LendingTree Data Shows What Happens to Your Credit Score When You Open or Close a Credit Card

Most cardholders see their credit score fall when they open or close a credit card, but a new LendingTree analysis of several thousand anonymized credit reports shows that this doesn’t have to be the case. Cardholders may have far more control over the direction and magnitude of these moves than they realize.

To answer the question of what happens to your credit score when you open or close an account, analysts reviewed credit reports one month before and one month after a single credit card was opened by 1,785 anonymized LendingTree users, as well as reports of 2,412 users who closed a single card. (The cards were opened or closed in the second quarter of 2021, and those who opened or closed multiple cards during that period weren’t included in the analysis. People who didn’t have a credit score before opening their card were also excluded.) Researchers then compared the VantageScore credit scores for those consumers to see how they changed.

What LendingTree found was that cardholders’ actions mattered a lot. While credit scores only move by a handful of points on average when a card is opened or closed, larger, more extreme moves in either direction do happen — and the magnitude and direction of those moves appear to be significantly influenced by what consumers do with those cards immediately after opening them or shortly before or after closing them.

TABLE OF CONTENTS

Key findings

- Most who open or close a credit card see their credit scores fall in the short term after doing so. 60% of those who opened a card saw their VantageScore credit score fall, while 52% of those who closed a card saw the same.

- The average change after opening or closing a card is small, but that’s not the full picture. Users’ credit scores fell by an average of 6 points in the month after opening a card and increased by an average of 2 points in the month after closing a card. However, a deeper dive shows that many consumers saw moves of as many as 25 points on average.

- The balance on a new card matters a lot. Two-thirds of people who opened a card increased their balance shortly after that. Their average scores fell by 14 points. Among those who reduced their overall balances, scores went up by 11 points.

- It’s not just about balance, though. Utilization is key, too. Roughly half of the folks who opened a card increased their utilization rate, or how much debt they have compared to how much available credit; their average scores fell 19 points. Among the half who decreased their utilization, their average scores climbed by 7 points.

The impact of opening or closing a credit card

It’s one of the most common questions I’ve been asked in more than a decade of talking about credit cards for a living: How does closing or opening a card affect my credit?

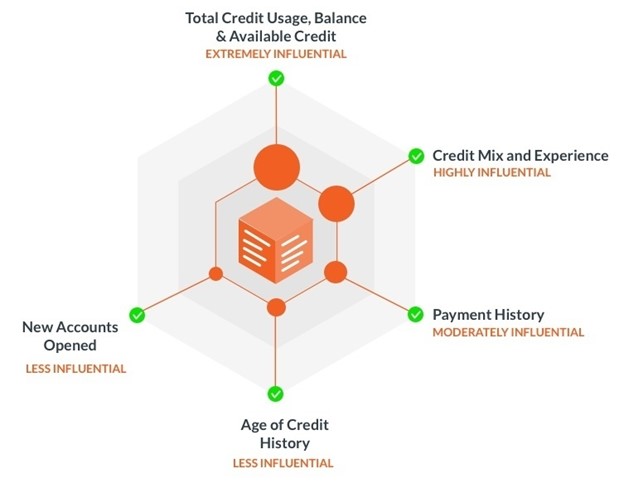

The short answer is that it depends. Whether you’re talking about VantageScores or FICO Scores, credit scores are incredibly complex, nuanced tools with myriad factors helping to determine how they move. These factors include the length of your credit history, the total number of loans you’ve taken out over time and how many different types of credit you’ve had, whether your balances and utilization are trending higher or lower and many, many more.

VantageScore and FICO formulas generally emphasize the same actions and traits, though they weigh them somewhat differently. For example, VantageScore’s formula states that your total credit usage — your balance compared to your available credit — is the most important piece of the formula, while FICO says your payment history is.

Researchers used VantageScores in creating this report.

While it may be impossible to predict the exact impact of a card opening or closure on a specific individual, data can help people better understand what they might expect. That was the goal of this report.

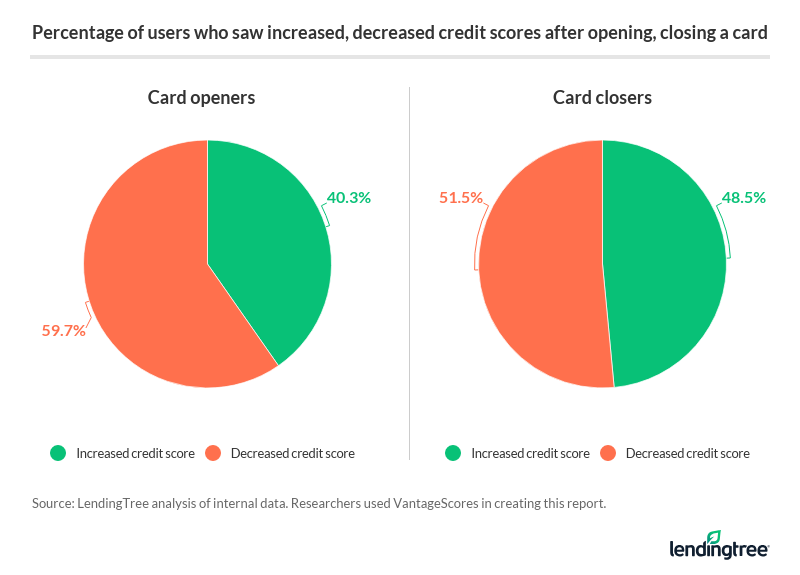

LendingTree researchers found that 60% of those who opened a card saw their VantageScore fall in the month after they opened it, while just 40% saw their scores rise. That split largely disappeared when looking at those who closed a card: 52% of those saw their VantageScore credit score fall and 49% saw it rise.

On average, a user’s VantageScore credit score fell by 6 points in the month after they opened a credit card and increased by 2 points in the month after they closed a credit card.

| What opening or closing a credit card does to your VantageScore (all users) | |

| Average score change, all users | |

| Card openers | Down 6 points |

| Card closers | Up 2 points |

But wait, didn’t we just say that most people see their credit score fall when they close their card? (Yes.) Then, how can the average score go up at the same time?

The answer is that while slightly more people see their scores fall (52% down versus 49% up), the average score increase is significantly larger than the average decrease. As a result, we get this statistical quirk in which most people see decreases but the average movement is up.

The chart below lays this out. A deeper dive into the data indicates that the shifts can be dramatic — in either direction.

| What opening or closing a credit card does to your VantageScore (credit scores) | ||

| Average score change, increased credit score | Average score change, decreased credit score | |

| Card openers | Up 24 points | Down 25 points |

| Card closers | Up 24 points | Down 18 points |

So why the big variation? One likely reason is that we all have very different credit histories, and those differences play a big role in how an individual move impacts a score.

For example, a person with five credit cards, a mortgage, a car loan and a spotless 20-year history of making payments may not see their score change much after closing one card or opening another. That’s because there are already decades worth of other data points being factored into their score. But if someone closes their only credit card or opens a new one for the first time, the shift could end up being more significant because their history is so thin.

Still, these movements aren’t only impacted by your distant past. Our data clearly indicates that what you do just before or after closing or opening that card has a huge impact as well.

Your balance matters a lot

Credit cards don’t get closed or opened in a vacuum — there are as many reasons for those openings and closures as there are cards. Those reasons tend to dictate the actions taken after those cards are opened or closed, and those actions appear to have a huge impact on what our credit scores end up looking like in the months after the openings and closures.

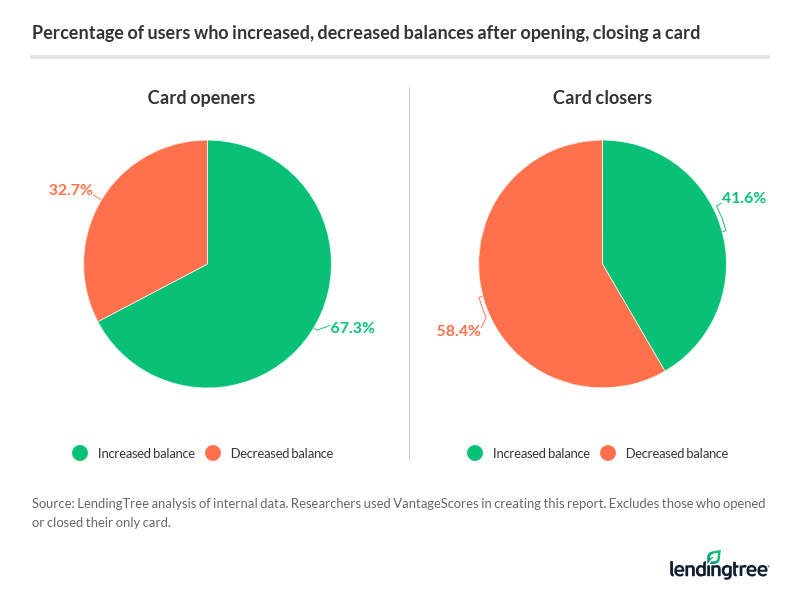

One action that has a major impact, according to the analysis, is raising or lowering your balance. For example, if you opened a credit card and proceeded to increase your overall balance, the data shows your VantageScore fell an average of 14 points in that first month with the card. Conversely, if you lowered your balance after getting that new card, your VantageScore rose an average of 11 points in that first month.

One example of when you might open a new card and lower your balance: a balance transfer. You may sign up for a zero-interest balance transfer credit card, do the transfer and then proceed to pay down your debt without any new spending.

The numbers look similar when closing a card. Increase your balance and your score drops an average of 12 points, but lower your balance and your score jumps an average of 10 points.

| What opening or closing a credit card does to your VantageScore (balances) | ||

| Average score change, increased balance | Average score change, decreased balance | |

| Card openers | Down 14 points | Up 11 points |

| Card closers | Down 12 points | Up 10 points |

Two-thirds of people who open a credit card increase their overall balance within a month of getting that card. Not surprising: People don’t generally get credit cards to stick them in a desk immediately. However, more than 4 in 10 people who close a credit card increase their balance on their other credit cards in that first month, leaving them with fewer cards but a higher overall balance. (It’s important to note that this report didn’t distinguish between voluntary and involuntary closures. It’s possible that some of the folks who increased their balance after a card closure might have had that card closed by their issuer, which has happened frequently since the beginning of the coronavirus pandemic.)

That’s troubling and has major ramifications when it comes to another critical aspect of credit scoring.

Utilization rates matter a lot, too

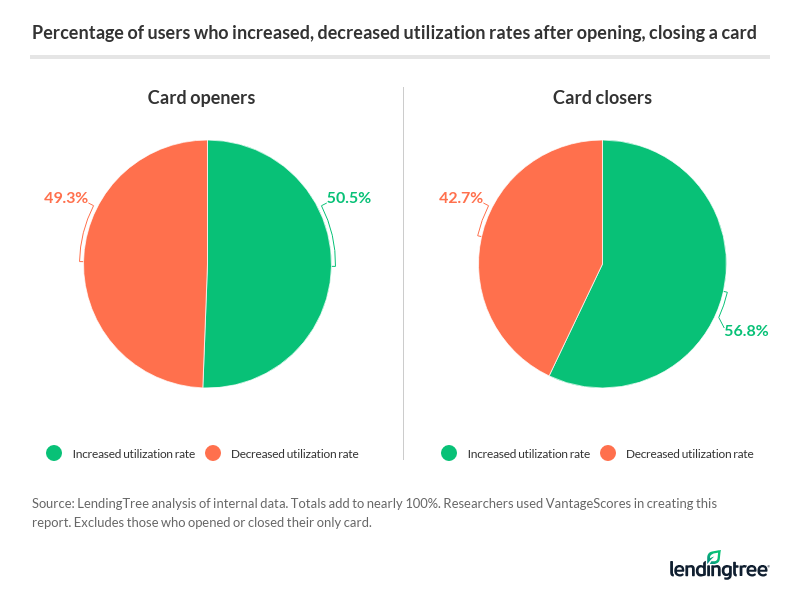

When opening and closing a card, often the biggest immediate impact of the move is on your utilization rate. If you owe $1,000 and have $5,000 in available credit, your utilization rate is 20%, which most any credit expert would tell you is an OK rate (though the goal should also be to keep that rate at zero).

If you open a new card with a $5,000 credit limit, suddenly the equation changes. Your total available credit jumps to $10,000 and your utilization drops to just 10%.

Close a card, and the shift can be more dramatic. If that closed card reduces your total available credit to just $2,000, your utilization rate is a suddenly unacceptably high 50% and your credit score is likely to suffer.

Those are significant changes, just from the act of closing or opening the card. However, the LendingTree data analysis again indicated that what people do afterward can have a major effect on how big those changes are.

Just over half (51%) of those who open a new card increase their utilization rate, resulting in an average 19-point drop in their VantageScore. Among the other 49%, the average score increased by 7 points.

When looking at those who closed cards, 57% saw their utilization rate jump and their average VantageScore fall by 10 points. The remaining 43% lowered their utilization and saw a 14-point jump.

| What opening or closing a credit card does to your VantageScore (utilization rate) | ||

| Average score change, increased utilization rate | Average score change, decreased utilization rate | |

| Card openers | Down 19 points | Up 7 points |

| Card closers | Down 10 points | Up 14 points |

Again, these different scenarios can arise because of people’s actions. For example, if someone gets a new credit card and immediately goes spending, that higher balance can override any benefit of the extra available credit. Or if someone closes a credit card but simultaneously pays off a significant part of their current balance, the positive impact of the debt reduction can make the negative of the reduced available credit less important.

6 things to know about opening or closing a credit card

The decision to open or close a credit card isn’t always an easy one, but there are some things you should keep in mind when considering making such a move.

- Focus on the basics, not the short-term impact: Most everyone’s credit profile is unique — what dramatically altered one person’s credit score might not make much difference to someone else’s. Your best move is to avoid the guesswork and focus on what matters most: paying your bills on time, keeping balances low and not applying for too much credit too often. Do those three things over and over and your credit will be fine.

- Running up a balance on a new card can be self-defeating: If you’re getting a new card to improve your utilization rate and bump up your credit score, a spending spree on that card could undo all the good that you’ve done. The key is to increase the available credit part of the equation while maintaining or even reducing the debt portion. That’s when real improvement can come.

- Don’t open/close cards if you’re planning to apply for a mortgage or auto loan soon: While it’s difficult to predict how much the opening or closure will impact your score, it likely will. That’s why it’s best to avoid making any major moves with your credit card before applying for a new home or auto. Any shifts in your credit score when applying for those big-ticket loans can cost you big money, so be patient and wait to get that new card after you close on that new house.

- Opening too many cards too quickly can be a red flag: Credit-scoring formulas factor in a certain amount of rate-shopping when seeking out cars, homes or student loans. They know that you may not just take the first rate from the first place that offers you a loan. But that’s not the case with credit cards: Applying for too many credit cards in too short a window can reek of desperation and be a real turnoff for lenders. Be cautious.

- Closing may not be your only option: If your card doesn’t have an annual fee, consider keeping the card but using it less. For example, charging a small recurring fee like a monthly streaming subscription can be a good way to keep a card active without running up unnecessary charges. You could also speak with your card issuer about downgrading your annual-fee card to a no-annual-fee version of that card. Issuers are frequently willing to do that, which will allow you to get rid of that annual fee for good without all the concerns that can come with closing a card.

- Keep perspective: Credit is important, but it’s not always the most important thing. If you need that new credit card to make ends meet in a tough time, don’t concern yourself with its impact on your credit. If you’re having difficulty resisting the lure of available credit or paying bills on time and the stress of having a credit card is too much, don’t be afraid to close it. The positive effect on your mental health may override any negative effects to your credit.

Methodology

LendingTree researchers compared credit reports one month before and one month after a single card was opened by 1,785 anonymized LendingTree users, as well as reports of 2,412 users who closed a single card.

People who opened or closed any additional cards in the three months (one month before, month of change, one month after) were excluded. The cards were opened or closed during the second quarter of 2021.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.