Venture Capital Financing: Is It a Good Idea for Your Business?

While banks and other lenders are often hesitant to loan money to new businesses, some startups are prime candidates for venture capital.

Fast-growing businesses tend to be most attractive to venture capitalists, who typically look for companies that can provide a quick and substantial return on their investment.

What is venture capital financing?

Venture capital is a form of financing in which a business owner gets funding in exchange for ownership in the company. Rather than borrowing from a bank or alternative business lender and paying back your debt, you receive money from an investor who helps to expand your business while earning a share of the profits.

Venture capital funding is typically for early-stage companies with potential for high growth. Venture capitalists, or VCs, invest in these companies with the expectation that the risk will result in significant returns as the businesses become successful.

How venture capital works

Venture capital may be available across multiple stages of business growth. While early-stage VC financing focuses on developing and launching a product, late-stage VC financing focuses on optimizing operations while marketing and expanding existing product lines.

Unlike traditional business financing, business owners won’t need to make monthly payments to repay venture capital. Instead, VCs hope to regain their investment by having equity in businesses that are likely to succeed.

For this reason, venture capital financing can be a risky arrangement for both business owners and investors. VCs typically invest in quite a few businesses with the expectation that several will fail, looking for companies that could have a big payoff to offset their anticipated loss. And owners can lose some control over their business.

Businesses that operate as C corporations are most likely to be candidates for venture capital financing, as many VCs do not invest in LLCs or S corporations for tax purposes. A C-corp structure allows investors to avoid pass-through taxation on business income and buy and sell stock more easily.

Stages of venture capital financing

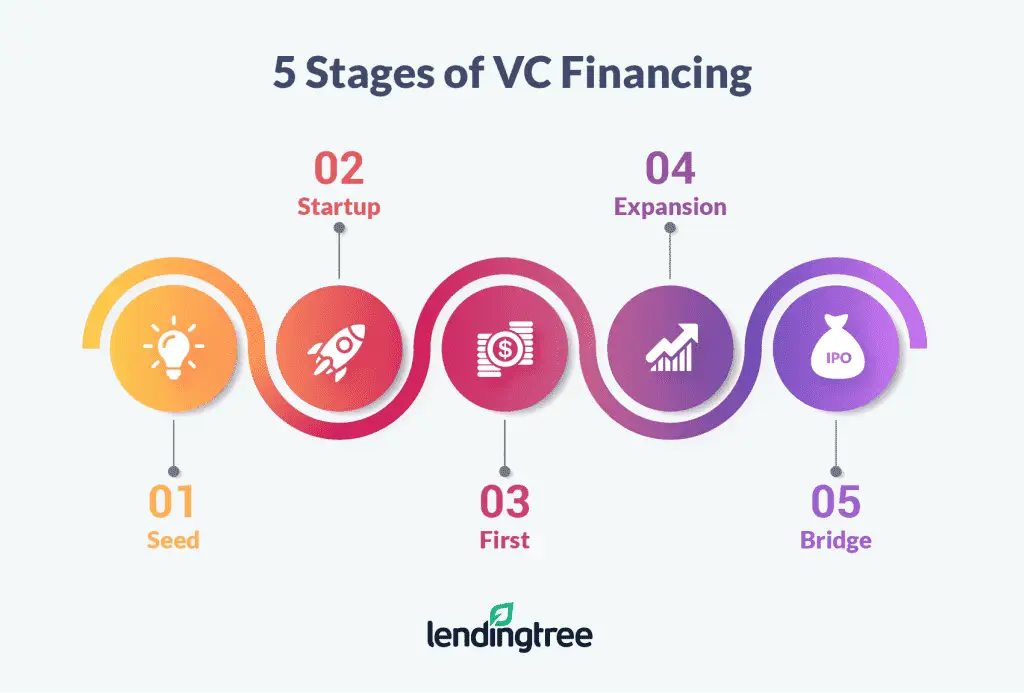

Let’s explore the five main stages of venture capital investments:

Five stages of VC

- Seed stage: Seed-stage VCs invest in businesses that are still just an idea for a product or service. If the idea has growth potential, the VC would finance early product or business plan development or market research. They may also set up a management team for the company.

- Startup stage: Once a startup has a business plan and product prototype to show investors, VCs would supply cash to cover startup costs, such as advertising and marketing. The business could obtain money from the same VCs that financed the seed stage, or the business could bring on new investors.

- First stage: VCs would provide capital for manufacturing and sales as the company becomes operational.

- Expansion stage: After the business starts selling products and services, VCs could help grow the business by investing in marketing expansion or a new product line.

- Bridge stage: The business could transition to a public company after reaching maturity. At this stage, VCs could provide financing to support a merger, acquisition or initial public offering (IPO), then sell off shares to exit the company and earn a return.

When a VC makes an investment, the business owner receives the funds in a lump sum. VC is milestone-driven and during each stage, you determine how much funding is necessary to bring your business idea to fruition. You receive the money upfront, then seek additional funding as your business moves into different stages. More will be raised later in different rounds based upon hitting milestones.

Pros and cons of venture capital financing

Before bringing in investors, consider both the benefits and disadvantages of obtaining venture capital financing.

Pros

- Money to get the business off the ground: Early-stage venture capital financing can fund your startup phase and help you compete in the market. Many lenders do not finance startups.

- Access to experts: Investors act as strategic advisors, guiding your business toward high growth. They may have additional connections in your industry that could be useful.

- No debt to repay: You do not have to repay money that is invested in your company. If the company doesn’t succeed, VCs simply lose their investment.

Cons

- Loss of control: Accepting VC financing means you no longer have full control of the company. The amount of equity granted to investors determines their involvement in the business.

- Misaligned goals: VCs prioritize making a return on their investment, and they could disregard any of your goals that hinder profit or growth.

- Difficulty ending the relationship: If it’s not working out with your investors, you may be able to buy them out and cease the relationship. However, it’s more likely that you would end up selling the company or shutting the business to part ways with investors.

Is venture capital financing a good choice?

Once you accept VC financing, your investors then have a say in business decisions. Investors also own a stake of the company, with most VCs requiring at least 20% ownership of the business. They become strategic advisors to the business and will likely challenge your decisions.

In addition to taking ownership of the business, VCs may include a vesting clause in your agreement. A vesting clause can require you to stay with the business for a certain number of years before you become eligible to receive the full value of your shares.

Ultimately, many small businesses don’t demonstrate the potential sought by VCs. If your business isn’t a good candidate for VC financing, you may want to consider focusing on positive cash flow and growth to build future opportunities. Other options might be relying on a small business loan or line of credit if you need money to expand.

How to secure venture capital financing for your business

From your first VC meeting to payday, here’s a look at what you can expect when seeking venture capital financing.

1. Find an investor

If you’re seeking VC financing, start by researching firms that invest in companies within your industry and stage of development. Online databases, industry publications and networking events can all be valuable resources. You can also leverage your personal and professional networks, using these connections to bridge the gap between you and potential investors.

You might even consider hiring an advisor or consultant to help you find a VC. Venture capital firms often rely on advisors to provide information about business owners who have already been researched and vetted.

Venture capitalists vs. angel investors

To compare potential investors, you’ll need to understand the difference between venture capitalists and angel investors. While VC firms invest large sums of money into high-growth companies, angel investors typically focus on providing seed funding to early-stage startups.

Angel investors are wealthy individuals who choose to invest their own money in promising businesses. Unlike VC firms, angel investors may be willing to take on higher risks, often having more flexibility in their investment criteria. For small business owners who are just starting out, seeking out angel investors might be a better option to secure seed money and validate a business idea. You may be able to find angel investors through platforms like AngelList or the Angel Capital Association.

2. Introduce your business

Instead of cold-calling or emailing an investor or venture capital firm, it’s best if you can find someone to make an introduction. You could leverage a personal connection or search online for other business owners in your industry who have received investments from the VC you’re eyeing. Either way, a formal introduction can go a long way toward securing VC financing.

3. Make your case

Before a venture capital firm decides to invest in your company, they’ll review the details of your operation. You can expect a VC to look for an experienced team, a large addressable market and an engaging product and vision.

Be prepared to explain how your business model is scalable and repeatable, and that you understand what your customers want and need. Investors want to make sure you understand how your business can drive revenue, cover costs and deliver value to the customer.

You should also present a pro forma statement to show how much money you’re trying to raise and why. A pro forma statement outlines how the company’s performance and results would change if investors put a certain amount of money into the business.

4. Review the term sheet and close the deal

If you’re trying to obtain financing from a venture capital firm, you may meet with several people before the deal is done. For example, you could first meet with an associate, who may then set up a meeting with a partner of the firm, who could then ask you to make your pitch in front of a larger group of partners.

The process can be similar to dating — after the first few dates, you may be invited to meet the family. If all goes well, eventually you may start planning a wedding. With VC financing, the financing deal would be the wedding and the term sheet would function somewhat like the prenuptial agreement.

Although the term sheet usually is not a legally binding document, it outlines the basic terms of the investment and what’s expected of both parties. The term sheet usually includes the amount of money being offered, the percentage of the company being exchanged and any conditions or investor demands. The expected date of the investment would also be included.

After reviewing the term sheet, you’d sign a number of legal forms to close the deal, including:

- Stock purchase agreement: Describes the terms of the purchase and sale of preferred stock, including purchase price, closing date and closing conditions

- Right of first refusal and co-sale agreement: Outlines the circumstances in which investors could purchase the business founder’s stock if they choose to sell

- Investor rights agreement: Protects various rights of the investor

- Indemnification agreement: Describes which party would be responsible for potential losses and damages

Keep in mind that the process of closing the deal would be indicative of how the relationship with the VC would be going forward. If there are issues, either party can walk away before the final documents are signed.

Small business owners should always consult a qualified attorney before signing a VC deal. An experienced lawyer will help you understand the terms and conditions of a VC investment, ensuring your business’ best interest is kept top of mind.

Compare business loan offers