Travel Insurance Benefits for the Chase Sapphire Reserve® Card

Your flights are booked, your hotels reserved and you’re ready to go. But have you purchased travel insurance?

If you have the Chase Sapphire Reserve®, you might not need to. Apart from offering lucrative rewards and VIP perks like airport lounge access, this premium travel credit card also offers some of the most generous benefits when it comes to credit card travel insurance. Here’s what you need to know about the Chase Sapphire Reserve® travel insurance, what it covers and whether or not it’s enough for your next trip.

What does Chase Sapphire Reserve® travel insurance cover?

The Chase Sapphire Reserve® travel insurance offers a long list of protections that provide generous coverage for a variety of unforeseen circumstances. These include more common benefits like trip cancellation/interruption insurance, rental car insurance and delayed baggage reimbursement as well as protections like emergency medical and dental insurance and travel accident insurance. Here’s what Chase Sapphire Reserve® travel insurance does and doesn’t cover.

Chase Sapphire Reserve® travel insurance benefits

| Benefit | Coverage amount |

|---|---|

| Rental car insurance | Up to $75,000 |

| Trip cancellation/interruption | Up to $10,000 per person or $20,000 per trip |

| Trip delay reimbursement | Up to $500 per ticket |

| Lost luggage reimbursement | Up to $3,000 per passenger |

| Delayed baggage reimbursement | Up to $100 per day for 5 days |

| Roadside assistance | Up to $50 per incident four times per year |

| Emergency evacuation and transportation | Up to $100,000 |

| Emergency medical and dental | Up to $2,500 |

| Travel accident insurance | Up to $1,000,000 for Common Carrier Travel Accident Insurance or $100,000 for 24 Hour Travel Accident Insurance |

| Travel and emergency assistance | N/A |

-

Rental car insurance

Quick takeaway Coverage amounts Up to $75,000 in primary coverage What it covers Theft and collision damage Important exclusions Antique cars, large vans, cars with an open cargo bed, trucks, motorcycle, mopeds, motorbikes, limousines, recreational vehicles, personal belongings and injury The Chase Sapphire Reserve® offers some of the best credit card rental car insurance. Valid in both the U.S. and abroad, it’s primary rental car insurance, which means you can use it without having to file a claim with your personal insurance. The coverage amount of $75,000 should easily cover any potential damage to most rental cars. You’ll have to decline the rental agency’s collision coverage and put the full cost of the rental car on your Chase Sapphire Reserve®, and your rental period can’t exceed 31 days.

-

Trip cancellation/interruption

Quick takeaway Coverage amounts Up to $10,000 per person or $20,000 per trip What it covers Nonrefundable, prepaid expenses for a trip that is cancelled or interrupted due to sickness, accidental injury, loss of life, severe weather, terrorist actions, hijacking, jury duty or court subpoena that can't be postponed or waived Important exclusions Preexisting conditions, travel that goes against the advice of a physician, trips exceeding 60 days, financial insolvency of travel company, a declared or undeclared war The Chase Sapphire Reserve®‘s trip cancellation insurance comes with fairly standard exclusions and coverage amounts that are more generous than what most credit cards offer, including other premium cards within the same class. The trip cancellation policy will reimburse any nonrefundable trip expenses that were prepaid with your Chase Sapphire Reserve®, such as hotels, tours and airfare, as long as they were cancelled for a covered reason. There is a $40,000 annual maximum on the benefit, and it only kicks in if you haven’t already been reimbursed by the travel company or any other travel insurance you hold.

-

Trip delay reimbursement

Quick takeaway Coverage amounts Up to $500 per ticket What it covers Reasonable expenses, such as food, personal items and accommodations, incurred due to a trip delay that is either overnight or more than six hours Important exclusions Delays you knew about before leaving for your trip and prepaid expenses If you’re ever stuck at an airport for hours on end or in a foreign city overnight due to flight delays, this benefit could come in handy. The Chase Sapphire Reserve® travel insurance includes trip delay reimbursement, which will cover any reasonable expenses you incur in the meantime as long as you aren’t already being reimbursed by your airline or other common carrier. The amount — $500 per ticket — should be more than enough to cover a typical delay.

-

Lost luggage reimbursement

Quick takeaway Coverage amounts Up to $3,000 per passenger What it covers Checked or carry-on luggage that's damaged or lost by an airline and personal items within the luggage Important exclusions Documents, money, securities, tickets, checks and furs; loss due to war; coverage of jewelry, watches and electronics is limited to $500 per person per trip If an airline or other common carrier damages or loses your luggage on a trip you’ve paid for with your Chase Sapphire Reserve®, you can use your Chase Sapphire Reserve® travel insurance to claim up to $3,000 in reimbursement for the luggage and covered personal property within the luggage. This benefit only kicks in after you’ve used up any other coverage like the airline’s reimbursement policy and outside travel insurance. If the airline you’re traveling on refuses to pay out, or only pays out a small portion of the value of lost or damaged luggage, this benefit can really come in handy to cover the difference. Both the cardholder and immediate family members are covered by this benefit. The Chase Sapphire Reserve®‘s coverage amount is in line with competing cards that offer this benefit, although many credit cards don’t offer luggage reimbursement at all.

-

Delayed baggage reimbursement

Quick takeaway Coverage amounts Up to $100 per day for up to five days What it covers Essential items such as toiletries, clothes and one cell phone charger Important exclusions Contacts, glasses, hearing aids, tickets, valuable documents, money, securities and checks Similar to the trip delay reimbursement, the Chase Sapphire Reserve® travel insurance includes a delayed baggage benefit comes into play if a trip you purchased with your credit card is delayed for six hours or longer. This policy covers the cardholder, the cardholder’s spouse or domestic partner and immediate family members. You can use this benefit to purchase any emergency essential items you need during your delay, and the coverage amount lasts for up to five days, while some competing cards only offer up to three days of coverage. If you have your own travel insurance, or if the transportation provider offers reimbursement, you’ll have to file a claim with them first.

-

Roadside assistance

Quick takeaway Coverage amounts Up to $50 per incident four times per year What it covers Breakdown services required while on the road, including battery charging, flat tire service, fuel delivery, towing and lockout assistance Important exclusions Areas that aren't commonly traveled such as off-road areas, commercial vehicles, campers, vehicles-in-tow and trailers with over one-ton capacity The Chase Sapphire Reserve® offers roadside assistance for cardholders driving a vehicle they own or lease in the U.S. or Canada. As long as the roadside assistance service you need is covered, this will provide up to $50 in coverage for each service event as many as four times per year. You’ll have to call the Chase Sapphire Reserve®‘s roadside assistance line — which is available 24 hours per day, 365 days per year — at 1-866-860-7978.

-

Emergency evacuation and transportation

Quick takeaway Coverage amounts Up to $100,000 What it covers Transportation (including land ambulances, air ambulances and motor vehicles), medical services and medical supplies that are necessary for an emergency evacuation Important exclusions Travel for medical treatment, non-emergencies, experimental care If you’re severely injured or fall ill while traveling and need to be transported to a medical facility, you might require emergency evacuation services. Emergency evacuation is extremely costly — it can easily reach $25,000, or more if you’re being transported long distances — so it’s important to have some type of coverage. The Chase Sapphire Reserve® travel insurance offers some of the best emergency evacuation coverage of any credit card, with a coverage amount of up to $100,000. You’ll only be covered if you paid for the trip with your credit card and it involves common carrier transportation, such as airline, bus, train or cruise ship travel. You’ll need to make a claim on any insurance you hold that covers emergency evacuation first, and a Chase Benefit Administrator must arrange the emergency evacuation in order for it to be covered by your Chase Sapphire Reserve®.

-

Emergency medical and dental

Quick takeaway Coverage amounts Up to $2,500 What it covers Necessary medical or dental services, hospital charges, ambulance services, medication and therapeutic services Important exclusions Non-emergencies and care that's not medically necessary, care not administered by a qualified medical professional, experimental care and countries that are deemed unsafe for travel by the U.S. government While the Chase Sapphire Reserve®‘s medical and dental coverage of up to $2,500 (with a $50 deductible) isn’t enough to cover many potential medical emergencies, it’s still more generous than what you’ll likely get elsewhere. Most credit cards, including premium cards that compete with the Chase Sapphire Reserve®, don’t offer this benefit at all. You’ll also get $75 per day for a hotel for up to five days if a physician deems it necessary for you to stay and recover. In order to qualify for this benefit, you need to be traveling at least 100 miles from home for between five and 60 days.

-

Travel accident insurance

Quick takeaway Coverage amounts Up to $1,000,000 for Common Carrier Travel Accident Insurance or $100,000 for 24 Hour Travel Accident Insurance What it covers Covered loss that occurs while traveling with an airline, bus, train, or cruise ship company for Common Carrier Travel Accident Insurance or loss that occurs during a trip that doesn't exceed 30 days Important exclusions Emotional trauma, illness, disease, infection, pregnancy, illegal activity, certain high-risk sports or recreational activities, war, travel on aircrafts that aren't registered or certified by the government Travel accident insurance provides coverage for accidental death, dismemberment, or a combination of loss of speech, sight or hearing. There are two different types offered by the Chase Sapphire Reserve® travel insurance:

Common Carrier Travel Accident Insurance, which covers you during transport with a common carrier and comes with a very high coverage limit

24 Hour Travel Accident Insurance, which covers you for the duration of your trip and comes with a lower but still generous coverage limit.

You have to have purchased the trip using your Chase Sapphire Reserve® to take advantage of this benefit, and you can’t receive a payout from both types of travel accident insurance for the same event.

-

Travel and emergency assistance

Quick takeaway Coverage amounts Not applicable What it covers Assistance and referrals via phone for emergency services while traveling for the cardholder, cardholder's spouse or domestic partner and dependent children below age 22 Important exclusions The cost of emergency services In addition to the Chase Sapphire Reserve® travel insurance, this card also comes with a travel and emergency assistance benefit. This isn’t a form of insurance but rather an emergency assistance phone line available to cardholders at all times during their travels. As a cardholder, you can call this toll-free number if you ever need assistance such as a medical referral, a legal referral, emergency transportation assistance, emergency ticket replacement, help locating lost luggage, emergency message service, emergency translation, prescription assistance, valuable document delivery or pre-trip assistance.

This benefit doesn’t cover any costs you incur — for example, you can use it to find a medical facility if you fall ill while traveling, but it won’t cover the cost of your treatment. That being said, it’s a very useful service to have on hand whether you find yourself in an emergency or simply want assistance gathering useful information for a trip you’ve planned.

How to file a travel insurance claim with your Chase Sapphire Reserve®

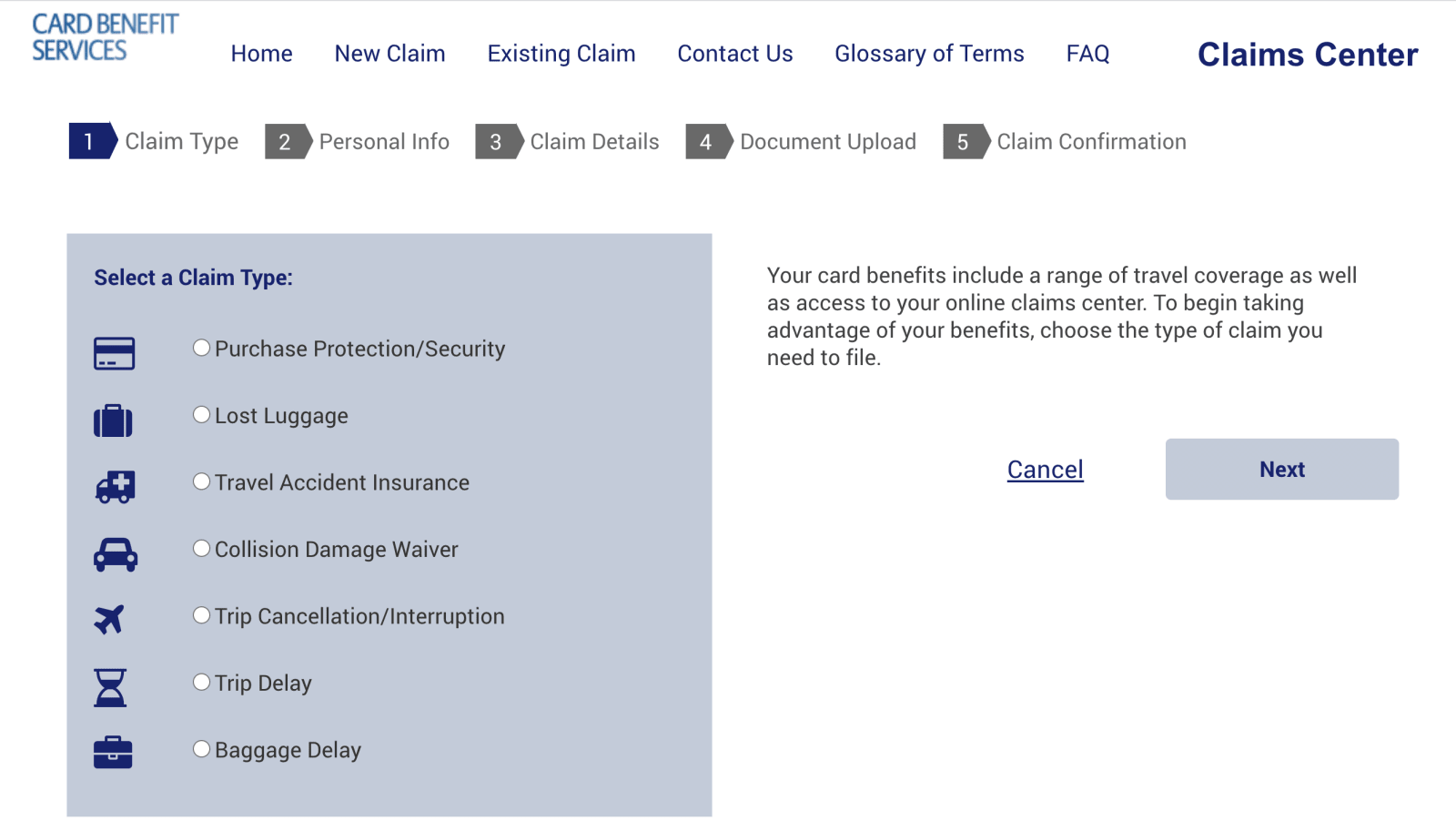

1. Start a new claim with Chase's claims center

You can file a Chase Sapphire Reserve® travel insurance claim at eclaimsline.com by selecting “New Claim” and inputting your card information. After that, you’ll be asked to select a claim type to begin filling out your claims form. The exception is Chase’s emergency evacuation and transportation insurance. In order to use this benefit, you’ll have to first contact your benefit administrator who will preapprove and arrange the evacuation. The benefit administrator will then send you a claims form.

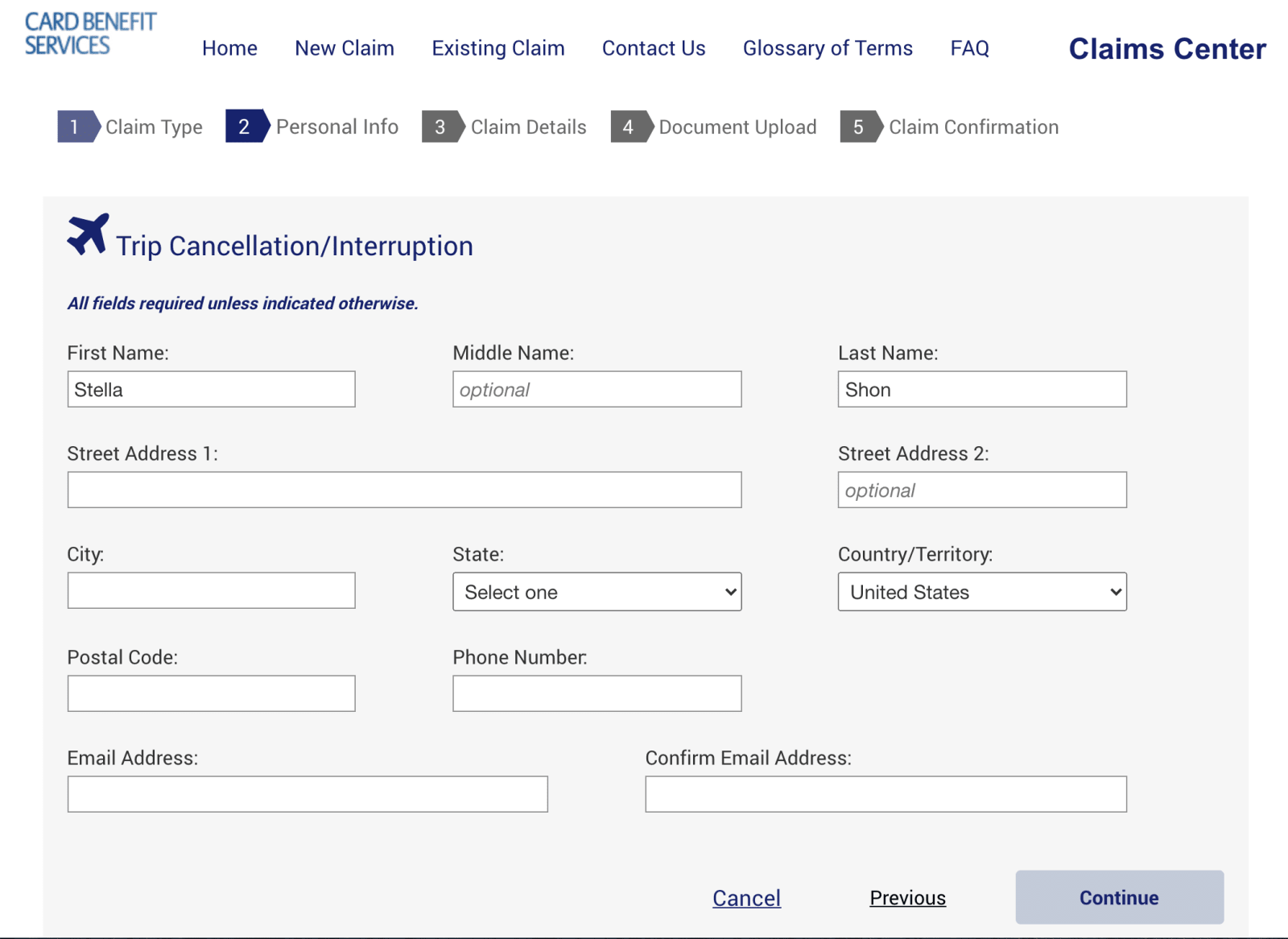

2. Enter your personal information and claim details

The claims form will ask for basic personal and contact information as well as information about your trip and/or incident. Once you’ve filled in both forms you’ll be taken to the “Document Upload” page.

3. Gather and upload the required documents

You’ll likely need a few documents to file your Chase Sapphire Reserve® travel insurance claim, although the exact documents you need will vary depending on the benefit you’re filing for.

Here’s what you’ll need for different types of insurance claims:

- Copy of the accident report form

- Copy of the initial and final auto rental agreements (front and back)

- Copy of the repair estimate and itemized repair bill

- Two photographs of the damaged vehicle, if available

- Police report, if obtainable

- Copy of the demand letter indicating the costs you are responsible for and any amounts that have been paid toward the claim

- Completed and signed claim form

- Travel itinerary

- Written confirmation of the baggage delay from the common carrier or cruise line

- Credit card account statement (showing the last four digits of the account number) reflecting the charge for the common carrier or cruise line fare

- Copy of the settlement or denial from the common carrier or cruise line

- Copies of receipts for the purchase of essential items over $25

- Any other documentation deemed necessary by the benefit administrator to substantiate the claim

- Completed and signed claim form

- Credit card statement (showing the last four digits of the account number) reflecting the charge for the common carrier ticket (or the travel itinerary reflecting the last four digits of your account number as payment method)

- If more than one payment method was USD, documentation linking a portion of the purchase back to the covered account

- Statement from your insurance carrier (and/or your employer or your employer’s insurance carrier) showing any amounts they paid toward the costs claimed

- If you have no other applicable insurance or reimbursement, please provide a statement to that effect

- Copy of medical bills

- Copy of transportation, medical services and medical supply bills incurred in connection with the emergency evacuation

- Copy of physician’s statement describing the need for emergency evacuation

- Copy of the original unused return tickets or statement indicating the value of the original unused return tickets

- Completed and signed claim form

- Credit card statement (showing the last four digits of the account number) reflecting the charge for the common carrier ticket (unless the travel itinerary reflects the last four digits of your account number as payment method)

- If more than one payment method was used, documentation as to additional currency, voucher, rewards programs or other payment method used

- Statement from your insurance carrier (and/or your employer or your employer’s insurance carrier) showing any amounts they paid toward the costs claimed

- Copy of any other valid and collectible insurance or reimbursement available to you, if applicable

- If you have no other applicable insurance or reimbursement, provide a statement to that effect

- Receipts for eligible medical/dental expenses

- Any other documentation deemed necessary by the benefit administrator to substantiate claim

- Completed and signed claim form

- Chase credit card statement (showing the last four digits of the account number) demonstrating that the purchase was made on your account

- If more than one payment method was used, please provide documentation as to any additional currency, voucher, points, or any other payment method utilized

- Copy of the itemized sales receipt

- Copy of the original manufacturer’s written U.S. warranty, and any other applicable warranty

- Description of the item, its serial number, and any other documentation deemed necessary to substantiate your claim (this includes bills, and, if necessary, a copy of the maintenance record and receipts

- Original repair estimate or repair bill, indicating cause of failure

- Any other documentation deemed necessary by the benefit administrator to substantiate the claim

- Completed and signed claim form

- Travel itinerary

- Credit card account statement (showing the last four digits of the account number) reflecting the charge for the common carrier or cruise line fare

- Written confirmation that the claim was filed with the common carrier or cruise line

- Copy of the settlement or denial from the common carrier or cruise line

- Copies of receipts for the purchase of replacement items over $25

- Copies of original receipts

- Any other documentation deemed necessary by the benefit administrator to substantiate the claim

- Completed and signed claim form

- Credit card account statement (showing the last four digits of the account number) demonstrating that the purchase was made on your account

- If more than one payment method was used, provide documentation as to the additional currency, voucher, points or any other payment method utilized

- Copy of the itemized store receipt demonstrating that the purchase was made on your account

- Copy of the documentation of any other settlement of the loss (if applicable)

- Copy of the police report (made within 48 hours of the occurrence in the case of theft), fire report or incident report to substantiate the loss; if the loss was not reported, provide a replacement receipt or other sufficient proof of loss deemed eligible solely by your benefits administrator (if applicable)

- Any other documentation deemed necessary by the benefits administrator to substantiate the claim

- Signed and completed claim form

- Your original itemized sales receipt for your purchase or original packing slip for mail order purchases

- Credit card account statement (showing the last four digits of the account number) demonstrating that the purchase was made on your account

- Completed and signed claim form

- Travel itinerary

- Police report confirming the claimed accident

- Credit card account statement (showing the last four digits of the account number) reflecting the charge for the common carrier or scheduled airline fare

- Copy of the death certificate

- Completed and signed claim form

- Travel itinerary

- Documentation confirming the reason for trip cancellation or interruption (e.g., medical documents, death certificate, etc.)

- Credit card account statement (showing the last four digits of the account number) reflecting the charge for prepaid travel arrangements (for trip cancellation), and proof of expenses incurred (for trip interruption)

- Copies of the cancellation or refund policies of providers involved in the trip, such as the common carrier, tour operator or travel supplier

- Proof of expenses incurred due to a trip interruption

- Any unused vouchers, tickets or coupons

4. Confirm your claim and wait to hear back from a claims specialist.

Once you’ve submitted your Chase Sapphire Reserve® travel insurance claim, you should hear back from a claims specialist within five business days. They’ll let you know if they need additional documentation and whether you claim is approved or denied.

Is Chase Sapphire Reserve® travel insurance enough?

When it comes to credit card travel insurance, there’s virtually no other card on the market that beats out the Chase Sapphire Reserve® travel insurance in terms of both what’s covered and coverage amounts. The list of travel insurance benefits offered by this card is long and includes some forms of insurance you’re unlikely to get from other cards, and coverage maximums are either in line with or above what competing cards cover.

How does the card’s travel insurance fall short?

That being said, even the best credit card travel insurance isn’t enough for all trips. Some travelers may want to secure a full-blown travel insurance policy, as these tend to offer more extensive coverage than any credit card. This is particularly true when it comes to medical coverage — while the Chase Sapphire Reserve® travel insurance is often enough to cover travel interruptions such as trip cancellation or lost and delayed luggage, it is not medical insurance and won’t always cover health-related incidents that can occur during your travels.

For example, while many of the Chase Sapphire Reserve® travel insurance benefits are only valid for shorter trips of up to 30 or 60 days, travel insurance policies usually cover longer trips. Coverage amounts will typically be much higher as well, with some basic policies covering up to $25,000 for medical and dental emergencies. These plans tend to cover preexisting conditions too, and often offer a variety of plan options with different premiums, coverage levels and deductibles.

Should you buy extra travel insurance?

The decision of whether or not to buy travel insurance on top of what’s offered by your credit card depends on your trip and tolerance for risk. If your trip involves big nonrefundable expenses, you might decide you want higher coverage amounts than what’s offered by the Chase Sapphire Reserve® trip cancellation insurance.

If you’re staying close to home, you can probably rely on the Chase Sapphire Reserve® travel insurance in conjunction with your own health insurance. However, if you’re traveling abroad, the best travel insurance companies will offer more extensive medical coverage that’s valid internationally. Likewise, if you’re participating in high-risk activities or have preexisting conditions, getting a travel insurance policy that covers those can be wise. On the other hand, if your existing health insurance plan will cover you while abroad or visiting out-of-network physicians, you may be able to rely on that.

Frequently asked questions

No, neither the trip cancellation nor trip interruption insurance covers flight cancellations. You can find the long list of losses that the Chase Sapphire Reserve® travel interruption and cancellation insurance cover on its benefits guide. Some include severe weather, accidental bodily injury and sickness, jury duty, hospitalization and more.

The Chase Sapphire Reserve®‘s travel insurance is excellent compared to other cards. It has a $550’s annual fee, so it’s able to provide more benefits. Some travel cards, particularly those with no annual fees, don’t have any insurance at all. The Chase Sapphire Reserve® covers all the bases.

If you or a person you’re traveling with contract COVID-19 and that prevents you from taking your trip, then you’ll likely be covered with the Chase Sapphire Reserve®. Note that Chase will only accept tests administered by third-parties, like pharmacists or federal, state or local agencies. But if you’re canceling a trip because you’re worried about COVID-19, then you’re less likely to qualify for travel insurance since that was your decision and not because of circumstances you can’t control, like severe weather or terrorism.

Depending on where you’re traveling, some international locations may require you to have more insurance than what’s covered by the Chase Sapphire Reserve®. But if you’re traveling within the U.S., you’re likely fine without extra travel insurance. It also depends on how long your trip is — if your trip is longer than 30 or 60 days, then you may want to think about other travel insurance, since the Chase Sapphire Reserve® travel insurance usually covers trips of that length.

You can fill out everything for your claim at eclaimsline.com. There, you can follow the instructions for filing a claim and view your existing claims.

The information related to the Chase Sapphire Reserve® has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.