Best Credit Cards for International Travel in May 2025

Our pick for best credit card

Our pick for best credit card

Chase Sapphire Preferred® Card

The Chase Sapphire Preferred® Card is the best, all-around international travel card for most consumers, thanks to its flexible points and great travel benefits.

Citi is an advertising partner.

Travel can be amazing and exhilarating, but it can also cause stress, especially if you’re traveling internationally. Seeing new places and new cultures is one of the reasons many people travel, but paying in a different currency can be challenging and sometimes costly. Many credit cards charge a foreign transaction fee for any purchases made in a foreign currency. If you spend $1,000 on a card that charges a 3% foreign transaction fee, that’s an extra $30 out of your travel budget.

The best credit cards for international travel waive these foreign transaction fees, while also offering rewards and benefits that help make your trip more comfortable, like lounge access.

Best cards for international travel

Best credit card for international travel overall

Chase Sapphire Preferred® Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Foreign transaction fee: $0

- Earns valuable transferable points

- Primary car rental coverage

- $0 foreign transaction fee

- $95 annual fee

- Only 2x earning on most travel purchases

The Chase Sapphire Preferred® Card is our pick for the overall best card for international travel because of its flexibility and versatility. The Ultimate Rewards points that you earn can be transferred to a Chase’s airline and hotel partners for great redemption values, or you can use them to book travel directly through the Chase Ultimate Rewards® travel portal. The Chase Sapphire Preferred® Card also comes with $0 foreign transaction fees, which means that you can safely use it abroad without paying extra fees.

- Click APPLY NOW to apply online.

- Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases

- Earn up to $50 in statement credits each account anniversary year for hotel stays through Chase Travel℠

- 10% anniversary points boost - each account anniversary you'll earn bonus points equal to 10% of your total purchases made the previous year.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Complimentary DashPass which unlocks $0 delivery fees & lower service fees for a min. of one year when you activate by 12/31/27. Plus, a $10 promo each month on non-restaurant orders.

- Member FDIC

- Rates & Fees

Best credit card for international travel and no annual fee

Capital One VentureOne Rewards Credit Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Foreign transaction fee: None

- $0 annual fee

- Foreign transaction fees: None

- Intro APR on purchases and balance transfers

- Low earning rate of 1.25 Miles per dollar on every purchase, every day; 5 Miles per dollar on hotels, vacation rentals and rental cars booked through Capital One Travel

- Relatively low welcome offer compared to other cards

If you’re seeking a travel credit card you can use abroad without racking up foreign transaction fees or paying an annual fee, the Capital One VentureOne Rewards Credit Card is a good way to go. While it has a lower welcome bonus and lower earning rates than some other cards, it can be a good choice if you’re looking to lower the amount that you pay in fees. The Capital One VentureOne Rewards Credit Card also comes with an introductory APR on purchases and balance transfers.

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- $0 annual fee and no foreign transaction fees

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Transfer your miles to your choice of 15+ travel loyalty programs

- Enjoy 0% intro APR on purchases and balance transfers for 15 months; 18.49% - 28.49% variable APR after that; balance transfer fee applies

- Top rated mobile app

- For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

Best card for international travel and lounge access

American Express Platinum Card®

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Foreign transaction fee: None

- Large welcome offer

- Many luxury perks

- Foreign transaction fees: None

- $895 annual fee

- Low earning rate for most non-travel purchases

If you’re a frequent traveler looking for luxury perks, you will want to consider American Express Platinum Card®. This premium luxury card offers the most robust airport lounge membership program of all travel cards on the market today. The American Express Global Lounge Collection comes with Priority Pass™ Select membership, exclusive access to ultra-swanky Amex Centurion lounges and Delta Sky Club access each time you fly with Delta. Other travel benefits include a fee credit for Global Entry or TSA PreCheck membership, automatic Hilton Honors Gold status (enrollment required) and Marriott Bonvoy Gold status (enrollment required).

- Click APPLY NOW to apply online.

- You may be eligible for as high as 175,000 Membership Rewards® points after you spend $8,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Get more for your travels with 5X Membership Rewards® points on all flights and prepaid hotel bookings through American Express Travel®, including Fine Hotels + Resorts® and The Hotel Collection bookings. You earn 5X points on flights purchased directly from airlines or through American Express Travel® on up to $500,000 on these purchases per calendar year.

- More Value! With over 1,550 airport lounges - more than any other credit card company on the market* - enjoy the benefits of the Global Lounge Collection®, over $850 of annual value, with access to Centurion Lounges, 10 complimentary Delta Sky Club® visits when flying on an eligible Delta flight (subject to visit limitations), Priority Pass Select membership (enrollment required), and other select partner lounges. * As of 07/2025.

- More Value! $200 Uber Cash + $120 Uber One Credit: With the Platinum Card® you can receive $15 in Uber Cash each month plus a bonus $20 in December when you add your Platinum Card® to your Uber account to use on rides and orders in the U.S when you select an Amex Card for your transaction. Plus, when you use the Platinum Card® to pay for an auto-renewing Uber One membership, you can get up to $120 in statement credits each calendar year. Terms apply.

- More Value! $300 Digital Entertainment Credit: Get up to $25 in statement credits each month after you pay for eligible purchases with the Platinum Card® at participating partners. Enrollment required.

- More Value! $600 Hotel Credit: Get up to $300 in statement credits semi-annually on prepaid Fine Hotels + Resorts® or The Hotel Collection* bookings through American Express Travel® using the Platinum Card®. *The Hotel Collection requires a minimum two-night stay.

- New! $400 Resy Credit + Platinum Nights by Resy: When you use the Platinum Card® to pay at U.S. Resy restaurants and to make other eligible purchases through Resy, you can get up to $100 in statement credits each quarter with the $400 Resy Credit benefit. Plus, with Platinum Nights by Resy, you can get special access to reservations on select nights at participating in demand Resy restaurants with the Platinum Card®. Simply add your eligible Card to your Resy profile to book and discover Platinum Nights reservations near you, enrollment required.

- More Value! $209 CLEAR® Plus Credit: CLEAR® Plus helps get you to your gate faster by using unique facial attributes to verify you are you at 50+ airports nationwide. You can cover the cost of a CLEAR Plus Membership* with up to $209 in statement credits per calendar year after you pay for CLEAR Plus with the Platinum Card®. *Excluding any applicable taxes and fees. Subject to auto-renewal.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees, such as checked bags and in-flight refreshments, are charged by the airline to the Platinum Card® Account*. American Express relies on airlines to submit the correct information on airline transactions to identify incidental fee purchases. If you do not see a credit for a qualifying incidental purchase on your eligible Card after 8 weeks, simply call the number on the back of your Card. Qualifying airlines are subject to change. See terms & conditions for more details.

- Start your vacation sooner, and keep it going longer. When you book Fine Hotels + Resorts® through American Express Travel®, enjoy noon check-in upon arrival, when available, and guaranteed 4PM check-out.

- New! $300 lululemon Credit: Enjoy up to $75 in statement credits each quarter when you use the Platinum Card® for eligible purchases at U.S. lululemon retail stores (excluding outlets) and lululemon.com. That’s up to $300 in statement credits each calendar year. Enrollment required.

- $155 Walmart+ Credit: Receive a statement credit* for one monthly Walmart+ membership (subject to auto-renewal) after you pay for Walmart+ each month with the Platinum Card®.*Up to $12.95 plus applicable local sales tax. Plus Ups not eligible.

- $100 Saks Credit: Get up to $100 in statement credits annually for purchases at Saks Fifth Avenue or saks.com on the Platinum Card®. That’s up to $50 in statement credits from January through June and up to $50 in statement credits from July through December. No minimum purchase required. Enrollment required.

- Whenever you need us, we're here. Our Member Services team will ensure you are taken care of. From lost Card replacement to statement questions, we are available to help 24/7.

- $895 annual fee.

- Terms Apply.

- Rates & Fees

Best credit card for international travel and airlines

The New United℠ Explorer Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Foreign transaction fee: $0

- Outstanding welcome offer

- Excellent United perks

- Foreign transaction fee: $0

- $0 intro annual fee for the first year, then $150 after the first year

- Must pay for flights with your United card to get free checked bags

The The New United℠ Explorer Card is a great option if you’re looking to earn airline miles. It comes with a $0 foreign transaction fee and an annual fee of $150, then $0 intro annual fee for the first year, then $150. You’ll also get perks when flying United, including free checked bags for the cardholder and one companion, priority boarding and 25% back when buying food, beverages and Wi-Fi on United flights. Additionally, the The New United℠ Explorer Card has an outstanding welcome offer.

- Earn 60,000 bonus miles

- $0 introductory annual fee for the first year, then $150

- 2x miles on United® purchases, dining, and hotel stays when booked with the hotel

- Enjoy priority boarding privileges and visit the United Club℠ with 2 one-time passes each year for your anniversary

- Free first checked bag - a savings of up to $160 per roundtrip. Terms Apply.

- Up to $120 Global Entry, TSA PreCheck® or NEXUS fee credit

- Earn a $100 United travel credit after spending $10,000 on purchases with your United℠ Explorer Card within a calendar year

- Over $500 in partner credits each year

- Member FDIC

Best for flexible rewards card for international travel

Capital One Venture Rewards Credit Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Foreign transaction fee: None

- Excellent welcome bonus

- Foreign transaction fees: None

- Great flexibility with miles

- $95 annual fee

- No bonus earning categories

For a simple travel card with rewards that are easy to redeem as they are to earn, the Capital One Venture Rewards Credit Card is hard to beat. You earn 2 Miles per dollar on every purchase, every day; 5 Miles per dollar on hotels, vacation rentals and rental cars booked through Capital One Travel. One of the best features of the Capital One Venture Rewards Credit Card is the flexibility of the rewards you earn. You can redeem them as a statement credit for any type of travel or transfer them to Capital One’s airline and hotel partners.

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app

- For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

Best credit card for international travel and business

Ink Business Preferred® Credit Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Foreign transaction fee: $0

- Generous welcome offer

- Foreign transaction fee: $0

- Earns flexible Ultimate Rewards points

- $95 annual fee

- Requires you to have a business to apply

The Ink Business Preferred® Credit Card is one of the most flexible and valuable business credit cards around. The card’s generous sign-up bonus and earning rate on business purchases can help add to the rewards pile fast. Like other Chase cards, it offers primary car rental protection and trip cancellation/interruption insurance when traveling for business. In addition to having $0 foreign transaction fees, that makes the Ink Business Preferred® Credit Card a great option for international travel.

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth more when you redeem for travel through Chase Travel℠

- Purchase Protection covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.

- Member FDIC

Best credit card for international travel and hotels

Marriott Bonvoy Brilliant® American Express® Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Foreign transaction fee: None

- Great welcome offer

- Monthly dining credit (up to $25 / month)

- Foreign transaction fees: None

- $650 annual fee

- Points can generally only be used for stays at Marriott hotels

The Marriott Bonvoy Brilliant® American Express® Card is our top pick for hotels due to its earning rate on paid Marriott hotel stays, over-the-top welcome offer and annual travel perks. While a $650 annual fee applies, cardholders get up to a $300 annual dining credit (up to $25 per month), a free night award after card renewal each year (up to 85,000 points) and a $100 Marriott Bonvoy property credit. Other perks like a Priority Pass™ Select membership (enrollment required), a fee credit for Global Entry or TSA PreCheck membership (enrollment required) and no foreign transaction fees round out this card.

- Click APPLY NOW to apply online.

- Earn 100,000 Marriott Bonvoy® bonus points after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership.

- Earn 6X Marriott Bonvoy® points for each dollar of eligible purchases at hotels participating in Marriott Bonvoy.

- Earn 3X points at restaurants worldwide and on flights booked directly with airlines.

- Earn 2X points on all other eligible purchases.

- Earn up to 21X Marriott Bonvoy® points for every $1 spent on eligible purchases at hotels participating in Marriott Bonvoy. Earn 6X points with the Marriott Bonvoy Brilliant® American Express® Card. Earn up to 10X points from Marriott Bonvoy for being a Marriott Bonvoy member. Earn up to 5X points from Marriott Bonvoy with the 50% Bonus Points on Stays, a benefit available with your complimentary Platinum Elite status.

- $300 Brilliant Dining Credit: Each calendar year, get up to $300 (up to $25 per month) in statement credits for eligible purchases made on the Marriott Bonvoy Brilliant® American Express® Card at restaurants worldwide.

- A Marriott Bonvoy® Platinum Elite member will earn 50% more points on eligible purchases at hotels participating in Marriott Bonvoy for each U.S. dollar or the currency equivalent that is incurred and paid for by the member.

- Receive 1 Free Night Award every year after your Card renewal month. Award can be used for one night (redemption level at or under 85,000 Marriott Bonvoy® points) at hotels participating in Marriott Bonvoy®, such as Le Metropolitan, a Tribute Portfolio Hotel in Paris. Certain hotels have resort fees.

- Each calendar year after spending $60,000 on eligible purchases on your Marriott Bonvoy Brilliant® American Express® Card, you will be eligible to select a Brilliant Earned Choice Award benefit. You can only earn one Brilliant Earned Choice Award per calendar year. See https://www.choice-benefit.marriott.com/brilliant for Award options.

- $100 Marriott Bonvoy® Property Credit: Enjoy your stay. Receive up to a $100 property credit for qualifying charges at The Ritz-Carlton® or St. Regis® when you book direct using a special rate for a two-night minimum stay using your Card.

- Fee Credit for Global Entry or TSA PreCheck®: Receive either a statement credit every 4 years after you apply for Global Entry ($120) or a statement credit every 4.5 years after you apply for a five-year membership for TSA PreCheck® (up to $85 through a TSA PreCheck official enrollment provider) and pay the application fee with your Marriott Bonvoy Brilliant® American Express® Card. If approved for Global Entry, at no additional charge, you will receive access to TSA PreCheck.

- Each calendar year with your Marriott Bonvoy Brilliant® American Express® Card you can receive 25 Elite Night Credits toward the next level of Marriott Bonvoy® Elite status. Limitations apply per Marriott Bonvoy member account. Benefit is not exclusive to Cards offered by American Express.

- With your Marriott Bonvoy Brilliant® American Express® Card, you can enroll in Priority Pass™ Select, with an unlimited number of visits to over 1,200 airport lounges in over 130 countries, regardless of which carrier or class you are flying. This allows you to relax before or between flights. You can enjoy snacks, drinks and internet access in a quiet, comfortable location.

- Trip Cancelled or Interrupted? If you purchase a round-trip entirely with your Eligible Card and a covered reason cancels or interrupts your trip, we may be able to help. Terms, conditions and limitations apply. Coverage is provided by New Hampshire Insurance Company, an AIG Company.

- No Foreign Transaction Fees on international purchases.

- $650 Annual Fee.

- Apply with confidence. Know if you're approved for a Card with no impact to your credit score. If you're approved and you choose to accept this Card, your credit score may be impacted.

- Terms Apply.

- Rates & Fees

Best credit card for international travel and students

Bank of America® Travel Rewards Credit Card for Students*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Foreign transaction fee: $0

- Solid return on all of your spending

- $0 annual fee

- Foreign transaction fees: $0

- No bonus categories

- Rewards are not transferable

The Bank of America® Travel Rewards Credit Card for Students is the best international travel card for students due to its lack of foreign transaction fees and $0 annual fee. Cardholders also earn 1.5 points per $1 spent on all purchases. . Its flexible rewards may be important for students who want to keep their options open as they figure out their travel style.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a 17.49% to 27.49% Variable APR will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- When handled responsibly, a credit card can help you build your credit history, which could be helpful when looking for an apartment, a car loan, and even a job. Access your FICO® Score for free within Online Banking or your Mobile Banking app.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

Best for international travel with bad credit

Capital One Quicksilver Secured Cash Rewards Credit Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Foreign transaction fee: None

- $0 annual fee

- Foreign transaction fees: None

- Earn cash back on every purchase

- Requires a minimum $200 refundable security deposit

The Capital One Quicksilver Secured Cash Rewards Credit Card is the best option for international travel when you have a low credit score. Capital One Quicksilver Secured Cash Rewards Credit Card is marketed to those with limited / poor credit, so it will be easier to be approved for this card than other cards. You’ll need to put down a minimum security deposit of at least $200 which will become your credit limit. It doesn’t charge an annual fee or any foreign transaction fees. Cardholders also earn 1.5% Cash Back on every purchase, every day; 5% Cash Back on hotels, vacation rentals and rental cars booked through Capital One Travel.

- No annual or hidden fees, and you can earn unlimited 1.5% cash back on every purchase, every day. See if you're approved in seconds

- Put down a refundable $200 security deposit to get at least a $200 initial credit line

- Building your credit? Using a card like this responsibly could help

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Earn unlimited 5% cash back on hotels, vacation rentals and rental cars booked through Capital One Travel

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Top rated mobile app

- For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

Best for dining and international travel

American Express® Gold Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Foreign transaction fee: None

- High earning rate on dining and U.S. supermarkets

- Generous dining and Uber benefits (enrollment required)

- Foreign transaction fees: None

- $325 annual fee

- Redeeming your points for non-travel options isn’t a good value

The American Express® Gold Card is an attractive option if you have a lot of dining purchases. The American Express® Gold Card lets you Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. Terms apply.

This makes it a great option to use while dining abroad, since it also comes with no foreign transaction fees. There is a $325 annual fee, but you can wipe out a large part of the fee if you take advantage of benefits such as up to $120 in credits toward select dining purchases ($10 monthly, enrollment required).

- Click APPLY NOW to apply online.

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.

- Rates & Fees

Best for international transfer partners

Capital One Venture X Rewards Credit Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Foreign transaction fee: None

- Outstanding welcome bonus

- Above average earning rate on all purchases

- Foreign transaction fees: None

- $395 annual fee

- Doesn’t offer any hotel or airline elite status

If you’re in the market for points that can easily be transferred to partners, consider the Capital One Venture X Rewards Credit Card. Capital One has over 15 hotel and airline transfer partners, allowing you to maximize your points no matter where you’re going. You’ll earn 2 Miles per dollar on every purchase, every day; 10 Miles per dollar on hotels and rental cars booked through Capital One Travel; 5 Miles per dollar on flights and vacation rentals booked through Capital One Travel. With no foreign transaction fees, the Capital One Venture X Rewards Credit Card is a great card to take when traveling abroad. The Capital One Venture X Rewards Credit Card comes with a $395 annual fee, but also gives 10,000 Venture miles on your anniversary and an annual $300 travel credit that applies to most travel purchases.

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights and vacation rentals booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Enjoy access to 1,300+ lounges worldwide, including Capital One Lounge locations and Priority Pass™ lounges, after enrollment

- Use your Venture X miles to easily cover travel expenses, including flights, hotels, rental cars and more—you can even transfer your miles to your choice of 15+ travel loyalty programs

- Enjoy a $100 experience credit and other premium benefits with every hotel and vacation rental booked from the Premier Collection

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Top rated mobile app

- For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

| Credit Cards | Our Ratings | Foreign Exchange Fee | Annual Fee | Welcome Offer | |

|---|---|---|---|---|---|

Chase Sapphire Preferred® Card

on Chase's secure site Rates & Fees |

$0 | $95 | Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. |

on Chase's secure site Rates & Fees |

|

Capital One VentureOne Rewards Credit Card

|

None | $0 | Earn 20,000 Miles once you spend $500 on purchases within 3 months from account opening | ||

American Express Platinum Card®

|

None | $895 | You may be eligible for as high as 175,000 Membership Rewards® Points after spending $8,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer. | ||

The New United℠ Explorer Card*

|

$0 | $0 intro annual fee for the first year, then $150 | Earn 60,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open. | ||

Capital One Venture Rewards Credit Card

|

None | $95 | Earn up to $1,000 towards travel once you spend $4,000 on purchases within the first 3 months of account opening | ||

Ink Business Preferred® Credit Card*

|

$0 | $95 | Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. | ||

Marriott Bonvoy Brilliant® American Express® Card

|

None | $650 | Earn 100,000 Marriott Bonvoy® bonus points after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership. | ||

Bank of America® Travel Rewards Credit Card for Students*

|

$0 | $0 | 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases | ||

Capital One Quicksilver Secured Cash Rewards Credit Card

|

None | $0 | N/A | ||

American Express® Gold Card

|

None | $325 | You may be eligible for as high as 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer. | ||

Capital One Venture X Rewards Credit Card

|

None | $395 | Earn 75,000 Miles when you spend $4,000 on purchases in the first 3 months from account opening |

Types of international travel credit cards

International travel credit cards come in a few different varieties:

Airline credit cards

Airline credit cards are usually co-branded between a specific airline and a credit card issuer. Airline credit cards usually earn the miles for that particular airline, and can come with airline-specific benefits like priority boarding, free checked bags or help qualifying for airline elite status.

Hotel credit cards

Hotel credit cards are usually co-branded between a credit card issuer and a particular hotel chain. Hotel credit cards usually earn hotel points that can be used for stays and also often offer hotel-specific benefits like complimentary night certificates, elite status or increased earning rates.

Transferable travel credit cards

Transferable travel credit cards are usually issued directly by a bank or credit card issuer, and earn flexible points that can be used in a variety of different ways. With most transferable travel cards, you can usually redeem your points for statement credits, to book travel directly or transfer to hotel or airline travel partners.

Business travel credit cards

Business travel cards are marketed towards small business owners, and you’ll need to enter in your business information when you apply for the card. Business travel credit cards can be airline, hotel or transferable travel cards, so you’re sure to find one that meets your needs.

How to choose an international travel credit card

When choosing an international travel credit card, you’ll want to consider factors like how widely it’s accepted, whether it charges foreign transaction fees and a variety of these other factors.

No foreign transaction fees

Whenever you use a debit or credit card outside of the U.S., your issuer will charge you a fee of around 3% of each purchase. While it may not seem like a huge deal, the charges will certainly add up. Finding a credit card with no foreign transaction fees is a must when considering an international credit card.

Worldwide acceptance

If you’re visiting major tourist destinations, resorts, hotels and museums, you should have no problem paying with your credit card there. However, some destinations may not accept certain networks — or credit cards at all. It’s important to research the common types of currency accepted in your given destination to make the right credit card choice.

Complimentary travel insurance

Many credit cards will come with the added benefit of complimentary travel protection benefits, such as trip cancellation or interruption insurance. In the event of an emergency while on your trip, you can contact your credit card company and receive reimbursement for any nonrefundable expense — potentially saving you hundreds of dollars.

Rewards rate

You’ll want to apply for a credit card that will reward you appropriately for your spending habits. For example, frequent diners will want a card that will offer bonus points or miles for restaurants and takeout. Meanwhile, frequent travelers will want to be rewarded for flight and hotel purchases. Many travel credit cards offer hybrid reward categories, offering points for both everyday and travel purchases.

Sign-up bonus

Many travel rewards cards incentivize you to apply by offering a large sign-up bonus that can be redeemed for free travel. This can heavily reduce the cost of your trip — especially if you plan on flying internationally.

Redemption options

If you’re particularly loyal to one airline, it would be advantageous to open a credit card affiliated with an airline to receive perks, such as free checked bags or priority boarding. Hotel cards can only offer free award stays as well as complimentary elite status. Finally, a general travel rewards card can offer flexibility to transfer your points to either airline or hotel programs.

Other travel perks

Owning a travel credit card can open a wide variety of benefits handy for your next international trip, such as Global Entry or TSA PreCheck application reimbursement or lounge access. You’ll want to think about how much you’re willing to spend on annual fees each year and what travel perks are important to you.

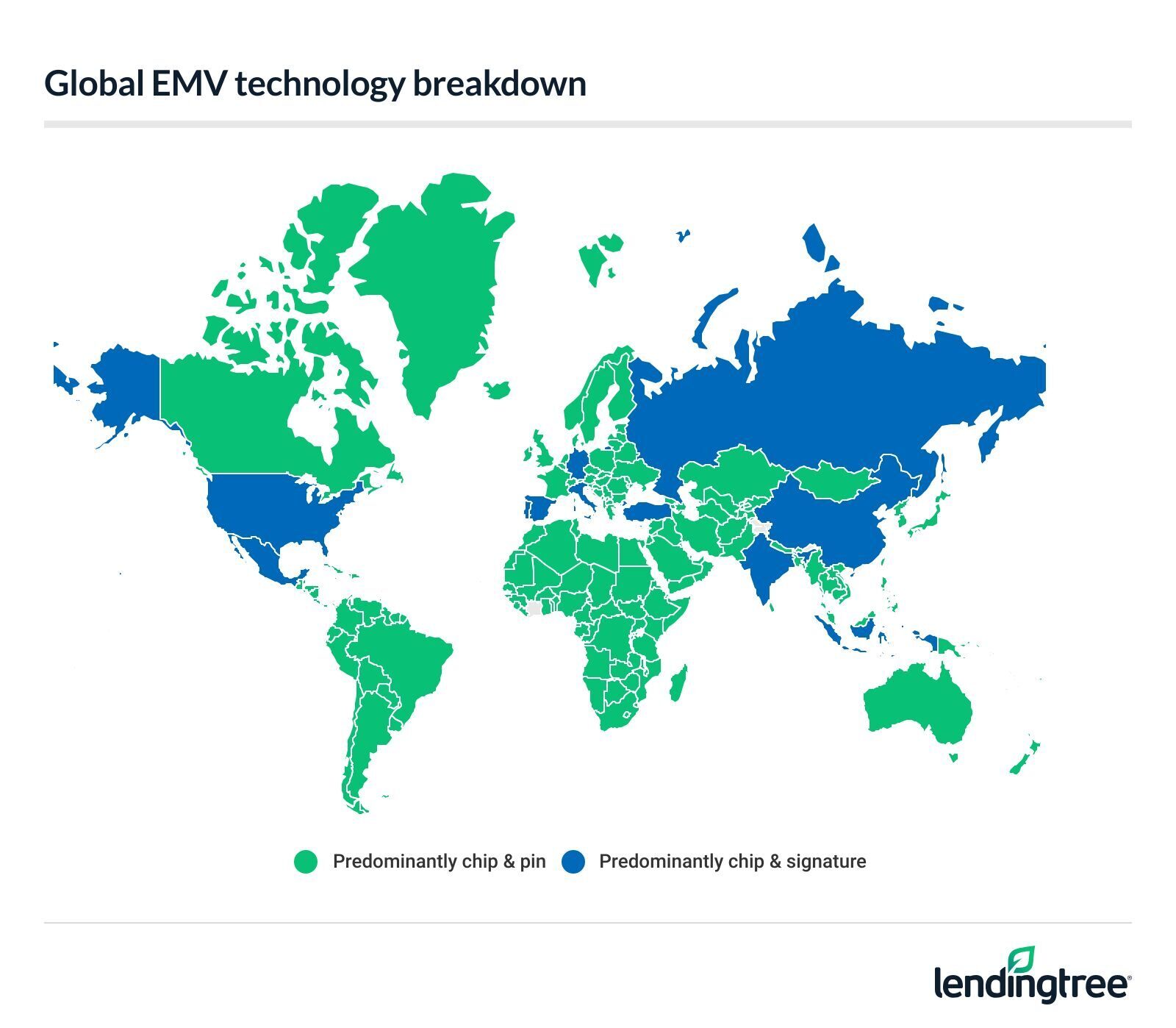

Chip and PIN technology

Some countries (such as France and Germany) require both an EMV chip and a PIN in order to use a credit card in an unattended terminal. While most credit cards issued within the U.S. include an EMV chip, cards with PINs are rare. However, some issuers (such as Bank of America) allow you to add a PIN to your travel credit card. You should check with your issuer to see if they offer this option.

Top cards for lounge access while traveling internationally

Another factor you should consider is if you want airport lounge access, significantly improving your travel experience. Many premium credit card companies come with lounge membership or passes — advantageous for frequent travelers.

Admirals Club®

- Citi® / AAdvantage® Executive World Elite Mastercard®

Amex Centurion lounge

Delta Sky Clubs

- Delta SkyMiles® Reserve American Express Card

- American Express Platinum Card®

Priorty pass select

United club

- The New United Club℠ Card

Avoiding dynamic currency conversion

Dynamic Currency Conversion (DCC) is when you choose to pay in your own currency, rather than the local currency. When you pay for things with a credit card internationally, you’ll often be presented with a choice to use DCC when finalizing your payment. While this might seem like a good idea, since you’ll then be more familiar with the actual cost of the purchase, DCC will often use a less-favorable exchange rate and should be avoided.

Here’s one example, using current conversion rates as a way to illustrate how dynamic currency conversion works. At the time of writing this article, 1 Euro can be converted to 1.07 USD. If you are traveling in Europe and have a 100 Euro bill, you may be presented with the option to pay 100 Euro or to convert to $109 — a higher rate than the current exchange rate (a fair conversion for 100 Euros in this scenario would be USD $107). For this reason, it’s a good rule of thumb to always pay in the local currency with your credit card, using a credit card that doesn’t charge foreign transaction fees.

How to use a credit card internationally

Making the most of your international credit card is best done by following all of these international credit card tips. Pick a card with no foreign transaction fees and good travel perks and use it for all of your regular expenses. When traveling internationally, generally you should choose to pay for purchases in the local currency rather than using dynamic currency conversion.

-

Use your credit card for all your regular expenses

This will help you maximize your international credit card use and ensure you rack up as many travel rewards points and miles as possible, which you can put towards your next trip, or flight upgrades and free hotel nights. Paying for your expenses with a credit card can also give you additional security or peace of mind if your card has a $0 fraud liability benefit. Plus, if you use a card with no foreign transaction fees and pay in the local currency, you will likely get a reasonable conversion rate.

-

Never carry a balance

International credit cards are notorious for charging high interest rates. Be sure to avoid carrying a balance on your card so you never have to pay more than you should. Carrying a balance on your card can also be damaging to your credit score, so you’ll want to watch out for that as well. Put yourself in a position where you have the financial ability and discipline to pay your credit card statement in full, each and every month.

-

Maximize card benefits for international travel

Many premium travel credit cards come with benefits that can make your trip more affordable and comfortable. Check to see if your card offers these benefits and learn how to take advantage of them ahead of your next international trip.

- Room or seat upgrades: Some airline or hotel credit cards offer upgrades to cardholders. An international trip can be a great time to redeem some of these card benefits.

- Free checked baggage: Many airline credit cards offer free checked bags. If you need to fly with more baggage than your ticket allows, consider signing up for an airline credit card as an alternative to paying baggage fees.

- Free lounge access: If your international trip is going to have you spending a lot of time in airports, look for cards that offer airport lounge access as a perk. An airport lounge can be a great way to make your trip more relaxing and less stressful, so you should pinpoint the lounges along your route and make sure they don’t require a reservation ahead of your arrival.

- Companion passes: Your airline credit card may offer a companion pass after meeting certain criteria. Using a companion pass on an expensive international trip can help you maximize your miles.

-

Sign up for Global Entry, TSA PreCheck and/or CLEAR

Global Entry, TSA PreCheck and CLEAR are three different programs that allow you to minimize the time that you spend in airport security lines. If you are a frequent traveler, it can be a good idea to sign up for one or more of these programs. Even if you save a few minutes on each trip, that can add up over tens or hundreds of trips.

Each of these three programs helps you save time with airport security in different ways. For international travel, Global Entry will likely be the most helpful. Having a Global Entry account allows you to skip much of the immigration line when entering the United States. And because Global Entry also includes TSA PreCheck, you’ll also save time while traveling domestically. Many credit cards offer a statement credit to reimburse your application fee for Global Entry or TSA PreCheck every four or five years.

Frequently asked questions

Just about any credit card can be used internationally, though not all retailers take every kind of card. As a general rule, Visa and Mastercard are more commonly accepted than Discover and American Express, especially internationally.

There are a variety of different credit cards that offer travel insurance. While most of these cards come with annual fees, the cost can be worth it if you need trip cancellation, lost baggage or trip delay insurance. Not all travel insurance credit cards are equal however, so make sure to check the details to know what is covered, what deductible you might have and exactly how your card’s travel insurance works.

Most banks and credit card companies no longer require you to let them know if you are traveling outside your local area or home country. In some cases, this is due to the added security that comes from most credit cards now having an EMV chip. While many credit card companies do allow you to let them know if you’re traveling if it gives you peace of mind, others (like Capital One) specifically say that you don’t need to tell them about your travel plans.

The best credit card for international travel will vary depending on the user. For high spenders and luxury travelers, owning a premium credit card will serve your travels well to score perks like hotel elite status and concierge services. We recommend the Chase Sapphire Reserve®, Chase Sapphire Reserve® or the Citi Strata Premier® Card in these cases. For the average traveler, cards such as the Chase Sapphire Preferred® Card should suffice — offering no foreign transaction fees and the potential to earn travel rewards.

It’s commonly thought that Visa and Mastercard are more generally accepted than any other card network available. This has changed dramatically in recent years, as networks such as American Express and Discover have worked hard to increase their international acceptance. In fact, our recent study found that Discover is the most accepted network internationally — with 48 million merchants. However, Discover isn’t accepted in some countries. Therefore, Visa will most likely be your best bet, since it’s accepted at more than 44 million merchants worldwide.

Methodology

To make choosing the right card easier, we’ve looked at credit cards reviewed on LendingTree as well as cards on major issuer sites to compile a list of the best rewards credit cards available right now. Our recommendations are based on the additional value you can earn with the cards — including the rewards value, cost of ownership and value of benefits such as travel and purchase protections, lounge membership and airline companion passes. No cards on this page charge foreign transaction fees. Our choices are not influenced by our advertisers. Learn more on how we calculate rewards.

To see rates & fees for American Express cards mentioned on this page, visit the links provided below:

- American Express Platinum Card®

- Marriott Bonvoy Brilliant® American Express® Card

- American Express® Gold Card

- Delta SkyMiles® Reserve American Express Card

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

The information related to the The New United℠ Explorer Card, Ink Business Preferred® Credit Card, Bank of America® Travel Rewards Credit Card for Students, Citi® / AAdvantage® Executive World Elite Mastercard®, Chase Sapphire Reserve® and The New United Club℠ Card has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.