On this page

- What you need to initiate a Discover balance transfer

- How to do a balance transfer to a new Discover card

- How to do a balance transfer for existing Discover cardholders

- How long does a balance transfer take with Discover?

- What types of debt can you transfer?

- Best Discover balance transfer credit cards

- Comparison of Discover balance transfer cards

- FAQ

How To Do a Discover Balance Transfer

Moving debt from a high-interest credit card to one with a 0% introductory APR via a balance transfer is one of the best tools available for getting out of debt more quickly. Discover issues several cards with balance transfer offers — so if you’re carrying debt on a card from another credit card company, doing a balance transfer with Discover could give you a window of time to pay off what you owe without incurring expensive interest charges.

There are just a few essentials for doing a balance transfer with Discover:

- A Discover credit card. This might be a new Discover card you opened for the purpose of doing a balance transfer or it might be an existing Discover credit card with a balance transfer offer available.

- The amount of debt you wish to transfer. Discover will allow transfers of about 95% of your credit limit, in order to leave enough credit to cover the balance transfer fee.

- Your old account information. You’ll have to enter the credit card number of the account you’re moving the balance from so Discover can pay it off.

If you’re applying for a new Discover credit card from an online application, you should see a screen option to transfer a balance as you proceed through the online form. You’ll need to enter details of the account that you want to pay off and the amount of debt you want to transfer. Just note your balance transfer request won’t begin processing until your new Discover card has been open for at least 14 days; you’re also not guaranteed to qualify for the entire transferred amount, as Discover will need to conduct a credit review before you’re approved.

Once you receive your physical card in the mail, you can also call the number on the back to request a transfer over the phone. Just make sure to check if there’s a deadline by which you must complete the balance transfer in order to take advantage of the 0% intro APR offer, and request the transfer as promptly as possible.

If you’re already a Discover cardholder, you can log into your online account, click the “card services” tab and then select “balance transfers.” You’ll be taken to a screen that shows available offers, if there are any.

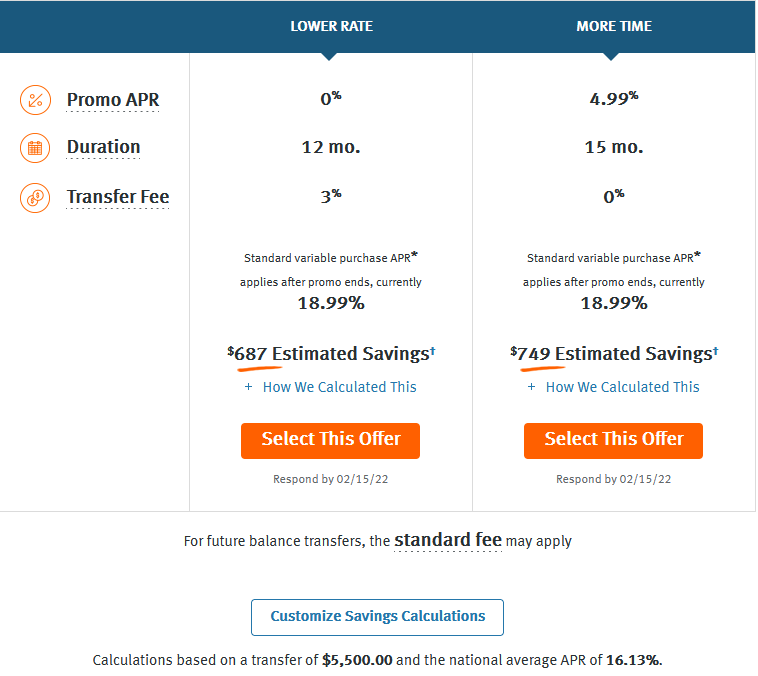

If you have available offers, you’ll be shown details on a screen like this:

After selecting your preferred offer, you’ll have to enter information about the amount you want to transfer and the account you’re paying off. You could also call the number on the back of your credit card and talk with a Discover representative by phone to find out if you have any offers and submit your balance transfer request.

If you’ve requested a balance transfer to an existing Discover credit card, the issuer notes that such requests are typically processed within four days. On the other hand, if you’ve requested a transfer to a new card, you should know your balance transfer won’t begin processing until the account has been open for at least 14 days.

Though balance transfers are commonly thought of as paying off one credit card with another, oftentimes you can transfer other types of debt to a balance transfer card. For example, Discover also lets you use a balance transfer to pay off gas and store cards, auto loans and medical bills.

That said, do the math before requesting a balance transfer, and be realistic about whether you’ll pay off the full amount of your debt before your card’s 0% intro APR period ends and the regular APR kicks in.

For example, using a balance transfer credit card to pay off an auto loan isn’t a smart move if the interest charges you’ll face on the card are more expensive than what you’d incur just by continuing to pay on the loan. Similarly, for medical bills, you might have an option to set up a medical debt payment plan rather than transferring the debt to a credit card.

Discover it® Balance Transfer*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Intro balance transfer APR: 0% Intro APR for 18 months

Followed by a 17.24% - 28.24% variable apr for balance transfers.

- $0 annual fee

- Long intro APR on balance transfers

- Shorter intro APR on purchases

- Balance transfer fee

The Discover it® Balance Transfer offers a lengthy 0% Intro APR for 18 months on balance transfers (after, a 17.24% - 28.24% Variable APR applies). The balance transfer fee is also reasonable: You’ll pay a 3% intro balance transfer fee, up to 5% fee on future balance transfers (see terms)*.

There’s also an intro APR on purchases, but it’s lackluster at just 0% Intro APR for 6 months (after, a 17.24% - 28.24% Variable APR applies) — there’s no doubt that its balance transfer offer is where this card shines.

Once you’ve finished paying off your transferred debt, keep this card in your wallet for a generous cash back program: Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

Note that you’ll need to activate bonus categories quarterly, and your 5% earnings are capped at $1,500 spent in the bonus category per quarter. If you max that out, that’s $75 in cash back at the elevated rate each quarter, after which your earning rate drops to 1% on all purchases until the next quarter comes around.

We don’t recommend using a balance transfer card for purchases until you’ve paid off what you transferred, but if you do make new purchases in the first year, there’s a sign-up bonus: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

The Discover it® Balance Transfer‘s annual fee is $0, and the foreign transaction fee is none.

Who’s this card best for?

Quite simply, the Discover it® Balance Transfer is an excellent choice for consumers who need a long time to pay off transferred debt. With a year-and-a-half of no interest on balance transfers, this card offers plenty of time to breathe. It’s also worth keeping around after you pay off your balance transfer thanks to a generous cash back program, which many balance transfer cards don’t offer.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

Discover it® Cash Back

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Intro balance transfer APR: 0% Intro APR for 18 months

Followed by a 17.24% - 28.24% variable apr for balance transfers.

- $0 annual fee

- Rotating quarterly bonus categories

- Generous sign-up bonus

- Long intro APR on purchases and balance transfers

- Low rewards rate outside of bonus categories

- Bonus categories require activation

- Bonus rewards rate applies for up to $1,500 per quarter

The Discover it® Cash Back comes with the same cash back program as the Discover it® Balance Transfer but different 0% intro APR periods. Cardholders get a somewhat shorter 0% Intro APR for 15 months on balance transfers, after which a 17.49% - 26.49% Variable APR applies. Still, the balance transfer fee is the same: a 3% intro balance transfer fee, up to 5% fee on future balance transfers (see terms)*.

There’s also a 0% Intro APR for 15 months on purchases, after which a 17.49% - 26.49% Variable APR applies.

Cardholders 5% cash back at different places each quarter up to the quarterly maximum when you activate. 1% unlimited cash back on all other purchases - automatically

Just be ready to activate new categories every quarter, otherwise you’ll earn just 1% on all purchases. And take note that your 5% earning rate is capped at $1,500 spent per quarter in the bonus category. Once you hit the cap, your rewards will drop to 1% back on all purchases until the next quarter rolls around.

The cash back categories for 2023 are as follows:

- Grocery Stores, Drug Stores and Select Streaming Services (January–March)

- Restaurants and Wholesale Clubs (April–June)

- Gas Stations and Digital Wallets (July–September)

- Amazon.com and Target (October–December)

Plus, the card comes with a sign-up bonus: Unlimited Cashback Match for all new cardmembers. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

You’ll pay a $0 annual fee to carry the card, and the foreign transaction fee is none.

Who’s this card best for?

If you don’t need quite as long to pay off your balance transfer as the Discover it® Balance Transfer offers, the Discover it® Cash Back is a fine choice. Plus, it comes with the same great cash back program — so as long as your spending typically lines up with what’s offered in the rotating bonus categories, this card offers the opportunity to earn generous rewards. But first, you should finish paying off your transfer before making new purchases.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases.

- Redeem cash back for any amount. No annual fee.

- Get a 0% intro APR for 15 months on purchases. Then 17.49% to 26.49% Standard Variable Purchase APR applies, based on credit worthiness.

- Terms and conditions apply.

Discover it® Chrome

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Intro balance transfer APR: 0% Intro APR for 18 months

Followed by a 17.49% - 26.49% variable apr for balance transfers.

- $0 annual fee

- Elevated earning rate on gas stations and restaurants

- Generous sign-up bonus

- Long intro APR on purchases and balance transfers

- Elevated rewards rate applies for up to $1,000 per quarter

- Balance transfer fee

The Discover it® Chrome offers a solid 0% Intro APR for 18 months on balance transfers; after, a 17.49% - 26.49% Variable APR applies. You’ll pay a 3% intro balance transfer fee, up to 5% fee on future balance transfers (see terms)*. There’s also a 0% Intro APR for 6 months on purchases, after which a 17.49% - 26.49% Variable APR applies. Plus, like the cards mentioned previously, there’s a unique sign-up bonus.

That bonus comes in the form of a cash back match: Unlimited Cashback Match for all new cardmembers. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards.

For ongoing rewards, cardholders 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter. 1% unlimited cash back on all other purchases - automatically

The annual fee is $0 and the foreign transaction fee is none.

Who’s this card best for?

Consumers who need a solid intro APR period on balance transfers, and don’t want to deal with the rotating cash back structures offered on the other two cards mentioned here, will likely find the Discover it® Chrome a useful tool. Once you’ve paid off your balance transfer, you can take advantage of this card’s straightforward cash back rewards on gas station and restaurant purchases — and if you hit the $1,000 combined spending cap on purchases in those categories each quarter, that’s $20 in cash back at the elevated rate.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. You'll still earn unlimited 1% cash back on all other purchases.

- Get a 0% intro APR for 18 months on balance transfers. Then 17.49% to 26.49% Standard Variable APR applies, based on credit worthiness.

- Redeem cash back for any amount

- No annual fee.

- Terms and conditions apply.

| Discover credit card | Balance transfer 0% intro APR | Balance transfer ongoing APR |

|---|---|---|

| Discover it® Balance Transfer | 0% Intro APR for 18 months | 17.24% - 28.24% Variable APR |

| Discover it® Cash Back | 0% Intro APR for 15 months | 17.49% - 26.49% Variable APR |

| Discover it® Chrome | 0% Intro APR for 18 months | 17.49% - 26.49% Variable APR |

No, you cannot transfer balances between credit cards from the same issuer. This is a standard restriction you’ll encounter when doing a balance transfer with any credit card company.

You will have to pay a balance transfer fee when moving debt to a Discover credit card. If you’re opening a new Discover card, you might have the option to start out with a 3% balance transfer fee with the potential for it to increase to up to 5% after a certain period of time.

However, you’ll be saving on interest charges that you’d otherwise incur if you were to carry a balance on a card without an intro period. Whether it’s worth it to you depends on how much debt you’re carrying and how high your interest rate is on the card where the balance currently is. If you’re not sure what your interest rate is, check the APR listed on your credit card statement.

Discover has a balance transfer calculator that you can use to do some quick figuring — just remember to add in any balance transfer fee amount into the total balance you include.

Yes, if you have a Discover balance transfer offer available, you can transfer a balance from a Chase credit card. In fact, you’ll be able to transfer balances from pretty much any issuer to a Discover card — except for Discover itself.

The information related to the Discover it® Balance Transfer has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.