Credit Card Confidence Index Dips to Lowest Level Since June

Credit card confidence ticked lower in November, according to the latest LendingTree Credit Card Confidence Index, dipping to its lowest levels since June and the second-lowest of 2023.

Every month since September 2018, LendingTree has asked a nationally representative sample of credit cardholders the following: “Think about all of your credit cards. On a scale of 1 to 5 (5 being very confident, 1 being not at all confident), how confident are you that you can pay the entire monthly statement balance on all of those cards in full this month?” Those who responded with 4s and 5s were called confident, while those who responded with 1s or 2s were deemed not confident.

Confidence has dipped below pre-pandemic levels in 2023, with November’s marginal decrease pushing it a tick lower. While confidence has remained relatively high through an immensely turbulent time in America’s financial history, a slow but steady downward trend has been underway since fall 2020.

Here’s what you need to know.

Key findings

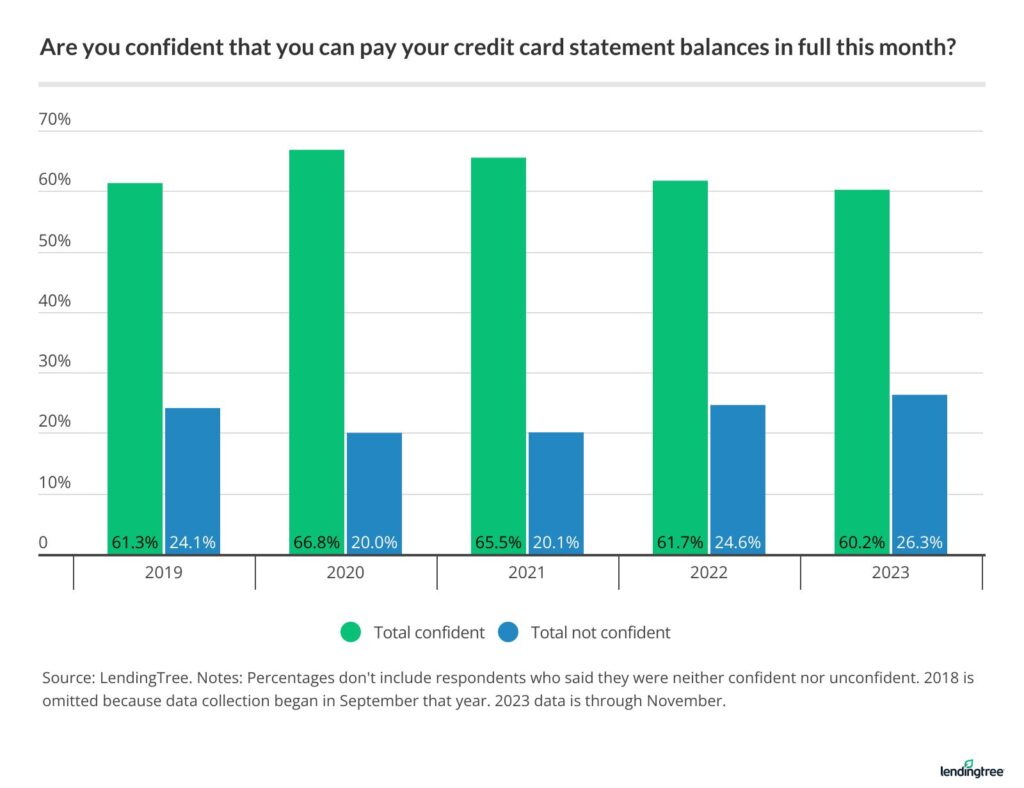

- Credit card confidence peaked in 2020 and has fallen every year since. In 2020, an average of 66.8% of cardholders each month said they were confident, including a record 74% that October. For 2023 to date, the average across each month is 60.2%, the lowest yearly average since 2019, the first year in which we have full data. The monthly average for the five-plus years of the index: 63.0%

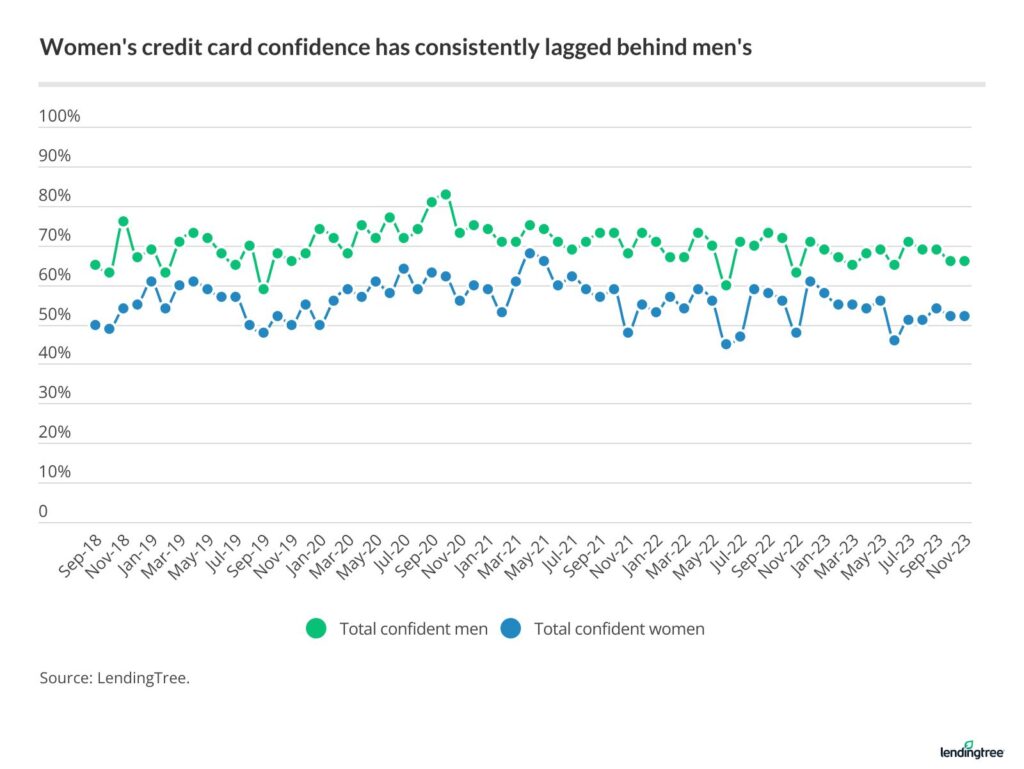

- Just 52% of cardholding women today say they’re confident in paying their credit cards’ monthly statement balances in full this month. That’s unchanged from October and well below the 66% of men who say the same. However, both of those numbers are far below their all-time highs. A record 68% of women expressed confidence in April 2021, while 83% of men did so in October 2020.

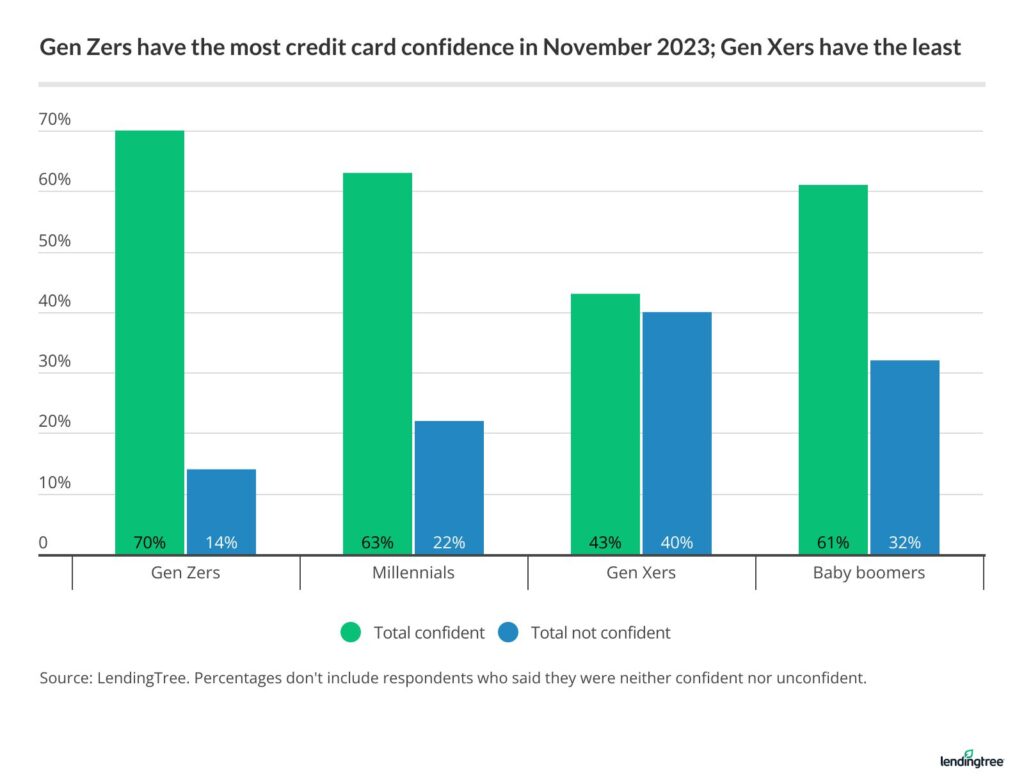

- Gen Z cardholders show the highest confidence today, while Gen Xers show the lowest. 70% of Gen Zers express confidence in being able to pay their credit cards’ monthly statement balances in full this month, compared with 63% of millennials, 61% of boomers and 43% of Gen Xers. It’s the ninth straight month in which Gen Zers have been the most confident, and the 21st in the last 24.

Confidence falling but still relatively high — though context is important

The trends are clear: Credit cardholder confidence has fallen off since 2020.

- In November 2023, 58% of cardholders expressed confidence in their ability to pay their credit cards’ monthly statement balances in full this month. That’s down a point from October and down 16 points from the record of 74% in October 2020.

- Also in November 2023, 28% of cardholders said they weren’t confident. That’s up a point from October and far higher than the 15% who said the same in December 2020 and April 2021.

- And consider the monthly averages for each of the past several years:

-

- 2020: 66.8% confident

- 2021: 65.5% confident

- 2022: 61.7% confident

- 2023 to date: 60.2% confident

-

Those are significant decreases. While those yearly average declines aren’t huge, their consistency is noteworthy. After all, multiple years of small decreases eventually add up to a larger one, and that’s what we’re seeing here.

Still, confidence levels remain relatively high. Sure, going from 74% to 58% is concerning, but 58% is still impressive, right?

Then, you have a significant number of cardholders who use their cards only sparingly, putting a few dollars a month on them. Those folks are probably pretty confident in paying their statement balances off, too.

If you removed the credit cardholders from those two scenarios — leaving only those who use credit cards more frequently — that confidence level would likely be well lower.

Women’s credit card confidence far lower than men’s

In the index’s five-plus-year history, there has never been a month in which women have been more confident about their credit card bills than men. In fact, there have only been eight months in which the gender confidence gap fell to single digits, but none since July 2021. (The gap was 7 points that month, equaling the record low set in April 2021.)

In November 2023, that gap stood at 14 points, with 66% of men and 52% of women expressing confidence. That men’s number is 4 points below its five-plus-year average of 70.1%, while the women’s is 4 points below their 55.9% average.

Both genders’ confidence levels are also far off their record highs, however. Men’s peak was 83% in October 2020, while women’s was 68% in April 2021. In fact, both are closer to their record lows today (59% for men in September 2019 versus 45% for women in June 2022) than their highs. Women’s confidence has fallen below 50% seven times in the index’s history, most recently at 46% in June 2023, while men’s has only fallen below 60% once (59% in September 2019).

Gen Z cardholders show the highest confidence, while Gen Xers show the lowest

Generally, the gap among age groups is less pronounced than the one between men and women. In November 2023, the youngest cardholders were the most confident in their ability to pay their monthly statement balances in full: Gen Zers (ages 18 to 26) at 70% and millennials (ages 27 to 42) at 63%. Baby boomers (ages 59 to 77) were close behind at 61%, while Gen Xers (ages 43 to 58) brought up the rear at 43%.

We don’t have age group breakdowns for the entire history of the index, but Gen Zers and Xers have consistently been the most and least confident, respectively, in recent years. Gen Zers have been the most confident in 21 of the last 24 months, while Gen Xers have been the least confident in 30 of the last 31 months.

However, among all four age groups, only Gen Zers’ confidence levels in November 2023 were above their average for the past two-and-a-half years.

Expect the slow downward trend to continue, at least for a while

The five-plus-year history of the index has encompassed one of the most volatile and unpredictable periods in America’s financial history.

Still, as we reported, a slow-but-clear downward trend has emerged since the October 2020 peak. It’s easy to understand why. The government stimulus checks, reduced spending and sky-high savings rates from the height of the pandemic gave way to making-up-for-lost-time spending, rampant inflation and frequently rising interest rates. However, despite all those headwinds, the downward trend has been gradual rather than sharp.

That doesn’t mean that things will be great, though. The headwinds facing credit cardholders are real and significant, and many Americans’ financial margin for error is tiny. Something like a job loss, medical emergency or another significant unexpected expense could push them over the edge from feeling good about their financial situation to feeling pretty darn shaky.

One of the best things cardholders can do — whether they feel good about their finances or wobbly — is knock down their credit card debt. If you don’t, sky-high APRs mean it will only continue to grow.

The good news is you have options. A 0% balance transfer card might be your best weapon against high interest rates, though a personal loan can help, too. And don’t forget that you might be able to lower your interest rate with a phone call. An April 2023 LendingTree survey found that 76% of cardholders who asked for a lower interest rate on their credit card in the past year got one, with an average rate reduction of 6 points. That can turn a 30% card into a 24% card or a 24% card into an 18% card. It’s absolutely worth the call.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,002 U.S. credit cardholders ages 18 to 77 from Nov. 6-9, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77

Media inquiries about the Credit Card Confidence Index

Want to talk to Matt about the latest Confidence Index numbers? Email him at [email protected]. You can also reach out via X at @matthewschulz or Instagram at @matt.schulz.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.