Percentage of Businesses That Fail — and How to Boost Chances of Success

More than 1 in 5 U.S. businesses fail in their first year, according to the latest U.S. Bureau of Labor Statistics (BLS) data. To put that into perspective, there are 34.8 million small businesses nationwide, so many new ones close yearly.

To determine where businesses fail at higher rates, LendingTree researchers examined state and industry data. Here’s what we found, and how those considering starting a business can boost their chances of success.

Key findings

- 21.5% of private sector businesses in the U.S. fail in the first year. After five years, 48.4% have faltered. After 10 years, 65.1% have closed.

- Minnesota sees the highest business failure rate in the first year. 27.7% of businesses in the state fail in the first year. The District of Columbia (27.2%) and Missouri (27.1%) follow.

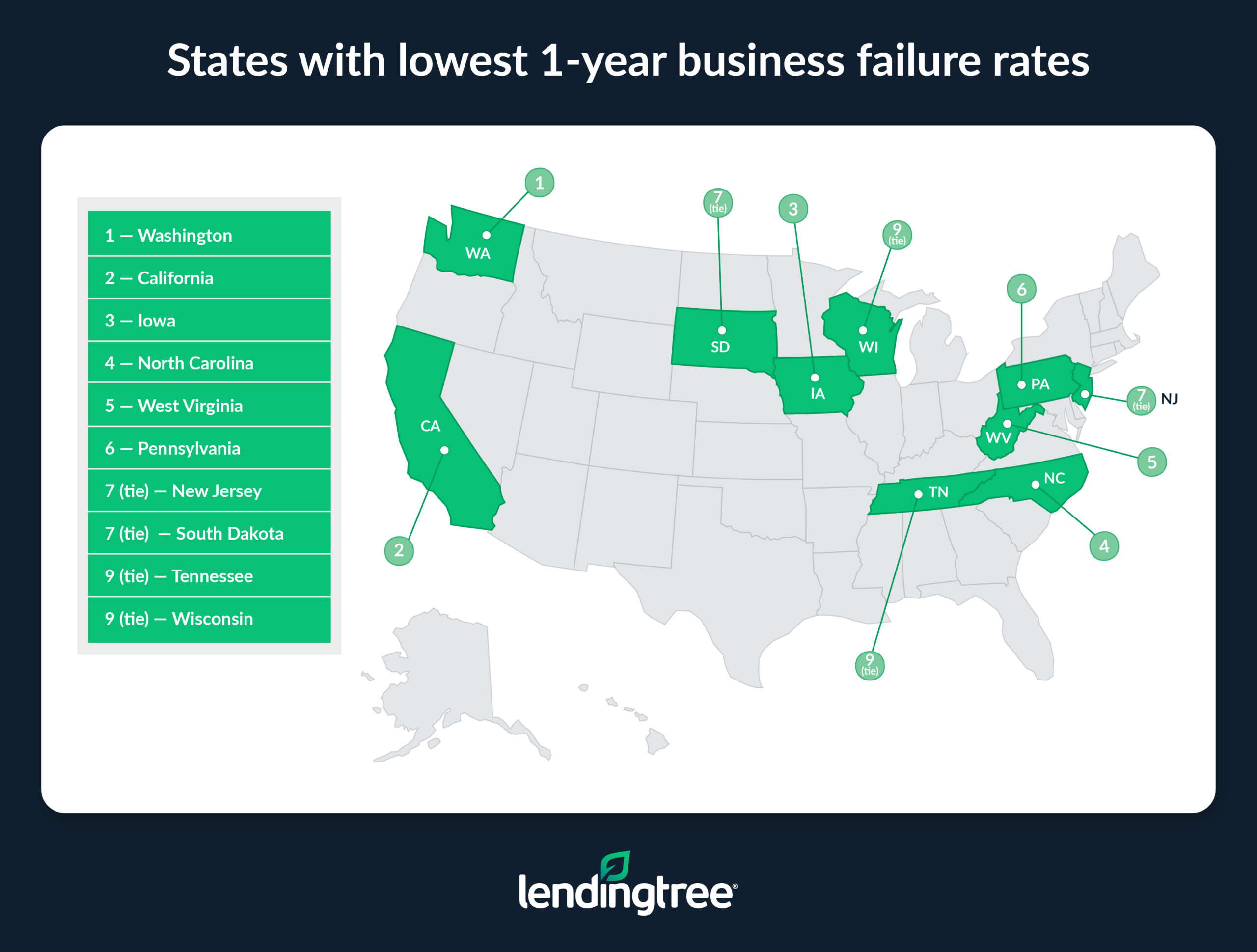

- Washington sees the lowest business failure rate in the first year. 13.6% of businesses in the state fail in the first year. California (14.0%) and Iowa (19.8%) follow.

- The information industry has the highest failure rate for new businesses, with 25.8% not surviving the first year. This industry involves producing and distributing information and cultural products and processing data. The administrative and waste services industry (25.0%) is next, followed by transportation and warehousing, and utilities (both 23.0%).

Percentage of businesses that fail in U.S.

According to the latest data on the March 2024 status of businesses that opened in March 2023, 21.5% of private sector businesses in the U.S. failed in the first year. In the same period, inflation was at 3.5% year over year, adding to difficulties for new businesses.

The one-year failure rate fell almost two percentage points from 23.2% in last year’s report (which compared March 2023 and March 2022). The report before that (comparing March 2022 and March 2021) found that 20.8% failed in the first year, making the rate similar to two years ago.

Interestingly, the 2021-to-2022 data coincided with a far higher inflation rate — 8.5% year over year. The longer Americans feel the squeeze of high prices for everyday purchases, the less likely they may be to buy new products and services from small businesses.

Business failure rate across the U.S.

| Time frame | % of businesses that fail |

|---|---|

| Within 1 year | 21.5% |

| After 2 years | 34.9% |

| After 3 years | 40.8% |

| After 4 years | 42.7% |

| After 5 years | 48.4% |

| After 6 years | 52.5% |

| After 7 years | 56.8% |

| After 8 years | 60.1% |

| After 9 years | 62.6% |

| After 10 years | 65.1% |

We also looked at the five- and 10-year business failure rates, which compared March 2024 to March 2019 and March 2014, respectively.

At those points, 48.4% and 65.1% of businesses fail, respectively. (Though the one-year failure rate decreased from last year, the five-year rate increased slightly from 48.0% to 48.4%.)

Highest business failure rate in 1 year: Minnesota, D.C., Missouri

Minnesota has the highest business failure rate in the first year, at 27.7%. (Remember, this looks at businesses in March 2024 that opened a year prior.) That’s half a percentage point higher than the second-highest rate, 27.2%, in the District of Columbia.

Minnesota’s unemployment rate generally stayed the same in this period, from 2.8% in March 2023 to 2.7% in March 2024.

Minnesota experienced a more than 5 percentage point increase from last year’s report, rising from 22.3% to 27.7%. Additionally, it reported the third-lowest 10-year failure rate this year, at 59.9%.

Interestingly, D.C. ranks second, third and first, respectively, for one-year, five-year and 10-year failure rates. That’s despite the District’s significantly higher median household income ($106,287) than the U.S. ($78,538).

That said, D.C. is an expensive place to live. In fact, it costs about $550 more to rent in D.C. than across the U.S., and median home values are more than twice as high. This, combined with other factors, makes the nation’s capital a difficult place to start a business.

After D.C., Missouri is third with a one-year business failure rate of 27.1%. The state has a lower median household income than the U.S., which could make starting and keeping a business more difficult. (The state is second for its five-year failure rate.)

Business failure rate across the 50 states and D.C.

| State | Rate after 1 year | Rank after 1 year | Rate after 5 years | Rank after 5 years | Rate after 10 years | Rank after 10 years |

|---|---|---|---|---|---|---|

| Alabama | 22.8% | 34 | 47.1% | 33 | 64.2% | 32 |

| Alaska | 26.3% | 4 | 44.0% | 48 | 61.7% | 46 |

| Arizona | 22.9% | 33 | 50.5% | 17 | 67.0% | 12 |

| Arkansas | 24.5% | 13 | 50.6% | 16 | 65.8% | 21 |

| California | 14.0% | 50 | 45.4% | 44 | 65.0% | 27 |

| Colorado | 24.9% | 11 | 51.2% | 13 | 67.9% | 6 |

| Connecticut | 24.7% | 12 | 42.5% | 50 | 67.9% | 6 |

| Delaware | 23.5% | 27 | 52.8% | 6 | 67.2% | 10 |

| District of Columbia | 27.2% | 2 | 55.3% | 3 | 74.6% | 1 |

| Florida | 23.0% | 32 | 49.9% | 21 | 65.3% | 24 |

| Georgia | 24.4% | 15 | 50.8% | 15 | 66.3% | 19 |

| Hawaii | 26.2% | 5 | 50.0% | 19 | 63.4% | 35 |

| Idaho | 25.4% | 8 | 52.9% | 5 | 66.9% | 13 |

| Illinois | 21.9% | 39 | 45.1% | 45 | 63.6% | 33 |

| Indiana | 22.0% | 38 | 46.6% | 38 | 60.3% | 48 |

| Iowa | 19.8% | 49 | 46.7% | 37 | 59.7% | 50 |

| Kansas | 25.3% | 10 | 53.2% | 4 | 65.3% | 24 |

| Kentucky | 21.9% | 39 | 47.4% | 31 | 63.0% | 37 |

| Louisiana | 24.4% | 15 | 47.7% | 30 | 65.6% | 22 |

| Maine | 24.1% | 21 | 47.0% | 35 | 63.0% | 37 |

| Maryland | 23.1% | 31 | 51.3% | 12 | 67.2% | 10 |

| Massachusetts | 23.6% | 25 | 46.2% | 39 | 62.7% | 40 |

| Michigan | 23.2% | 30 | 46.1% | 40 | 65.0% | 27 |

| Minnesota | 27.7% | 1 | 45.8% | 42 | 59.9% | 49 |

| Mississippi | 24.5% | 13 | 47.2% | 32 | 64.4% | 31 |

| Missouri | 27.1% | 3 | 56.8% | 2 | 69.0% | 4 |

| Montana | 23.6% | 25 | 46.1% | 40 | 59.0% | 51 |

| Nebraska | 21.8% | 41 | 49.8% | 23 | 68.8% | 5 |

| Nevada | 24.2% | 20 | 52.1% | 9 | 66.5% | 17 |

| New Hampshire | 25.4% | 8 | 51.1% | 14 | 67.7% | 9 |

| New Jersey | 21.5% | 44 | 49.7% | 24 | 66.6% | 15 |

| New Mexico | 26.2% | 5 | 51.4% | 11 | 69.2% | 3 |

| New York | 22.2% | 36 | 50.5% | 17 | 66.9% | 13 |

| North Carolina | 20.5% | 48 | 45.6% | 43 | 62.5% | 42 |

| North Dakota | 24.0% | 23 | 47.1% | 33 | 65.0% | 27 |

| Ohio | 23.5% | 27 | 45.0% | 46 | 62.1% | 45 |

| Oklahoma | 22.8% | 34 | 49.9% | 21 | 66.1% | 20 |

| Oregon | 25.6% | 7 | 48.7% | 25 | 63.6% | 33 |

| Pennsylvania | 21.0% | 46 | 44.0% | 48 | 63.1% | 36 |

| Rhode Island | 24.0% | 23 | 51.8% | 10 | 66.6% | 15 |

| South Carolina | 23.3% | 29 | 48.0% | 27 | 66.5% | 17 |

| South Dakota | 21.5% | 44 | 45.0% | 46 | 61.0% | 47 |

| Tennessee | 21.7% | 42 | 48.0% | 27 | 65.2% | 26 |

| Texas | 22.2% | 36 | 47.0% | 35 | 62.7% | 40 |

| Utah | 24.3% | 18 | 50.0% | 19 | 65.0% | 27 |

| Vermont | 24.1% | 21 | 48.6% | 26 | 63.0% | 37 |

| Virginia | 24.4% | 15 | 52.3% | 8 | 69.8% | 2 |

| Washington | 13.6% | 51 | 58.9% | 1 | 67.8% | 8 |

| West Virginia | 20.9% | 47 | 42.4% | 51 | 62.2% | 44 |

| Wisconsin | 21.7% | 42 | 47.9% | 29 | 62.4% | 43 |

| Wyoming | 24.3% | 18 | 52.5% | 7 | 65.5% | 23 |

Conversely, Washington has the lowest business failure rate in the first year, at 13.6%. California (14.0%) and Iowa (19.8%) follow.

Notably, Washington state’s unemployment rate in March 2024 was 4.8%, up from 4.5% in March 2023.

Industries with worst survival rates

The information industry has the highest percentage of businesses that fail in the first year, at 25.8%.

The information industry involves producing and distributing information and cultural products and processing data. Its main sectors are the publishing industries (traditional and online), motion picture and sound recording industries, broadcasting industries (traditional and online), telecommunications, web search portals, data processing and information services.

The information sector saw unemployment rise from 3.1% in March 2023 to 3.6% in March 2024.

The industries with the next highest one-year failure rates are:

- Administrative and waste services: 25.0%

- Transportation and warehousing: 23.0%

- Utilities: 23.0%

The transportation and warehousing industry, the highest in the previous year’s study, fell to third-highest, tying with the utilities sector at 23.0% — down from 24.8% last year.

“It seems like information would be a difficult space to break into,” says Matt Schulz, LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life, “because it involves things like motion picture, sound and publishing companies, as well as telecommunications. These industries feature giant players who dominate the space, making it tough to make a name for yourself.”

Once you look at the 10-year failure rate, though, the mining, quarrying, and oil and gas extraction industry takes the lead, with 76.4% of businesses failing.

Business failure rate across industries

| Industry | Rate after 1 year | Rank after 1 year | Rate after 5 years | Rank after 5 years | Rate after 10 years | Rank after 10 years |

|---|---|---|---|---|---|---|

| Accommodation and food services | 13.6% | 19 | 42.6% | 11 | 58.7% | 10 |

| Administrative and waste services | 25.0% | 2 | 49.6% | 5 | 63.1% | 6 |

| Agriculture, forestry, fishing and hunting | 14.3% | 17 | 34.2% | 19 | 46.2% | 19 |

| Arts, entertainment and recreation | 14.5% | 16 | 39.8% | 15 | 59.3% | 9 |

| Construction | 19.1% | 8 | 44.1% | 10 | 57.1% | 14 |

| Educational services | 19.0% | 9 | 41.7% | 13 | 57.8% | 12 |

| Finance and insurance | 18.8% | 10 | 46.2% | 9 | 60.1% | 8 |

| Health care and social assistance | 15.2% | 15 | 46.4% | 8 | 57.8% | 12 |

| Information | 25.8% | 1 | 54.6% | 1 | 69.9% | 2 |

| Management of companies and enterprises | 19.9% | 7 | 50.6% | 3 | 64.9% | 5 |

| Manufacturing | 18.6% | 11 | 42.6% | 11 | 55.2% | 16 |

| Mining, quarrying, and oil and gas extraction | 22.1% | 6 | 54.4% | 2 | 76.4% | 1 |

| Other services (except public administration) | 15.7% | 14 | 41.7% | 13 | 58.3% | 11 |

| Professional, scientific and technical services | 22.2% | 5 | 49.3% | 6 | 66.0% | 4 |

| Real estate and rental and leasing | 17.1% | 13 | 39.5% | 17 | 55.1% | 17 |

| Retail trade | 14.1% | 18 | 39.3% | 18 | 56.3% | 15 |

| Transportation and warehousing | 23.0% | 3 | 49.9% | 4 | 63.0% | 7 |

| Utilities | 23.0% | 3 | 39.7% | 16 | 51.1% | 18 |

| Wholesale trade | 18.6% | 11 | 49.1% | 7 | 66.4% | 3 |

The information industry had the highest five-year failure rate in last year’s report, at 55.7%, just as it does in this report at 54.6%.

Meanwhile, agriculture, forestry, fishing and hunting has the lowest failure rate after both five (34.2%) and 10 years (46.2%).

Why small businesses fail

Many factors contribute to small businesses failing, including:

- Inflation: The cost of materials can make it difficult to own a business. When you add inflation to the mix, profit margins can suffer, making survival more challenging. Although inflation was not as extreme from March 2023 to March 2024 compared to the previous analyzed period, the costs can add up for consumers.

- Access to capital: Between startup costs and paying employee salaries and benefits, weathering the sales dips that naturally occur over a year can be difficult. On top of that, it can be difficult to access funding, especially if the business owner doesn’t have great credit or the business hasn’t established a track record.

- Bad luck: Yet another reason why businesses might fail is bad luck. Sometimes the timing isn’t right, or other factors out of their control prevent business owners from achieving success, Schulz says.

How to succeed in your first year of business

Many businesses don’t survive their first year. But there are things you can do to strengthen yours and make it over that hurdle.

Craft a solid business plan

“Some business owners doom their businesses from the start by failing to do the proper research and develop a sensible business plan,” Schulz says. “For example, you have to understand your target customers and primary competitors and have a sense of how you can make money. Those things may sound basic, but taking the time matters.”

A solid business plan should include the basics of your business (like how it works and who your audience is), as well as more complex aspects like market analysis, profit margins and financial projections. This can help you lay a solid foundation to build your business. It can also be a vital step in accessing a business loan.

“There’s an old saying that failing to plan is planning to fail,” he says. “Making a business successful is a tall enough task. Don’t make it even harder on yourself.”

Strengthen your credit

Having great credit can not only help you save money on future financial opportunities, but it can also allow you to access products, like startup business loans, for which you may not have been able to qualify.

A “very good” personal credit score starts at 740. Most lenders consider borrowers with that score very dependable, so that’s a good goal. Still, you’ll want to raise your score as much as possible to qualify for the best rates and terms — especially if a loan is necessary to get your business off the ground. Plus, having great credit is useful should you encounter income dips. (Eventually, you’ll want to focus on your business credit score, which has different criteria.)

Quick tip: Signing up for autopay, reducing credit card debt and avoiding applying for other lines of credit are just a few ways to help build your credit over time.

Make marketing a priority

“The best product or service can’t succeed if no one knows about it,” Schulz says. “As simple as it sounds, spreading the word about what you have to offer is crucial.”

That’s why marketing your business and products is an important part of success during the first year, when few people may have interacted with you or your business.

“Leverage social media,” Schulz says. “Network with other businesses in your community. Lean on friends and family to help build word of mouth. Reach out to local media to share your story. There are so many things you can try, but often businesspeople get so wrapped up in other aspects of building the business that they forget one of the most essential tasks: marketing.”

Take advantage of the resources available to you

Owning a small business can feel isolating, but it’s something millions of Americans have done, and it’s an important part of the American economy. There are resources available to help people in your situation succeed.

If you’ve never started a business, talking to someone familiar with keeping a business alive can be extremely helpful. They can help you better understand your industry and even the lesser-known issues that may crop up. You’ll be able to plan for those setbacks, and your business will be less likely to falter when you encounter those inevitable hiccups.

“The Small Business Administration and Department of Commerce websites are great places to start, but a simple Google search of ‘small business resources near me’ can reveal a lot of options as well,” Schulz says. “For women, people of color, the LGBTQ+ community and other underserved populations, there are groups aiming to help. Starting a business is incredibly difficult, and the odds are stacked against you in so many ways. You can shift the odds in your favor a bit by enlisting some help.”

Methodology

LendingTree researchers analyzed the latest U.S. Bureau of Labor Statistics (BLS) data to find business failure rates nationwide.

Specifically, we calculated the one-year, five-year and 10-year survival rates for businesses by state and industry. One-year data looks at whether businesses opened in March 2023 remained open in March 2024, while the five-year data compared March 2019 and March 2024 and the 10-year data compared March 2014 and March 2024.

Compare business loan offers