the typical rewards offered, Schulz says certain cards can get you access to special events that could make for an amazing date. “Whether it’s presale access for concert tickets or an exclusive dinner cooked by a celebrity chef, there are plenty of unique opportunities out there if you keep your eye out for them,” he says.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 1,578 U.S. consumers ages 18 to 76 from Aug. 12 to 16, 2022. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2022:

- Generation Z: 18 to 25

- Millennial: 26 to 41

- Generation X: 42 to 56

- Baby boomer: 57 to 76

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.