How Much Credit Americans Had Available on Cards at the Start of the Coronavirus Crisis

The financial status of millions of American households changed dramatically over the past month due to efforts to try and curb the spread of COVID-19. Millions have been laid off or furloughed as businesses slowed down or shuttered their doors.

LendingTree investigated how much available credit American consumers had on their credit cards in order to cover emergency costs during this unprecedented time by looking at anonymized credit reports of more than 675,000 consumers with active credit cards.

During the Great Recession, some credit card issuers reduced credit limits to protect against losses, and there is reason to be concerned this may happen again, said Matt Schulz, chief credit analyst at LendingTree.

“We probably will end up seeing credit limits getting reduced, but it’s not something that we’re seeing an awful lot of right now … What we saw in the previous financial crisis was that banks shut down a lot of card accounts, they slashed a lot of credit limits, and that’s in part because they wanted to limit their own risk,” Schulz said.

Using credit cards to cover expenses you otherwise cannot afford should be a last resort. That being said, there are consumers who already are carrying big balances – as consumers’ revolving debt levels hit a new high in February 2020 of $1.096 trillion, according to the Federal Reserve.

Key findings

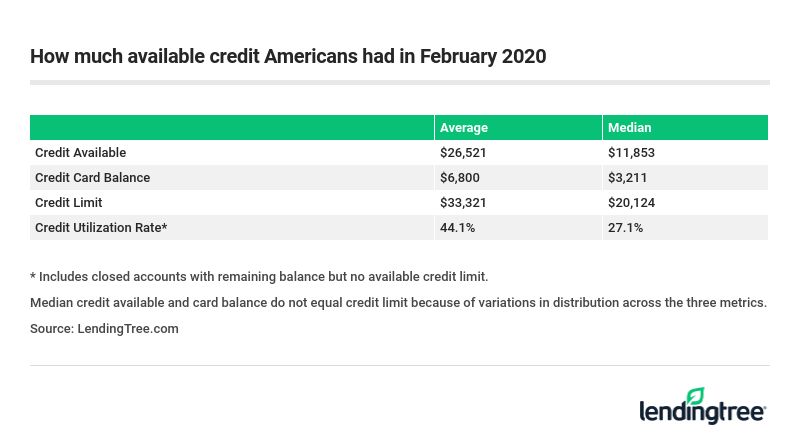

- The median available credit in the US is $11,853, and the average is $26,521.

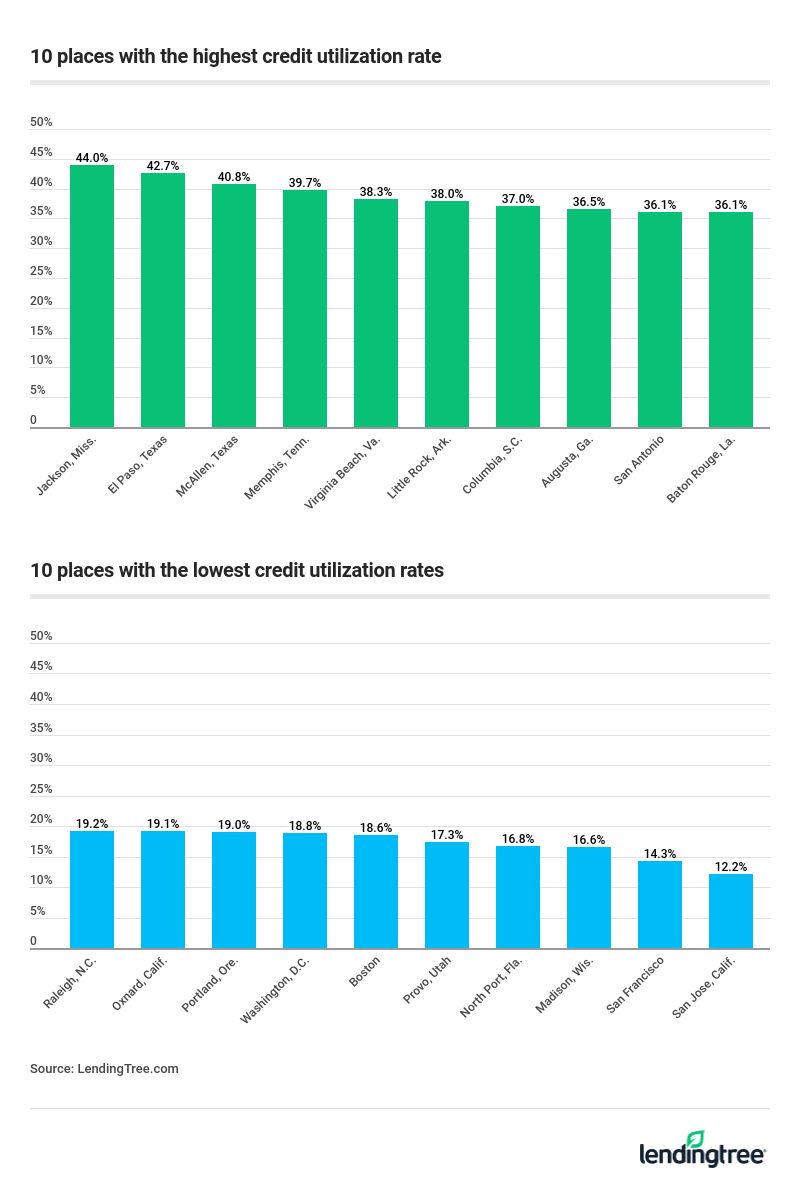

- The median credit utilization rate – the amount of one’s credit limit that’s been charged up – is 27%, which is uncomfortably high. The average is 44%, which suggests that Americans who do have high rates have extremely high rates.

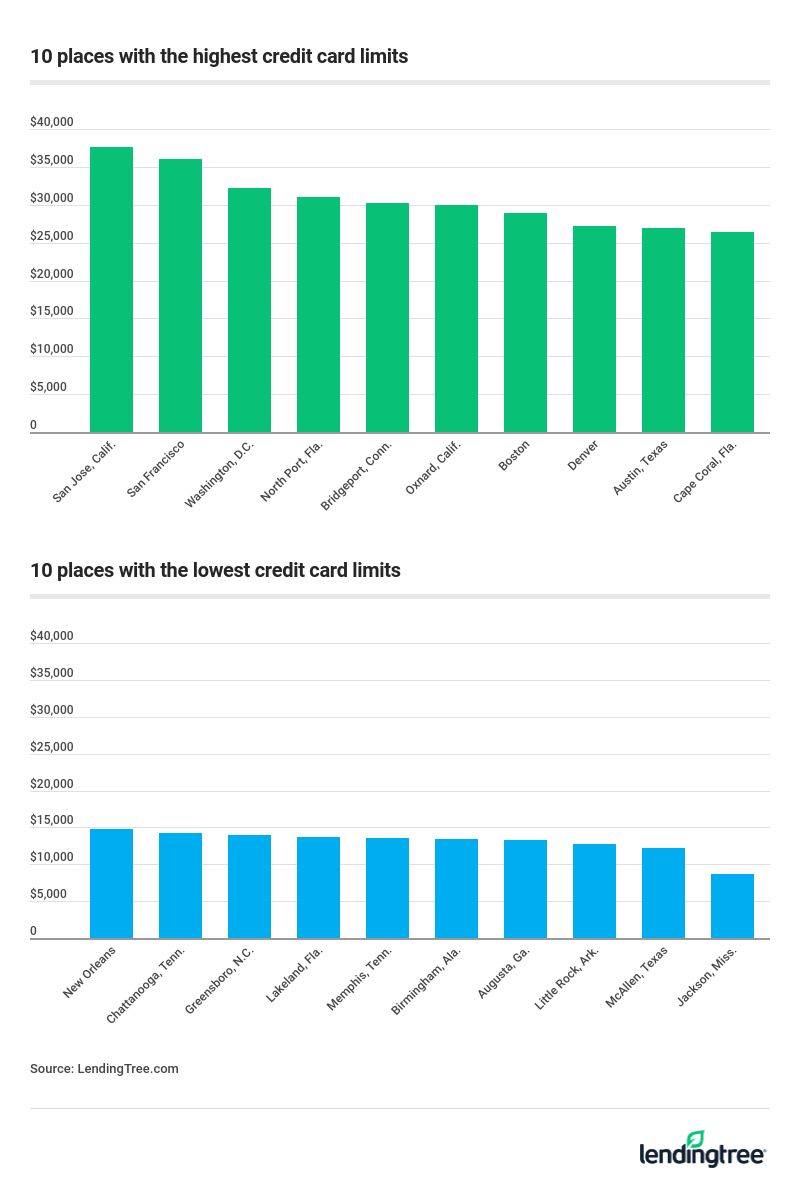

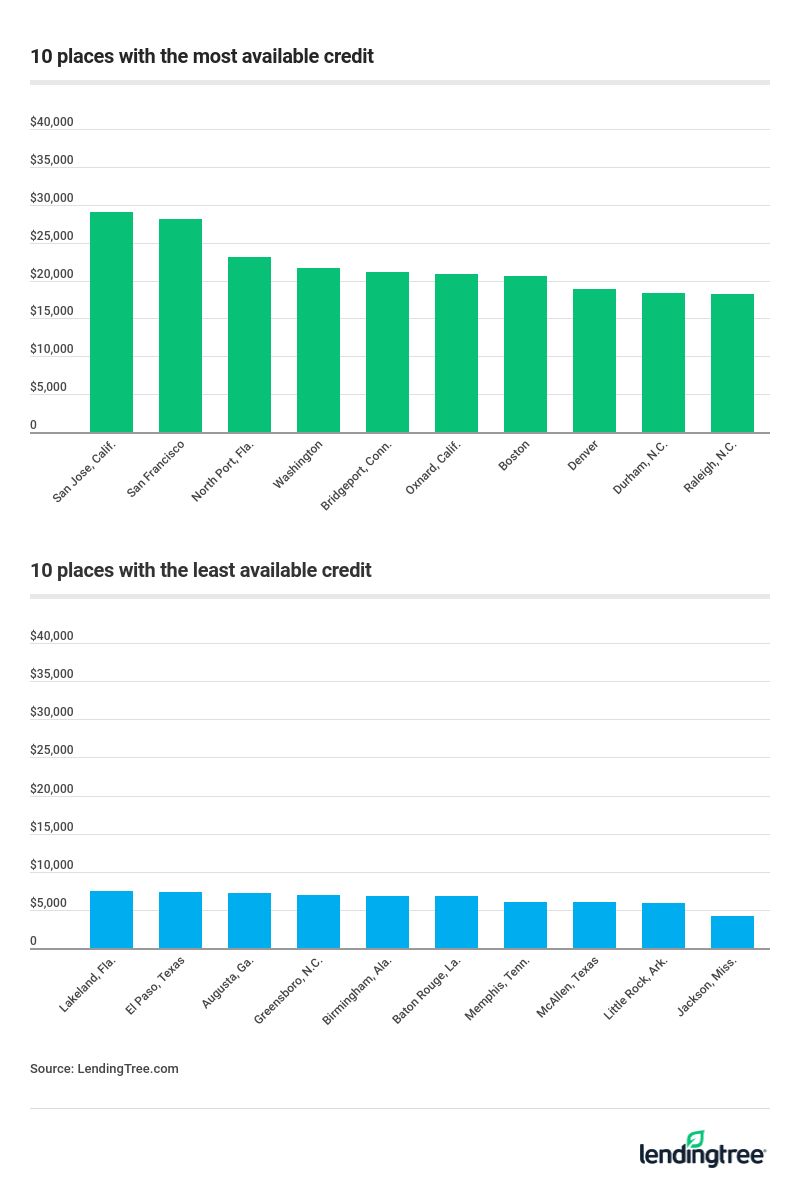

- San Jose cardholders – in the heart of Silicon Valley – have the highest median credit available at $29,022. San Jose cardholders also have the highest median credit limit in the country ($37,600) and the lowest credit utilization rates (12%).

- Cardholders in the San Francisco metro area follow with a median of $28,075 available credit on a median $36,000 credit limit and a 14% utilization rate.

- Residents of Jackson, Miss., have a remaining available median credit amount of $4,211 available on their cards. They have the lowest median total credit limits at $8,695 and the highest median credit utilization rate at 44%. Low credit limits can lead to higher utilization rates, which can lead to lower credit scores and lower credit limits.

- Little Rock, Ark., McAllen, Texas, and Memphis, Tenn., all have median available credit amounts under $6,000 ($5,891, $5,990, and $5,998, respectively).

How a reduced credit limit will impact your credit score

Having a higher credit limit can help you keep your credit utilization low (assuming you don’t regularly max out your credit limit). But if your credit limit is lowered, your credit score could be damaged, depending on how much of a balance you are rolling over every month.

According to Schulz, the second-most important factor in determining your credit score is your utilization rate, which is how much of your available credit you are using.

“So if your credit limit is reduced, it can have a negative impact on your credit score as your available credit shrinks. Unless you do something to immediately reduce the debt you have, that utilization rate is going to go up and that hurts your credit score. And that’s one of the last things anybody needs when they’re struggling financially because of all this,” he said.

Steps to take to protect your credit limit

If you’re worried your lender may lower your credit limit as the economic crisis progresses, there are steps you can take now to decrease the odds of that happening by showing lenders you are a responsible, low-risk borrower.

Don’t miss payments. If you want to stay on your card issuer’s good side, don’t miss or be late on payments. You’ll avoid paying late fees and additional charges this way, too.

Fix credit report errors. Errors can show up on credit reports and could harm your credit score unnecessarily. As lenders review your credit score to confirm your creditworthiness, you’ll want to dispute any potential errors on your credit report.

Avoid maxing out your card. Maxing out your credit limit increases your credit utilization amount. Ideally, you’ll want to keep well below 30%. That means if you have a $1,000 limit, you don’t want to carry a balance of more than $300 per month.

Keep your credit card active. Schulz recommends keeping your credit cards active if you want to keep your limit high. He suggests putting a recurring monthly subscription, such as Netflix or Spotify, on a card you don’t use often to keep it active. (The exception being if the card has an annual fee that is no longer worth paying.) When the card stays active, but with a low balance, and you pay your bill every month, those positive actions will work toward building a stronger credit history.

What to do if your credit limit is slashed

If you find your credit limit is slashed by your card issuer, Schulz suggests calling your card issuer and asking for your credit limit to be restored. If they won’t raise the limit on that particular card, you can attempt to have the limit raised on any other credit card you have from other lenders, or apply for a new credit card.

There is no guarantee your lender will agree to restore your limit, but Schulz said that “it can’t hurt to ask, especially if you’ve been a good long term customer.”

He warned that you may experience long call waiting times, but that you should be patient. “It’s important for people to understand even though it’s no fun being on hold for all that time, it will be worth your time if the bank is willing to give you some help,” he said.

Bottom line

Using your credit cards responsibly is as important now as ever before. Ideally, you’ll continue to keep your credit cards active, have multiple credit cards to cover you in case one limit gets cut and you’ll make your payments on time to keep your credit history healthy.

Methodology

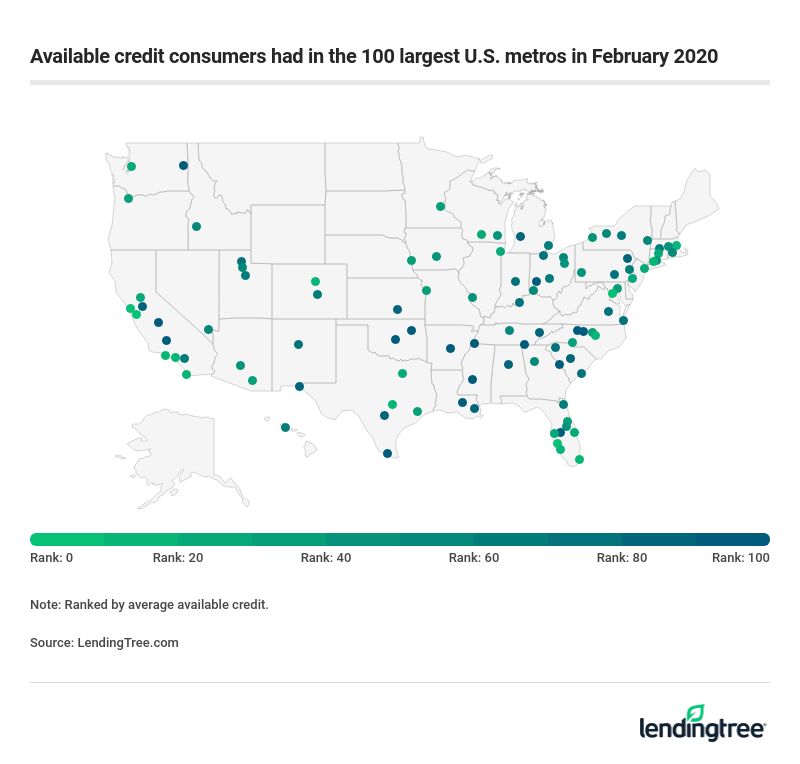

Using a sample of more than 675,000 February 2020 anonymized credit reports from LendingTree users with at least one active credit card, analysts calculated each user’s total credit limit, balance, remaining available balance on active cards, as well as their credit utilization ratio, which is the total of all balances from cards (both open and closed) divided by the sum of credit limits from all cards. These were then aggregated across the 100 largest U.S. metros. Joint accounts have not been specially treated, as we presume that joint holders have equal access to that credit and equal responsibility toward balances. Our 44% average runs a lot higher than other sources, which run closer to 30%. Most (if not all) of those sources are limited to bank cards, whereas we include all card types, open and closed.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.