One great benefit you can get, however, is a 0% introductory APR for the first 15 billing cycles After that, there is a 18.74% to 28.74% Variable APR.

PNC Cash Rewards® Visa® Credit Card Review

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

Our take: The PNC Cash Rewards® Visa® Credit Card has a $0-annual-fee and comes with a solid sign-up bonus and elevated rewards rate on everyday purchases like gas and groceries.

Pros and cons

- $0-annual-fee

- Up to 4% cash back in popular categories

- Competitive cash back rates on grocery, gas and dining purchases

- Up to $800 in cellphone insurance

- Low annual cap on higher rewards rates

- Limited reward redemption options

- Short term on balance transfer intro APR

Is the PNC Cash Rewards® Visa® Credit Card a good card?

Citi is an advertising partner.

With a sign-up bonus, elevated cash back rewards and a $0-annual-fee, the PNC Cash Rewards® Visa® Credit Card checks all the boxes for a good credit card. The caveat, however, is that there is a cap on the higher rate of cash back rewards. Once you reach $8,000 of spending on groceries, dining and gas, you’ll only earn 1% for the remainder of the year.

You can earn 4% on gas station purchases, 3% on dining purchases at restaurants, and 2% on grocery store purchases for the first $8,000 in combined purchases in these categories annually. Earn at least 1% cash back on all other purchases everywhere. For this reason, the card is most ideal for someone who doesn’t spend a lot and can take advantage of the rewards without exceeding the spending cap. Additionally this card is good if you like maximizing your rewards by spending strategically across a variety of credit cards.

Quick facts

- $200 after you make $1,000 or more in purchases during the first three billing cycles

- You’ll earn at least 1% cash back on purchases everywhere, every time. Earn 2% on grocery store purchases, 3% on dining purchases at restaurants and 4% on gas station purchases for the first $8,000 in combined purchases in these categories annually.

- Cash back is automatic – there’s no need to enroll or track rotating categories

- 0% intro APR on balance transfers for the first 15 billing cycles following account opening when the balance is transferred within the first 90 days following account opening. Then a variable APR, currently 18.74% to 28.74% Variable based on credit worthiness.

- No annual fee.

- Recommended Credit

Credit scores ranges may vary. Your individual chance at approval may vary due to factors such as creditors using a particular variation at their discretionExcellent

- Balance transfer intro APR offer

- Cellphone protection of up to $800

- Zero-liability fraud protection

Intro Purchase APR

N/A

Regular Purchase APR

18.74% to 28.74% Variable

Intro BT APR

0% introductory APR for the first 15 billing cycles

Regular BT APR

18.74% to 28.74% Variable

Annual Fee

$0

Cash Advance Fee

Either $10 or 5% of the amount of each cash advance, whichever is greater

Foreign Transaction Fee

3% of each foreign transaction in U.S. dollars

Balance Transfer Fee

$5 or 4% of the amount of each balance transfer, whichever is greater, for the first 90 days following account opening. After that, either $5 or 5% of the amount of each balance transfer, whichever is greater

Earn $200 cash bonus

The PNC Cash Rewards® Visa® Credit Card offers a nice sign-up bonus:

Earn $200 bonus after you make $1,000 or more in purchases during the first three months.

Although the spending threshold will be attainable for many cardholders, the minimum spending requirement for the PNC Cash Rewards® Visa® Credit Card bonus is a bit higher than other cards for the reward earned. For instance, the Wells Fargo Active Cash® Card lets you earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months.

Additionally, many other cards offer slightly more competitive sign-up bonuses that may be worth exploring.

Up to 4% cash back

One of the best features of the PNC Cash Rewards® Visa® Credit Card is the points structure that allows low spenders to maximize their rewards.

With this card, the points structure is only applicable to the first $8,000 in purchases in the gas, dining and grocery categories annually.

So how do PNC cash rewards work? The points breakdown is as follows:

Earn 4% on gas station purchases, 3% on dining purchases at restaurants, and 2% on grocery store purchases for the first $8,000 in combined purchases in these categories annually. Earn at least 1% cash back on all other purchases everywhere.

After hitting the annual $8,000 cap, all purchases, including gas, dining and grocery purchases will accumulate only 1% cash back. That reason is why this card is particularly good for low spenders who will not be at risk of exceeding $8,000 in spending in these categories.

Note that the annual spending cap is based on when you opened the card, not on a calendar year. If you open your card in October, your year does not reset on Jan. 1 of the following year but rather the following October.

As shown in the infographic above, the PNC Cash Rewards® Visa® Credit Card is competitive with other top cash back cards such as the Citi Double Cash® Card and the Chase Freedom Unlimited®. These cards earn an average of $0.02 in rewards per dollar spent based on typical spending behavior.

The one card that does surpass the PNC Cash Rewards® Visa® Credit Card is the Blue Cash Preferred® Card from American Express, which charges an annual fee.

Note that if you are a high spender, the Citi Double Cash® Card and the Chase Freedom Unlimited® may be better choices for you because of the $8,000 spending cap by the PNC Cash Rewards® Visa® Credit Card on its bonus categories. If you spend more than $667 a month on new charges to your credit card, the PNC Cash Rewards® Visa® Credit Card is probably not an ideal choice if you want to maximize cash back earning potential.

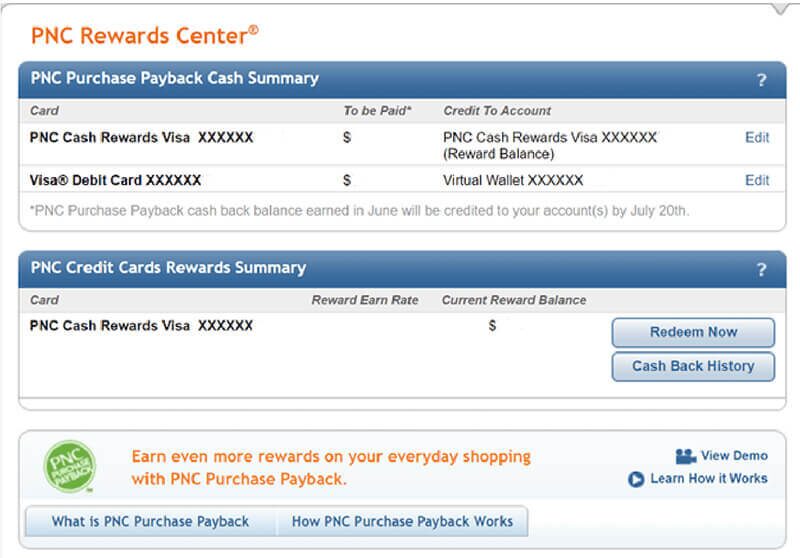

Redeeming cash back

There aren’t many options in regards to receiving or using your cash rewards payments making the process pretty inflexible. The two options for redeeming your credit are:

- Getting your cash back as a statement credit

- Getting your cash back deposited into a qualifying PNC account

PNC Cash Rewards can be redeemed at any point once you have accumulated $25 in your cash rewards account in your PNC rewards center, which is a higher threshold than some competitors, such as Chase bank or Bank of America, which have no minimums on statement credits or account deposits.

On the bright side, once you have accumulated your cash rewards with PNC, they never expire as long as you keep the account active.

Other PNC Cash Rewards® Visa® Credit Card benefits

The PNC Cash Rewards® Visa® Credit Card’s main benefit is its robust points structure that heavily rewards purchases that are common for most customers, such as gas, dining and groceries. The card is sparse on additional benefits, but there are a few worth noting:

With the PNC mobile app you can manage your account on the go from your cellphone. Use the app to pay your monthly bill, manage other PNC bank accounts and track your rewards. You can even use it to lock or unlock your PNC Cash Rewards® Visa® Credit Card if it’s lost, stolen or misplaced.

Another credit card perk you get by using your PNC Cash Rewards® Visa® Credit Card is cellphone protection. When you pay your monthly cellphone bill with your card, you are eligible for up to $800 in cellphone protection if your phone is stolen or damaged. Note that there is a $50 deductible and a maximum of two claims will be paid in each 12-month period.

With a $0-annual-fee, the PNC Cash Rewards® Visa® Credit Card won’t cost you anything to use. Paying your statement balance on time will help you avoid late fees and interest charges that contribute to credit card debt.

How does the PNC Cash Rewards® Visa® Credit Card compare to other cards?

Unsure about the PNC Cash Rewards® Visa® Credit Card? Here’s how the PNC Cash Rewards® Visa® Credit Card stacks up next to some of our favorite cashback cards:

| Credit Cards | Our Ratings | Welcome Offer | Rewards Rate | Annual Fee | |

|---|---|---|---|---|---|

PNC Cash Rewards® Visa® Credit Card*

|

$200 bonus after you make $1,000 or more in purchases during the first three months | Earn 4% on gas station purchases, 3% on dining purchases at restaurants, and 2% on grocery store purchases for the first $8,000 in combined purchases in these categories annually. Earn at least 1% cash back on all other purchases everywhere. | $0 | ||

Bank of America® Customized Cash Rewards credit card

on Bank Of America's secure site |

$200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening | 6% cash back for the first year in the category of your choice, 2% cash back at grocery stores and wholesale clubs, and unlimited 1% cash back on all other purchases. After the first year from account opening, you’ll earn 3% cash back on purchases in your choice category. Earn 6% and 2% cash back on the first $2,500 in combined purchases each quarter in the choice category, and at grocery stores and wholesale clubs, then earn unlimited 1% thereafter. After the 3% first-year bonus offer ends, you will earn 3% and 2% cash back on these purchases up to the quarterly maximum. | $0 |

on Bank Of America's secure site |

|

Citi Double Cash® Card

on Citibank's secure site Rates & Fees |

Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back. | Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, earn 5% total cash back on hotel, car rentals and attractions booked with Citi Travel. | $0 |

on Citibank's secure site Rates & Fees |

|

Chase Freedom Flex®*

|

Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening. | 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Enjoy new 5% categories each quarter! Plus, earn 5% cash back on travel purchased through Chase Travel℠, 3% on dining and drugstores, and 1% on all other purchases. | $0 |

PNC Cash Rewards® Visa® Credit Card vs. Bank of America® Customized Cash Rewards credit card

The Bank of America® Customized Cash Rewards credit card credit card is great for people who want flexibility in their rewards.

This card allows you to earn a higher rate of cash back on groceries and a category of your choice, but only on $2,500 in spending per quarter. After that you will earn 1%.

Unlike the PNC Cash Rewards® Visa® Credit Card, there is no limit to redeeming rewards, but your options for redemption are not diverse: You are limited to statement credits or transfers to eligible Bank of America and Merrill accounts.

PNC Cash Rewards® Visa® Credit Card vs. Citi Double Cash® Card

The Citi Double Cash® Card is a great choice for people who value simplicity and who are less concerned with optimizing their rewards.

Determining whether this card will get you more cash back than the PNC Cash Rewards® Visa® Credit Card requires some math because of the tiered structure of PNC’s rewards.

PNC Cash Rewards® Visa® Credit Card vs. Chase Freedom Flex®

The Chase Freedom Flex® is one of the most valuable cashback cards. If used in the most optimal way, the card has the potential to earn even better cash back rewards than the PNC Cash Rewards® Visa® Credit Card.

Unfortunately, the Chase Freedom Flex® does not offer consistent bonuses for grocery purchases, making the PNC Cash Rewards® Visa® Credit Card a potentially better card for grocery shopping. However, the Chase Freedom Flex® card’s 5% bonus on rotating categories can be extremely rewarding for cardholders who can manage to hit the $1,500 spending limit each quarter.

Also note that the Chase Freedom Flex® is a Chase Ultimate Rewards® credit card. This means that rewards earned with the card can be transferred to premium travel Ultimate Rewards credit cards like the Chase Sapphire Reserve® or the Chase Sapphire Preferred® Card, and redeemed for travel with a 25% to 50% bonus, or transfer to one of Chase’s travel partners for even better deals on travel.

Is the PNC Cash Rewards® Visa® Credit Card right for you?

The PNC Cash Rewards® Visa® Credit Card is great for low spenders who will not be putting more than $8,000 or people who want to maximize the cash rewards by reserving this card for gas, dining and grocery purchases. Once the cap is hit, the earning rate at 1% is less competitive than many other cash rewards cards.

If you are someone who will easily exceed the $8,000 cap, then it may be best to have another cash back credit card with no rewards cap or switch to another card when you reach your yearly cap. Ultimately, if looking for an overall solid cash rewards card, maybe something like the Citi Double Cash® Card might be a better fit.

Frequently asked questions

By going to your rewards center in the PNC app or online and selecting redeem. Can only be done when you have met the redemption minimum of $25.

Your cash back never expires as long as your account is open.

Yes, the foreign transaction fees are 3% of each foreign transaction in U.S. dollars.

No, there is a $0-annual-fee on the card.

The minimum balance to redeem rewards is $25.

After filling out your application, you will receive a response immediately regarding your approval. If approved, your card will arrive in seven to 10 business days.

The information related to the Chase Freedom Flex® and Capital One Savor Cash Rewards Credit Card has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

To see rates & fees for American Express cards mentioned on this page, visit the links provided below:

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

The information related to the PNC Cash Rewards® Visa® Credit Card, Wells Fargo Active Cash® Card, Chase Freedom Flex® and Chase Sapphire Reserve® has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.